Pound Sterling Looks For a Hunt Boost

- Written by: Gary Howes

Prime Minister Rishi Sunak speaks with the Chancellor of the Exchequer Jeremy Hunt in the Chancellors Office in 11 Downing Street as they prepare for the annual Budget statement on March 6th. Picture by Simon Dawson / No 10 Downing Street

The British pound could be set to benefit if Wednesday's Spring Budget is considered both responsible and stimulatory to the economy, say foreign exchange analysts we follow.

Fiscal events such as the budget are traditionally low-risk events for FX markets, but memories of the Liz Truss-Kwasi Kwarteng 'mini budget' are still fresh in investors' minds, and analysis of financial markets reveals the pound and bond market still hold a slight 'danger' premium.

"Some premium has been placed into the curve given some residual concerns about the outcome, but this is relatively small," says Kamal Sharma, an analyst at Bank of America.

The Truss era has nevertheless installed a sense of discipline in UK politicians in both the Conservative and Labour parties, and analysts we follow see upside potential for the Pound if Chancellor Hunt delivers a stimulatory budget that is deemed credible.

"Markets remain relaxed that there will not be a fiscal mistake," says Sharma.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"Times have moved on since the dark days of September 2022 when PM Truss and Chancellor Kwarteng backed unfunded tax cuts and sent the Gilt market and pension fund industry into meltdown," says Kenneth Broux, a strategist at Société Générale.

Broux points out that these fiscal events are traditionally not a market mover for the pound, unless borrowing and spending estimates cause a knee jerk reaction in Gilt yields and BoE rate expectations.

"A sense of fiscal responsibility has been restored under PM Sunak and Chancellor Hunt and has brought down Gilt yields, cutting the cost of debt financing for the Treasury," he adds.

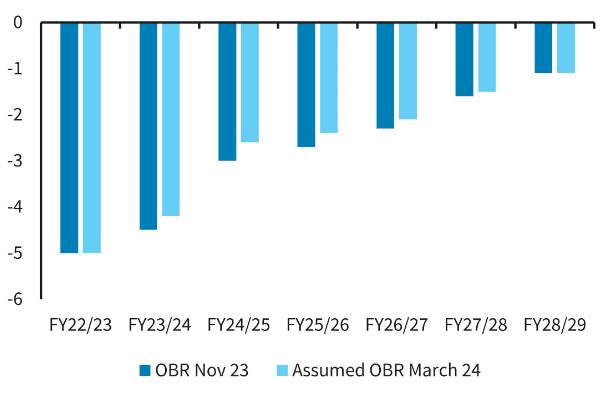

Above: Public sector net borrowing forecasts (% of GDP). Image: Barclays. Track GBP with your own custom rate alerts. Set Up Here

So how big would a stimulus be? According to the Resolution Foundation, lower interest rates are likely to increase the room for fiscal manoeuvre by around £10BN to £23BN, with further cuts to National Insurance contributions widely cited as being likely.

This would leave more money in the pockets of UK workers and therefore acts as a fiscal stimulus.

Such a stimulus could increase expenditure, which would boost the economy but risks creating the demand that keeps inflation higher for longer.

As such, it could give the Bank of England reason to maintain interest rates at 5.25% for an extended period. All else equal, this is supportive of the Pound.

"This week's Spring budget announcement could include additional fiscal stimulus as the Tory Party attempts to woo voters ahead of the impending general election," says Matthew Ryan, Head of Market Strategy at Ebury. "If confirmed, these measures would likely be marginally positive for sterling."

Above: ING's models suggest the Pound is undervalued against the Euro.

"Hunt's Budge on Wednesday, that could contain a few tax cuts and near-term spending increases to support growth – which should tend to support the pound," says Asmara Jamaleh, an analyst at Intesa Sanpaolo.

But the Times reports Jeremy Hunt is drafting plans for up to £9BN worth of tax rises and spending reductions in an effort to balance the books and pay for a potential 2p cut in national insurance. Any stimulatory effect of the National Insurance cuts could be blunted by tax rises elsewhere.

The Times reports Hunt will enact a number of "stealth" tax rises amounting to up to £4BN, while planning to cut expenditure by 0.25% after the next election. This will give an additional £9BN for tax cuts on top of the £12.8BN of fiscal headroom projected by the Office for Budget Responsibility.

George Vessey, Lead FX Strategist at Convera, says fresh tax cuts could apply some upward pressure on yields, which are near 15-year highs.

"Sizable cuts to income tax would add further incentive for the Bank of England to keep interest rates on hold a little longer," he adds.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The Bank of England is expected to have delivered its first cut by August, but market pricing shows decent odds of a June rate cut. Should rate cut expectations fall in the wake of the budget, UK yields and the Pound can rise.

The risk to the Pound is that the Chancellor announces measures that once again raise questions about the sustainability of the UK's finances, as was the case under the Truss government.

"Were Chancellor Hunt to misread the mood of gilt investors and cause another upset, sterling would again come under pressure," says Chris Turner, Global Head of Markets at ING. "Short-term models suggest a 2% sell-off in sterling could happen quite easily were investors to again demand a risk premium of sterling asset markets."