Pound Sterling Defends Gains Following News The Economy Returned to Growth in August

- Written by: Gary Howes

- Pound looks for 7th daily advance against Euro, Dollar

- UK economy returned to growth in August

- Third-quarter contraction still likely owing to July slump

- But growth expected in Q4 and into 2024

- Ensuring recession is avoided

Image © Adobe Images

The British Pound looks to defend a run of small daily gains against the Euro and a more pronounced short-term rebound against the Dollar and could find some assistance from the release of GDP data confirming a sharp rebound in activity during August.

The ONS reported a tranche of economic statistics on Thursday with the headline being that the UK economy returned to growth, but elsewhere there was disappointment, particularly with regards to the manufacturing sector which remains in the deep freeze.

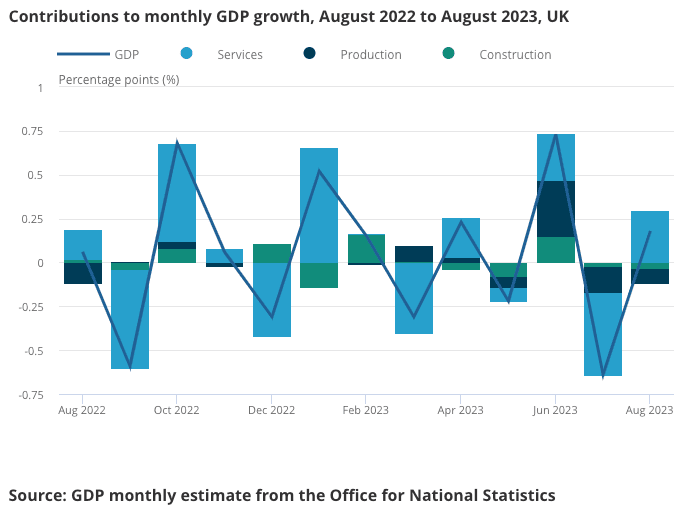

UK GDP expanded 0.2% in August, said the ONS, which was in line with analyst expectations and a solid rebound on July's downwardly revised -0.6%. This took the year-on-year growth figure to 0.5%, which was also in line with expectations.

The Pound to Euro exchange rate was at 1.1582 following the release of the data, the Pound to Dollar exchange rate was higher at 1.2317. Both conversions have now recorded six consecutive daily advances.

Above: GBPUSD (top) and GBPEUR are looking for a seventh consecutive daily advance. Set up a daily rate alert email to track your exchange rate OR set an alert for when your ideal exchange rate is triggered ➡ find out more.

Services output rose by 0.4% during the month and was the main contributor to the growth in GDP.

"The outlook for the UK has improved considerably over the course of 2023, to the extent that we now expect the UK to avoid a recession and for the Bank of England to manage a 'soft' landing for the economy as it slows activity sufficiently to bring CPI back to target," says Stuart Cole, an analyst at online trading services provider Equiti.

"In FX... the greenback is losing its shine somewhat... a further USD slide could also help sterling after monthly GDP and industrial production data are released in the UK this morning," says Roberto Mialich, FX Analyst at UniCredit Bank.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

However, the Pound's rebound potential will have been capped by news the manufacturing sector contracted 0.8% month-on-month in August, which was worse than the -0.4% anticipated by the market, albeit a slight improvement on July's -1.2%

Industrial production read at -0.7%, down on the -0.2% expected but slightly improved on July's -1.1%.

Elsewhere, the UK trade balance remains deep in negative territory at -15.95BN GBP, which was deeper than the -14.70BN expected.

Looking at the broader picture, GDP increased by 0.3% in the three months to August 2023, when compared with the three months to May 2023, with growth seen in all sectors.

Although production was disappointing in August, it grew by 1.2% and was the main contributor to the three-month growth figure.

"Whilst growth may be nothing to write home about, the economy does appear to be shaking off fears of a looming recession. Forecasters have long predicted a recession that has yet to arrive. The economy may continue to find a way to muddle through, despite the weather," says Jonathan Moyes, Head of Investment Research at Wealth Club.

Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics, says it is a close call as to whether the economy records a quarterly decline for the third quarter, mainly owing to the contraction of July.

But, growth can nevertheless be expected heading into year, end which will mean the chances of a UK recession remain unlikely.

"Prices now are rising substantially less quickly than wages, and households’ disposable incomes will be squeezed only gently by higher interest rates—at least in aggregate—because the value of their bank deposits now is only slightly smaller than the value of their debt," says Tombs.

"Accordingly, households' real disposable income looks set to rise over coming quarters, albeit sluggishly. Meanwhile, confidence among both households and businesses has recovered materially over the last six months," he adds.

Pantheon Macroeconomics expects GDP will rise gradually in the fourth quarter and into 2024.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes