Hot Inflation Numbers Keep Sterling in Touch with 2022 Highs

- Written by: Gary Howes

"In fact, so severe is the inflationary pressure that Capital Economics points out CPI is now further above the Bank of England’s target than at any point since the UK first adopted an inflation target in October 1992."

Image © Adobe Images

The British Pound's strong start to 2022 finds further support from inflation numbers that came in hotter than the market was expecting and further surges in inflation are anticipated by economists.

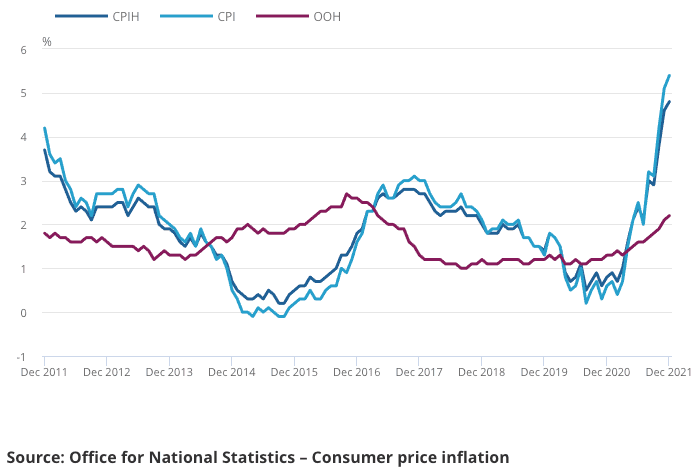

UK CPI inflation for December read at 5.4% year-on-year according to the ONS, beating expectations for a reading of 5.2% and surpassing November's 5.1%.

Core CPI inflation read at 4.2%, breezing past the market's expectation for 3.9%.

The above-expectation numbers - particularly the core CPI reading - will pile pressure on the Bank of England to act given inflation is now well above its 2.0% target, cementing the odds of a February rate rise.

"A February rate hike now looks likely from Bank of England," says Michael Hewson, Chief Market Analyst at CMC Markets.

In fact, so severe is the inflationary pressure that Capital Economics points out CPI is now further above the Bank of England’s target than at any point since the UK first adopted an inflation target in October 1992.

For the British Pound these dynamics are supportive:

The Pound to Euro exchange rate has nudged above 1.20, the Pound to Dollar exchange rate is at at 1.3610.

Above: The Annual CPIH inflation rate is at its highest since September 2008.

The Bank of England raised rates on December 16 on fears inflation in the UK was at risk of becoming anchored above their 2.0% target and markets anticipate another rate rise will come in February.

In fact markets now expect the Bank Rate to be as high as 1.25% by the time 2022 is done.

But there is already a great level of anticipation regarding the direction of interest rates already incorporated into the Pound's current values.

"Aggressive" readjustment in expectations for higher rates at the Bank of England means the Pound has already achieved "the appreciation we forecast for H1 2022 as a whole," says Audrey Ong, a strategist at Barclays.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Ong says the extent of sterling’s appreciation since the fourth quarter of 2021, and particularly since mid-December, makes her cautious about further near-term gains.

But other foreign exchange strategists see the Pound potentially advancing further in 2022 amidst a combination of strong employment levels, high inflation and a proactive Bank of England.

"An awful lot is priced for the BoE cycle - yet we think it is too early to 'fade' the GBP rally on a fully-priced BoE cycle - just in the same way it is too early to fade the dollar rally," says Chris Turner, Global Head of Markets and Regional Head of Research for UK & CEE at ING Bank.

