China's New 5% Growth Target Looks Ambitious, Say Economists

- Written by: Sam Coventry

Image © Adobe Stock

China needs to announce new stimulus measures if it is to hit its newly minted economic targets, warn economists.

China's annual session of the National People's Congress began Tuesday and Premier Li Qiang unveiled key economic targets and policy priorities for the year.

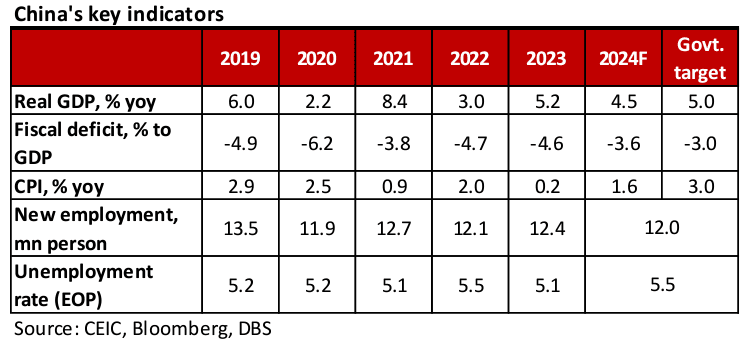

China's GDP growth target was set at around 5% for 2024 - similar to last year's and the consensus estimate - and a fiscal deficit of 3% of GDP.

"The target will be hard to achieve without further economic stimulus in our view," says Joseph Capurso, an economist at Commonwealth Bank. Indeed, Premier Li said, "it is not easy for us to realise these targets".

Image courtesy of DBS.

The government aims to stabilise growth while transitioning to high-quality development and will likely provide incremental support to address economic challenges, particularly in the property sector.

By way of stimulus, China announced plans to issue RMB1 trillion in ultra-long special central government bonds. "This move aims to fund strategic sectors crucial for China's high-quality development goal, such as infrastructure, technology, and green energy projects, by leveraging the central government's credibility and low financing costs," says a note from DBS Bank.

The growth plan includes support for strategic industries with an emphasis on the "new three": solar, electric vehicles, and batteries. According to DBS, these industries are not only central to sustainable growth but also position China as a leader in green technology on the global stage. Continued investment and state support for these sectors will drive innovation, exports, and domestic consumption.

"In our view, the "new three" industries will play a crucial role in the country’s ongoing economic growth and clean energy leadership. China dominates these fields globally, commanding over 80% of solar exports, 50% of batteries, and 20% of electric vehicles," says DBS.

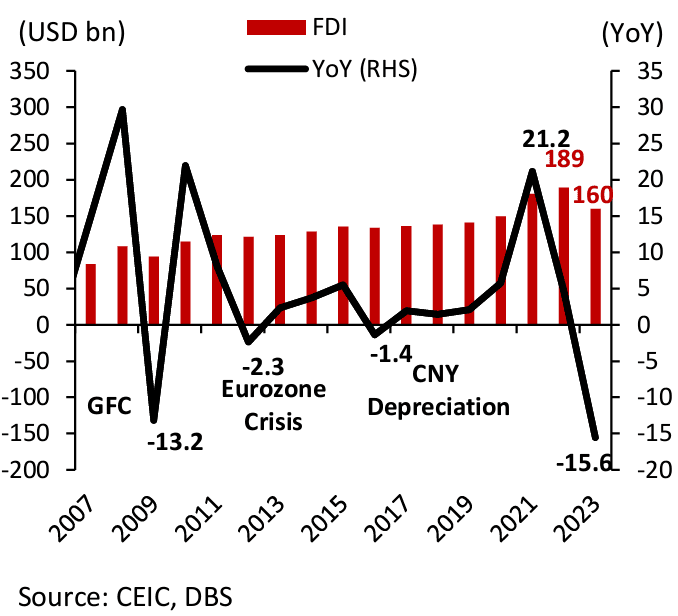

Above: Realised foreign direct investment in China.

To further open up its economy and reverse a significant drop in inward investment, China says it aims to continue reducing the negative list for foreign investment, fully open manufacturing to foreign capital, and ease market access in sectors including telecommunications and healthcare.

"These efforts are vital for attracting foreign direct investment (FDI), which is essential for achieving the targeted growth rate," says DBS.

Looking ahead, economists expect both monetary and fiscal policies to surprise to the upside in 2024 to achieve the goal of stabilisation and high-quality growth. This may include further cuts to the Reserve Requirement Ratio (RRR) and policy rates aimed at keeping funding costs in check and stimulating credit growth.