Bank of England Interest Rate Predictions: 1.25% by End of 2022 says Capital Economics

- Written by: Gary Howes

Image © Bank of England

The UK's benchmark interest rate could be as high 1.25% by the end of 2022 says a leading independent economics research house.

Capital Economics says their expectation is based around risks the UK's labour market "remains stronger for longer, CPI inflation stays above the 2% target well into next year."

Money market gauges also point to the Bank of England's basic lending rate, known as Bank Rate, reaching 1.25% by the end of the year, which is higher than the rates which will be set in both the U.S. and Eurozone.

This divergence in expectations for future interest rates has been a key driver behind the rally in the value of the Pound seen since December, when Bank Rate was lifted to 0.25%.

But although the money markets are saying Bank Rate will reach 1.25%, most in the analyst community do not agree.

In fact the majority of economists and currency tacticians we follow warn that a major headwind to the Pound over coming months would be the Bank not meeting the market's expectation for a further 100 basis points of hikes.

Above: Bank Rate Expectations (%), Sources: Refinitiv, OBR, Bank of England, Capital Economics.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

But Capital Economics says inflationary pressures will be a major concern for the Bank which will go ahead and hike aggressively.

"We still think that the leap in inflation will prompt the Bank of England to raise interest rates further this year than most economists anticipate, from 0.25% to 1.25%," says Paul Dales, Chief UK Economist at Capital Economics.

"The risks are that the labour market remains stronger for longer, CPI inflation stays above the 2% target well into next year and the Bank of England raises interest rates further in 2023," he adds.

Foreign exchange strategists at Bank of America Merrill Lynch have this week told clients they hold onto a bearish forecast for the British Pound largely on expectations the Bank of England will deliver far fewer rate hikes than the market anticipates.

"The peak of the cycle has now passed in our view as UK growth slows in both absolute and relative terms and the UK rates markets price in a very proactive Bank of England," says Kamal Sharma, FX Strategist at Bank of America.

Bank of America's UK Economist Robert Wood forecasts two rate hikes in 2022, the first in February and then by another 25bps in November.

This takes Bank Rate to 0.75% by the end of the year, versus market expectations for 1.25%.

"We think the UK rates market is aggressively priced for UK rate which we think will be hard to crystallise. This risks to GBP are therefore obvious," says Sharma.

Above: BoE Target Stock of QE (£bn), Sources: Refinitiv, OBR, Bank of England, Capital Economics.

But Capital Economics says inflationary pressures in the UK are set to remain elevated, in part thanks to wage growth.

They anticipate worker shortages to continue putting upward pressure on wage growth during the first half of this year.

"We expect those shortages to ease in the second half of the year. But the risk is that the labour market remains tighter for longer and that wage growth is higher in 2023," says Dales.

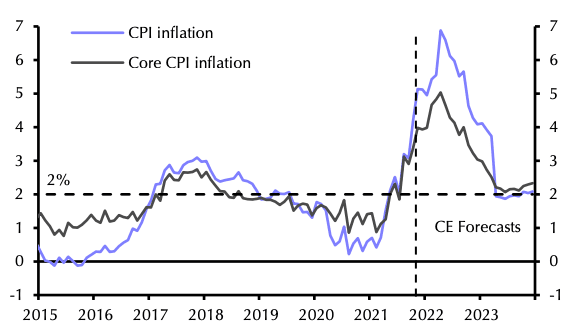

Above: CPI Inflation (%). Sources: Refinitiv, OBR, Bank of England, Capital Economics.

This contributes to a peak CPI inflation forecast of 6.9% in April, helped by a 50% jump in utility bill prices on April 01.

"While CPI inflation will probably ease from April, it’s unlikely to fall to 2% until April 2023. By that point, it will have been above the 2% target for two years," says Dales.

The Bank of England will respond with interest rates that take Bank Rate to 1.25% by December.

"We expect the Bank will continue to put more weight on the outlook for inflation than activity and will raise interest rates four times this year, to 1.25%. That would leave rates higher than most economists expect, but a little bit below the level priced into the markets," says Dales.