Pound Sterling's Positive Outlook Underpinned by Consensus-beating Labour Market Reading

- Written by: Gary Howes

- UK economy creates jobs, despite Omicron

- Vacancies reach record highs

- But rate of vacancy creation slowing

- Real wages hit by surging inflation

Image © Adobe Images

A strong set of labour market readings released on January 18 could offer the Bank of England confidence to raise interest rates again in February and maintaining a positive outlook for the British Pound.

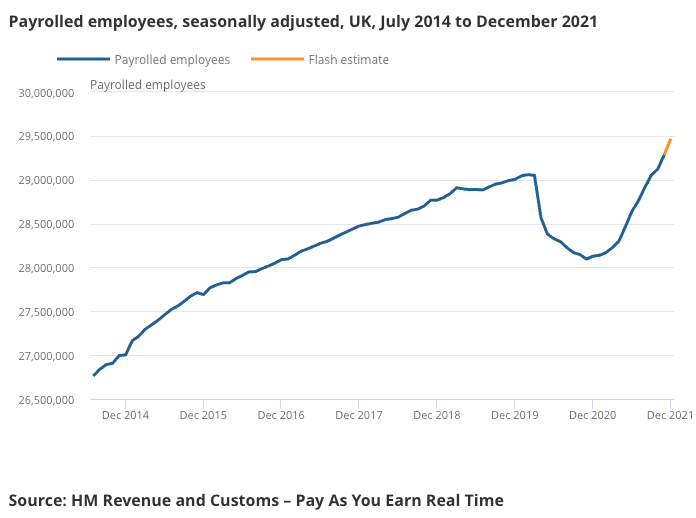

The UK added 184K employees to the payroll in December said the ONS, beating analyst expectations for a rise of 120K. This makes for a rise of 1,340,000 payrolled employees (+4.8%) compared with December 2020.

In a further sign that the labour market was performing well in the post-furlough period, and despite the Omicron surge, the unemployment rate fell to 4.1% from 4.2% previously, beating expectations for a reading of 4.2%.

This means there are 409K more people in work than was the case pre-Covid in February 2020 level.

Above: "The number of employees declined between February and November 2020, but is now above the pre-coronavirus level" - ONS.

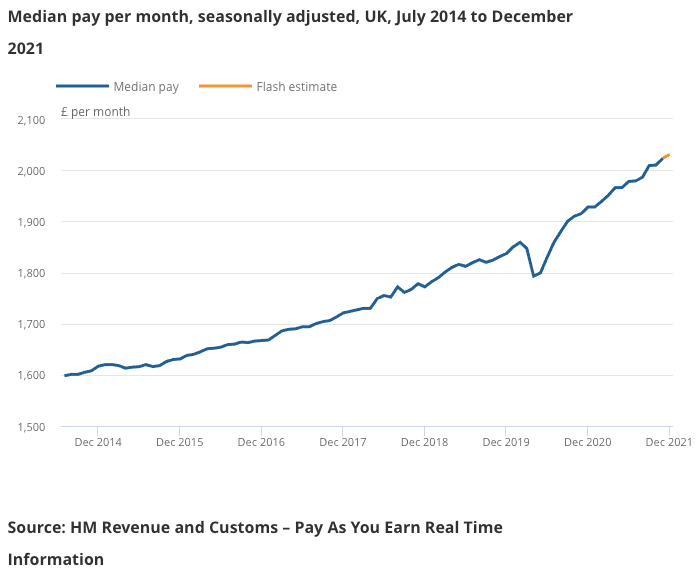

Weekly earnings remained elevated by historical standards, even if they were coming off recent highs: weekly earnings, with bonuses included, read at 4.2% in November which is in line with consensus expectations.

In October earnings stood at 4.9%.

The data points to a robust labour market and will provide cover for the Bank of England to proceed and raise interest rates again next month.

"The labour market appears to have remained tight both after the end of the furlough scheme and the start of the Omicron wave, which supports our view that interest rates will be raised from 0.25% to 0.50% on 3rd February," says Paul Dales, Chief UK Economist at Capital Economics.

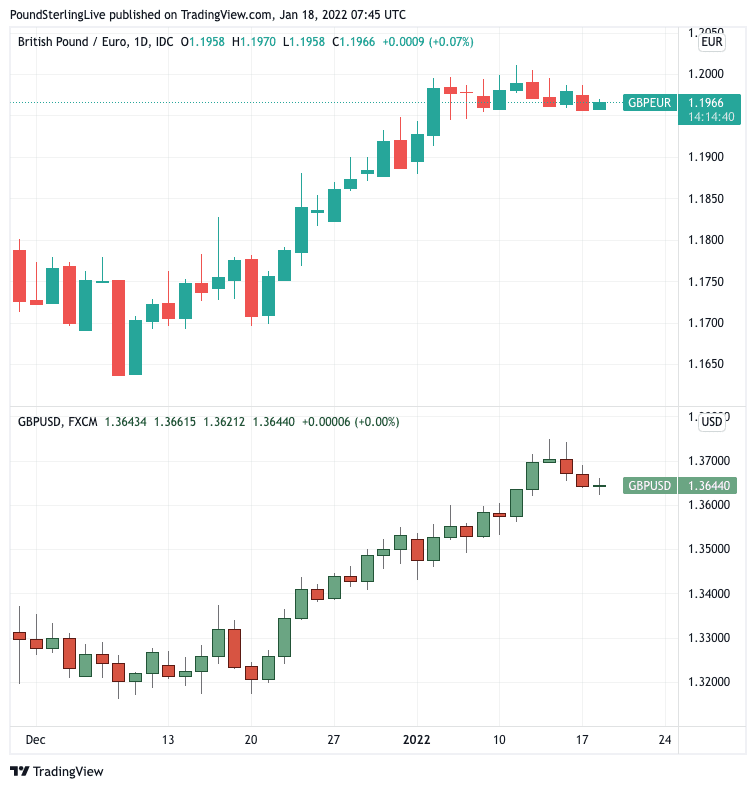

Pound Sterling traded near recent multi-week highs against the Euro, Dollar and other currencies following the release of the data:

The Pound to Euro exchange rate was at 1.1970, the Pound to Dollar exchange rate was at 1.3640.

