UK Consumer Confidence at 20-Month High, Hints at Green Shoots of Recovery

- Written by: Gary Howes

Image © Adobe Stock

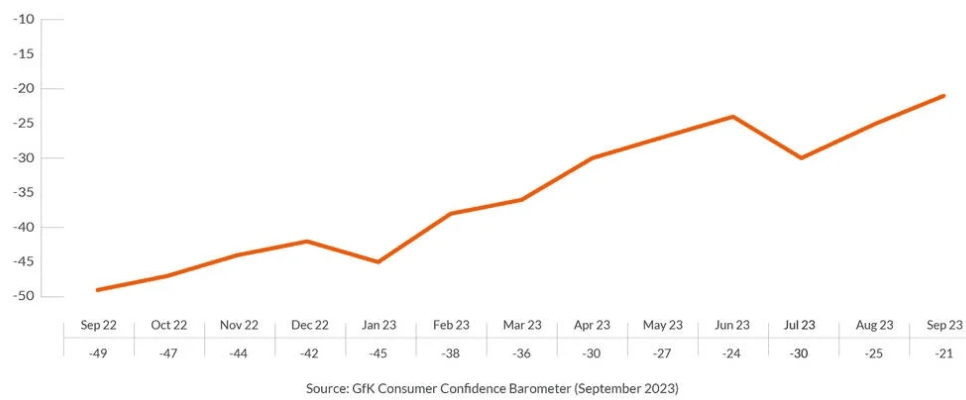

The UK consumer hasn't been this confident in 20 months according to the latest GfK consumer confidence survey which surprisingly improved by four points to read at -21 in September.

This was the highest reading since January 2022, albeit still below its historical average.

The improvement nevertheless matters for the UK economic outlook given the UK's is primarily a consumer-driven economy.

GfK says improvement comes amidst a backdrop of falling core inflation, higher interest rates and rising average weekly earnings, although challenges still remain.

"Against the backdrop of falling inflation figures, growth in wages and high interest rates, UK consumer confidence rose this month to -21, the best recorded showing since January 2022," says Joe Staton, Client Strategy Director GfK.

Staton says the view on our personal financial situation for the past year and the next is registering marginal but welcome growth, while expectations for the UK’s wider economy in the coming year show a more robust six-point increase.

"With less than 100 shopping days to Christmas, the four-point boost to the major purchase measure might offer some hope to retailers, who know all too well that many people face financial pressure in the run-up to this year’s festive season," he adds.

The GfK news is posted on the same morning the ONS reported retail sales recovered in August.

"While the financial pulse of the nation is still weak, these signs of optimism are welcome during this challenging time for consumers across the UK," says Staton.

Gabriella Dickens, Senior UK Economist at Pantheon Macroeconomics says the consumer outlook will likely improve over the rest of the year, supported by further growth in real wages, as the pace of price rises continues to slow.

Pantheon's calculations show mortgage refinancing looks set to subtract about 0.2 percentage points from quarter-on-quarter growth in households' disposable income in Q3 and Q4, which is an unhelpful but not decisive headwind.

"On balance, then, real household disposable incomes should be around 2.0% higher in Q4 than a year ago," says Dickens.