Pound Sterling Hit by Wave of Proft Taking Ahead of Key Week

- Written by: Gary Howes

Image © Bank of England

The British Pound is under pressure as investors take money off the table ahead of next week's inflation data release and Bank of England decision.

Sterling is the second-best performing major currency of 2024 but the rally will be tested if next week's inflation data undershoots expectations and the Bank of England signals it is inclined to cut interest rates in August.

Currently, markets see less than a 50% chance of an August rate cut, which implies there is scope for a repricing in expectations in a GBP-negative direction. "Monetary policy will remain a more important driver for the pound sterling," says David Alexander Meier, an analyst at Julius Baer.

The Pound to Dollar exchange rate is down 0.64% on the day at 1.2680, meaning it could be about to register its largest daily loss since April. The Pound to Euro exchange rate flew to 1.19, a new 22-month high earlier in the day owing to ongoing anxiety linked to France, but the pair has given back some of those gains to quote at 1.1855.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"Whilst external factors have been more influential in moving GBP than domestic data and UK election developments, we think markets are underpricing the chance of a Bank of England rate cut this summer," says George Vessey, Senior FX Strategist at Convera.

The Pound's strong run thus far in 2024 could be stifled by a softer-than-forecast inflation print and any signal from the Bank of England that it is ready to cut interest rates.

Such developments would result in selling pressure. Investors will ask whether they should risk waiting for the outcome or lock in recent gains, which could explain some of Friday's losses.

"We expect the MPC to stick to its current communication, priming the markets for a forthcoming start to a cutting cycle. We expect the first 25bp cut in August," says Kirstine Kundby-Nielsen, an analyst at Danske Bank.

She sees the balance of risk skewed to a move lower in the Pound v. Euro exchange rate, "as the BoE tends to err on the dovish side."

Negative risk sentiment is also playing its part in GBP volatility.

France is in the spotlight as President Manuel Macron's surprise decision to call a vote for the legislature risks handing control of the government to either the left or right. Both sides of the divide are unlikely to be helpful when it comes to dealing with the country's mounting debts.

French debt (bonds) have sold off as anxiety grows, but we note that UK bonds are also falling. Jeremy Stretch, an analyst at CIBC Capital Markets, notes that investors continue to prefer the safety of German bonds to UK ones. "Gilt-Bund spreads have widened around 8bps over the last couple of sessions," he says.

This is a European-centric risk-off market, i.e. all things Europe appear risky, particularly relative to the U.S., which is keeping the Dollar at the top of the pile while not playing in Sterling's favour.

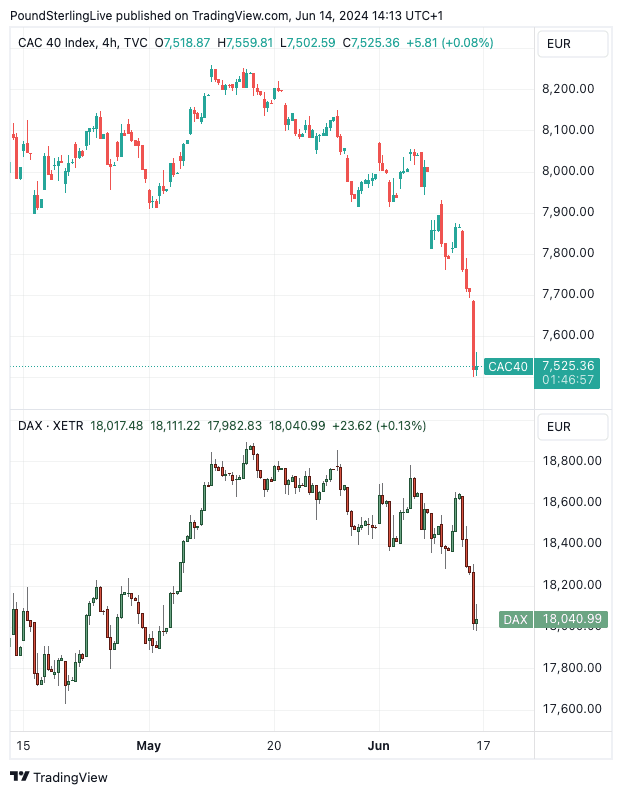

Above: German and French markets are taking a hammering.

Other safe havens, such as the Franc and Yen, are also in demand. But we're also seeing the Pound record losses against commodity currencies such as the Australian, New Zealand and Canadian Dollars, which is not what would see in a typical 'risk off' market.

Geography is important, and this confirms the Pound is in a neighbourhood that doesn't look very appealing at present.