Above: GBP/EUR (top) and GBP/USD (bottom) have been since December, aided by a Bank of England rate hike, and expectations for more to follow.

- Reference rates at publication:

GBP to EUR: 1.1970 \ GBP to USD: 1.3646 - High street bank rates (indicative): 1.1736 \ 1.3364

- Payment specialist rates (indicative): 1.1910 \ 1.3578

- Get a market-beating rate quote, here

- Set up an exchange rate alert, here

"The British pound is one of the best performing currencies of the year so far, helped by the Bank of England’s (BoE) decision to hike interest rates last month and less stringent COVID-19 restrictions in place. Inflation and jobs data is crucial to the BoE and its hiking cycle, so the pound may be sensitive to these data releases this week," says George Vessey, a currency market strategist at Western Union Business Solutions.

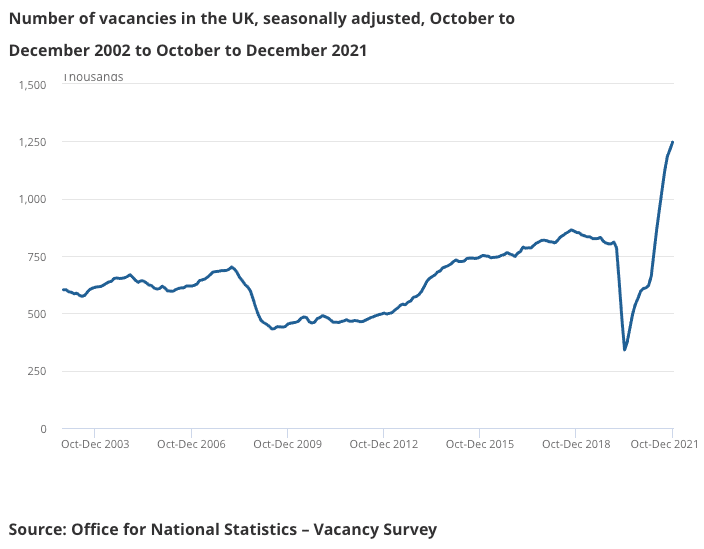

The labour market will likely remain robust as the number of job vacancies in October to December 2021 rose to a new record of 1,247,000, an increase of 462K from its pre-coronavirus January to March 2020 level, with most industries displaying record numbers of vacancies.

This would maintain pressures on wages and signal to the Bank of England inflationary pressures might remain elevated above their 2.0% inflation target for longer than expected.

Indeed, Pound Sterling Live reports today that the Bank could push its benchmark interest rates as high as 1.25% by the end of 2022 amidst expectations for ongoing robust wage increases and elevated inflation.

Should such expectations be met the British Pound would find itself relatively well supported against peers, particularly currencies belonging to central banks that are reluctant to raise interest rates.

Above: "Median pay decreased sharply in April 2020, but has returned to the previous trend" - ONS.

"The UK labour market has continued to recover well since the end of the furlough scheme and the jobs market is still building strength," says Paul Craig, portfolio manager at Quilter Investors. "The Omicron variant has had less of an impact than many anticipated, and major restrictions were thankfully avoided."

The ONS says the rate of vacancy creation is however slowing as the ratio of vacancies to every 100 employee jobs reached a record high 4.1 in October to December 2021.

Rising inflation meanwhile means pay increases in real terms (adjusted for inflation) is struggling with total and regular pay showing minimal growth in September to November 2021.

"Strong demand for labour and limited supply pushed up the number of vacancies to a record high of 1.247m in the three months to December. That said, the single-month data show that vacancies fell in both November and December, which could be an early sign that job shortages are easing," says Dales.

Above: "Vacancies rose to a record 1,247,000 in October to December 2021" - ONS.

Looking ahead, economists are of the view wage growth is unlikely to keep up with inflation, thereby adding pressure to household finances in 2022.

"These data suggest that labour demand has remained fairly strong, that supply is struggling to keep up and that the squeeze on households real wages is only just beginning," says Dales.

The data point to the UK being close to 'full employment' as they suggest a dwindling pool of unemployed labour to draw from.

Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics, says employment growth will likely will slow from the strong pace seen over the last nine months.

"For a start, few people who want a job don’t have one currently. The unemployment rate is only 0.4pp above its pre-Covid low, while the number of people who are technically inactive—because they are not actively looking for work and available to start immediately—but say they would like a job equates to only 5.0% of the workforce, a record low share," says Tombs.

Pantheon Macroeconomics anticipate job market turnover likely will return to pre-Covid norms this year, dampening pay growth, as it has been job-to-job moves that have boosted pay.

"Accordingly, we continue to think that average weekly wages will rise by just 3.5% this year, well below the near-5% average rate of CPI inflation," says Tombs.