Pound Sterling: GDP Surprise Prompts Fall against Euro and Dollar

- Written by: Gary Howes

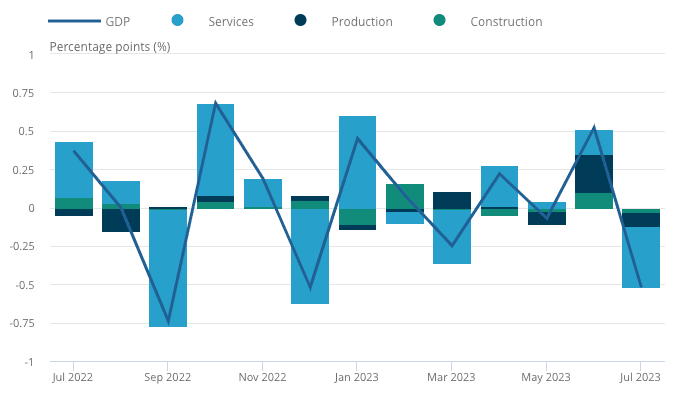

- GDP -0.5% m/m in July

- Pound falls against euro & dollar

- UK stagflation fears are rising

- But economy will avoid recession says one economist

Image © Adobe Images

The British Pound was under pressure in midweek trade following the release of data that showed an unexpectedly sharp decline in economic growth in July.

The ONS reported UK GDP fell by a sizeable 0.5% in the month to July, far outstripping the consensus estimate for -0.2% and representing a sharp slowdown from June's 0.5% growth.

The slump was largely a result of an unseasonably wet July and strikes in the public sector.

Economic growth in the year to June was flat at 0%, which was worse than the consensus estimate of 0.4% and down on the previous month's 0.9% growth. But GDP increased by 0.2% in the three months to July 2023, with growth in all three main sectors being reported.

The data sends a warning signal that the UK economy could be entering a period of stagflation where high inflation marries falling growth.

It also furthers expectations that the Bank of England will raise interest rates for a final time on September 21 as it bets inflation will fall sharply owing to a weakening economy that is yet to experience the full force of previous interest rate hikes.

These expectations put downward pressure on UK bond yields which in turn pressure the pound:

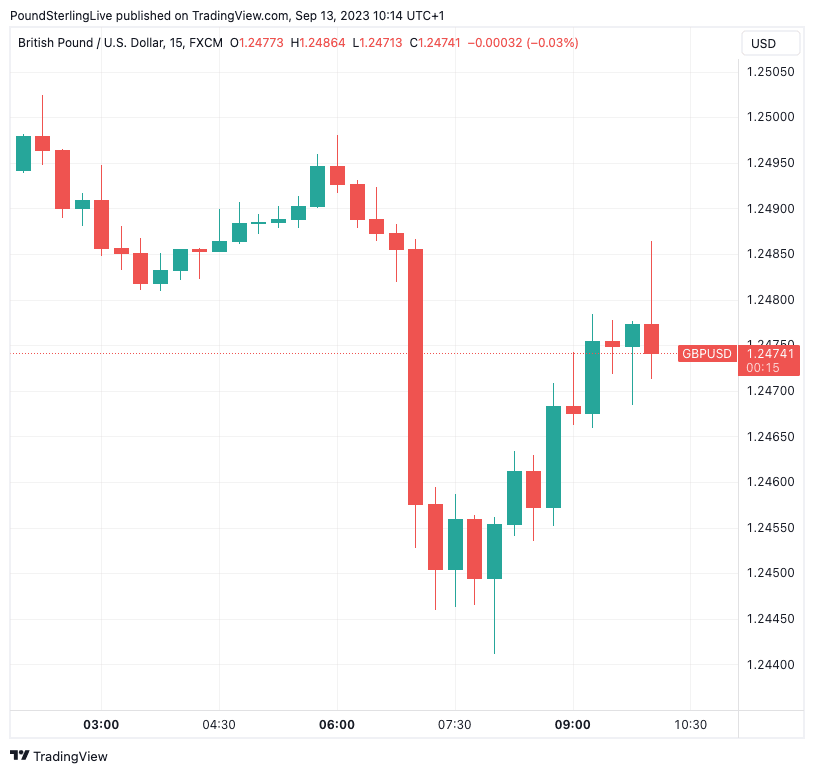

The pound to euro exchange rate was seen 0.14% lower on the day at 1.1599 following the release of the GDP data and the pound to dollar exchange rate was a quarter of a per cent lower at 1.2459.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"Sterling dropped further against the dollar, from GP/USD 1.25 to 1.24, following of the signals of weakness sent this morning by monthly industrial output and GDP data, but it may recover in part today in the wake of the US inflation reading – unless the latter surprises on the upside," says Asmara Jamaleh, Economist at Intesa Sanpaolo Bank.

The ONS says the services sector was the main source of weakness with output down 0.5% in July, after growth of 0.2% in June 2023. Strike action by NHS doctors meant the health services sector was the largest drag on the broader services sector.

NHS England reported that 65,557 appointments and procedures were cancelled because of the senior doctors strike and 101,977 acute inpatient and outpatient appointments were cancelled because of the industrial action by junior doctors.

Elsewhere, production output fell by 0.7% in July, after growth of 1.8% in June and the construction sector fell by 0.5% in July, after growing 1.6% in June 2023.

The GDP report follows Tuesday's labour report that revealed unemployment is starting to accelerate with the unemployment rate rising to its highest level in two years.

"It strengthens the UK stagflation case in which the Bank of England will soon err on the dovish side of expectations," says Mathias Van der Jeugt, an analyst at KBC Markets.

Neil Birrell, Chief Investment Officer at Premier Miton says the speed of the slowdown could be indicating that recession is around the corner. "It does suggest that higher interest rates and sticky inflation are having a more significant effect on the economy."

Ben Jones, Lead Economist at the CBI, points out the economy has been erratic of late with varied performances across sectors in July, making it difficult to separate the signal from the background noise.

"Manufacturing and construction output has been volatile recently and strikes continue to weigh on parts of the service sector. Consumer spending is similarly mixed – July was a washout for the retail sector, but a bumper month at the box office," says Jones.

Above: GBPUSD chart showing a sharp drop at 7:00 on the GDP release.

Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics, is more upbeat, saying the July figures do not mean a major turn for the worse is underway.

W"e doubt that July’s month-to-month drop in GDP marks the start of a falling trend, given that it can be uncontroversially attributed to one-off developments. For a start, sharp falls in output in the health and education sector, which collectively subtracted 0.24pp from month-to-month growth in GDP, were the result of strikes," he says.

He expects strike action to be less of an issue going forward given the settlement between the government and teachers, meanwhile, doctors are unlikely to strike for more than five days in any given month.

"We expect output to start rising again in both these consumer-facing sectors in July, in line with real wages," says Tombs.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes