GBP/EUR Rate Week Ahead Forecast: Paring Gains on Easing French Risks, UK Inflation and Bank of England Eyed

- Written by: Gary Howes

Image © Pound Sterling Live

We forecast the Pound to Euro exchange rate to retreat further this week if French political risks abate and UK inflation undershoots expectations, thereby raising the odds of an August interest rate cut at the Bank of England.

The Pound to Euro exchange rate opens the new week relatively unchanged on Friday's close at 1.1846 with no unexpected developments from France over the weekend to boost volatility.

French political risk has been the major driver for this exchange rate of late and we will be watching French bond markets and political developments in the coming week. We wonder if the bad news is already 'in the price' in terms of President Emmanuel Macron's party losing control of the legislature.

If this is the case, scope for a limited Euro rebound exists.

"The market’s reaction has been logical, contained and there is no sign of panic. Investors are reassessing France’s risk premium, but that is normal," says Vincent Mortier, chief investment officer at Amundi. He says that a parliamentary majority for the National Rally, the populist right-wing party led by Marine Le Pen, would not create a "hock to confidence" for investors.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Pound Sterling sold off against all the major currencies last Friday as concerns peaked and traders booked profit ahead of an all-important UK inflation print due Wednesday and Thursday's Bank of England decision. The Pound's strong run thus far in 2024 could be undermined by any developments that would suggest the Bank of England is ready to cut interest rates in August.

Such developments would result in selling pressure. Investors won't want to risk any profits heading into these events and will want to lock in recent gains, explaining the selloff.

"It's a big week for UK markets. The main event? The June Bank of England decision. We will also get the May CPI report the day before the MPC decision is due," says Sanjay Raja, Senior Economist at Deutsche Bank.

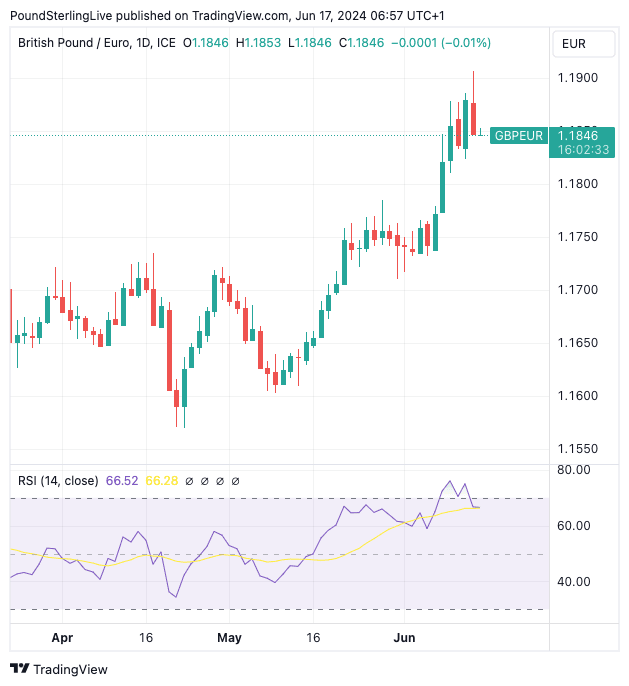

Ahead of these events, we see Pound-Euro coming off overbought conditions, which also suggests Friday's pullback was a necessary correction following strong advances that took the Relative Strength Index (RSI) above 70 and into overbought territory:

Above: GBP/EUR at daily intervals with the RSI in the lower panel. Track GBP/EUR with your own alerts, find out more here.

Nevertheless, the technical setup in Pound-Euro is constructive and pullbacks should be shallow.

Should this week's inflation data beat expectations and the Bank of England express caution about raising interest rates, Pound-Euro can test last week's highs at 1.19 again.

"My prediction for next week’s CPI inflation figures. Headline 2.3% (unchanged). Services inflation 6% (+0.1). Goods inflation -1% (-0.2). Core inflation 3.8% (-0.1%). Not enough change to prompt a rate cut from MPC," says Andrew Sentance, an economist and former member of the Bank of England's MPC.

In May, Sentance correctly predicted that April's inflation reading would overshoot expectations, and if he is again correct, these upside surprises will likely boost the pound.

The key figure to watch on Wednesday is the services inflation print, as this is running well ahead of levels consistent with a durable fall in UK headline inflation to 2.0%.

The Bank of England and other economists expect a steady pickup in inflation over the remainder of the year owing to elevated services inflation levels. Another above-consensus reading would raise questions about just how fast the Bank of England can cut interest rates.

There are sizeable downside risks for the Pound this week if inflation comes in softer and the Bank of England is inclined to signal an August rate cut. This is because the market currently sees less than a 50% chance of an August cut, meaning there is scope for repricing in a GBP-negative direction.

Pound-Euro will likely fall below 1.18 if this occurs.

"The pound may lose some of its recent momentum if UK services inflation comes in cooler than expected next Wednesday, as it would raise the probability of a BoE cut in August and bring rates differentials back to the fore, especially when it comes to GBP/EUR," says George Vessey, Lead FX Strategist at Convera.