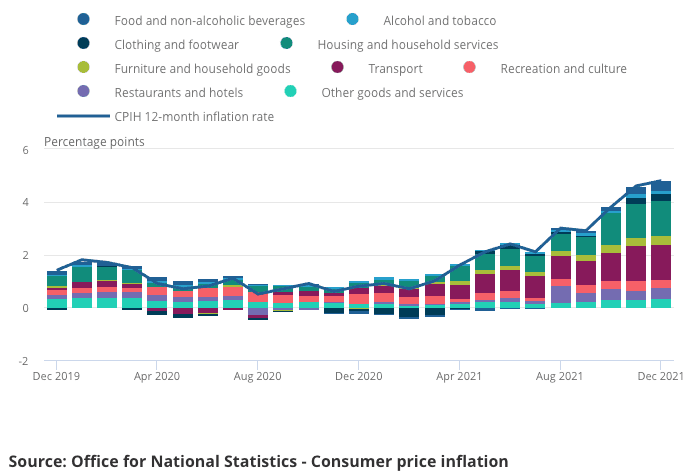

According to the ONS price rises in transport, food and non-alcoholic beverages, furniture and household goods, and housing and household services were the largest contributors to the December's strong inflation reading.

This indicates broad-based pressures on UK prices; exactly the kind of inflation the Bank of England cannot dismiss as being exclusively externally driven in nature. Downward contributions to the monthly rate came from alcohol and tobacco.

ING is anticipating a 25 basis point interest rate rise at the February Bank of England policy meeting while expecting EUR/GBP to continue working its way towards the 0.8270/80 area, which is a lift in the GBP/EUR to the ~1.2092/1.2077 area.

Looking ahead, economists are of the view inflation is yet to peak.

"We’ve not seen the end of rising inflation yet. We expect it to peak in the months ahead, not least if, as expected, the energy price cap is raised," says Alpesh Paleja, CBI Lead Economist.

"With prices on the rise and real wages already falling, it’s likely households will face a cost-of-living crunch for much of this year," he adds.

Responding to the inflation numbers Chancellor Rishi Sunak said, "I understand the pressures people are facing with the cost of living, and we will continue to listen to people's concerns."

Adding to any 'cost of living crisis' would be tax increases planned by the government, the most important being the hike to National Insurance which will also fall in April.

"Can't see those tax rises happening now," says Hewson responding to Sunak's comments, "he has to bin them".

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

"It's now vital that the Government comes forward with urgent solutions to protect the most vulnerable consumers, who will struggle most with anticipated price rises. Solutions must also be found for firms that are struggling with ever-growing cost burdens, especially energy-intensive businesses. This should be a precursor to longer-term energy market reforms, to build resilience against future energy price shocks," says the CBI's Paleja.

Economists at Pantheon Macroeconomics have meanwhile brought forward their forecast for the next increase in Bank Rate to February, from March, following December’s consumer prices figures.

"The headline rate was 0.9 percentage points above the MPC’s forecast in November’s Monetary Policy Report, exceeding the 0.6pp margin in November," says Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics.

Tombs notes inflation in the services sector continued to pick up, reaching 3.4% in December which is its highest rate since June 2013.

"In addition, the MPC’s preferred measure of underlying services inflation, which excludes transport services, package holidays and education from the main services index, has increased to 3.1%, from 2.8%, and now comfortably exceeds its 2.4% average rate in the 2010s," adds Tombs.

But Pantheon Macroeconomics note that Pound Sterling’s recent appreciation - which has seen the trade-weighted index rise 5.6% above its post-EU referendum average - will add to the downward pressure on goods prices.

The UK is a net importer of goods and fuel, therefore a stronger Pound would help ease import prices.

"We continue to think that the MPC will raise Bank Rate by only 50bp this year, half the increase anticipated currently by markets," says tombs.

How far the Bank of England raises interest rates ultimately depends on how long inflationary pressures remain elevated above the 2.0% target.

Gerard Lyons, Economist at Netwealth says oday’s data shows that during 2021 the annual rate of UK inflation rose from 0.7% in Jan to 5.4% in Dec.

"I still expect inflation to peak above 7% in April, stay elevated and decelerate from August, but to then remain above the 2% inflation target throughout next year too," says Lyons.

Such a forecast would be consistent with the Bank of England delivering rate hikes that could take Bank Rate to above 1.0% by the end of 2022.

"In coming months the data may reflect firms pushing through higher costs to maintain or boost margins. Alongside other factors - such as higher energy prices and unnecessary tax rises - this will contribute to the imminent cost of living squeeze," says Lyons.