Soc Gen Strategists Look for Euro Rebound against the Pound

- Written by: Gary Howes

Image © Adobe Images

The British Pound is prodding new two-year highs against the Euro midweek, but we are seeing the limits of the UK currency's strength, according to a strategist at Société Génénerale.

Olivier Korber, FX and Derivatives Strategist at Société Génénerale, says the Euro to Pound exchange rate (EUR/GBP) has fallen towards a line in the sand and the odds of crossing it are low enough to initiate a trade that would profit on a rebound.

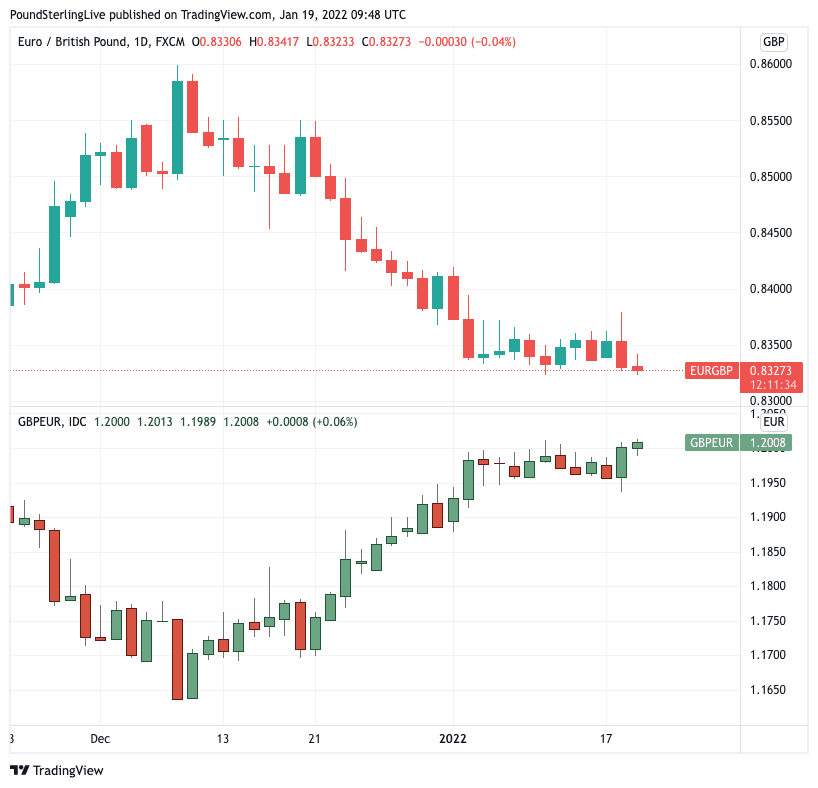

The Euro has been under pressure against the Pound since December, falling from a December 08 high of 0.8599 to a January 11 low of 0.8323 (Pound-Euro rally up to 1.2014).

"The EUR/GBP has been moving in a slow downtrend over the past year, but euro weakness in December pressured it near the line in the sand," says Korber.

But, charts show the decline has found support around the 0.83333 level (which equates to the round number resistance at 1.20 for GBP/EUR).

Above: The Euro has found support of late.

- Reference rates at publication:

GBP to EUR: 1.2008 - High street bank rates (indicative): 1.1688 - 1.1772

- Payment specialist rates (indicative: 1.1922 - 1.1950

- Find out more about specialist rates and service, here

- Set up an exchange rate alert, here

"Since the Brexit vote in 2016, the lower bound has been about 0.83, suggesting that the stabilization since the start of the year and yesterday's bounce might be pointing to a more meaningful rebound," he says in an ad-hoc strategy note out January 19.

A fundamental thesis to a rebound in the Euro against Sterling can be found in expectations for a fall in discretionary consumer spending over coming months.

Société Génénerale economists note that UK wage growth continues to slow, as inflation rises sharply, suggesting wages will in fact fall in real terms in 2022.

"With the labour market so tight, surely there will be upward pressure on wages in the months ahead, but weak real wage growth is a drag on discretionary spending," says Korber.

Furthermore, Korber's colleague, Kit Juckes, says in a separate assessment of Sterling that the Bank of England will fail to fulfil the market's expectation to hike the Bank Rate all the way to 1.25% by the end of 2022.

One of the key drivers of Sterling's December-January bounce was the December 16 rate hike at the Bank and heightened expectations that further rate hikes will be delivered.

If the market's expectation for a terminal rate at 1.25% is disappointed, the Pound could face headwinds.

"This suggests that the GBP optimism is in the price, so that gains are likely to be over, making EUR/GBP now looking too low," says Korber.

Korber is looking for EUR/GBP to rebound to 0.86, (GBP/EUR down to 1.1630).