Macron's Costly Gamble Hits the Euro

- Written by: Gary Howes

File image of Emmanuel Macron, Copyright: European Union.

The Pound to Euro exchange rate registered its highest close in 23 months on Tuesday and holds recent advances near 1.1862 at the time of writing amidst rising political uncertainty in France.

Those looking to buy euros are currently doing so at the best rates in nearly two years, thanks to a combination of relative calm in UK politics and rising uncertainty across the channel in France and other major European countries. In fact, "since the EU referendum in 2016, GBP/EUR has traded above €1.18 for only 8% of the time," points out George Vessey, Lead FX Strategist at Convera.

France's bonds (the debt it issues to pay for its spending) and stock markets have come under pressure following Emmanuel President Macron's gamble to call a snap election for later this month. The decision and a wider trouncing of establishment parties in Eurozone elections have shaken confidence in the broader euro project.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The president of France's conservative The Republicans party, Éric Ciotti, announced Tuesday his party would form an alliance with the far-right National Rally (RN) of Marine Le Pen ahead of snap legislative elections.

Le Pen hailed Ciotti's move as a "courageous decision" as she hopes to unite France's right wing in the run-up to the snap ballot abruptly convened by Macron on Sunday after RN swept to victory in the European vote.

"One reason why investors are not rushing to buy this latest dip is that the policies of a potential coalition government that could be led by President Macron and a far-right Prime Minister Jordan Bardella are unclear," says Fawad Razaqzada, an analyst at City Index. Bardella is the President of RN.

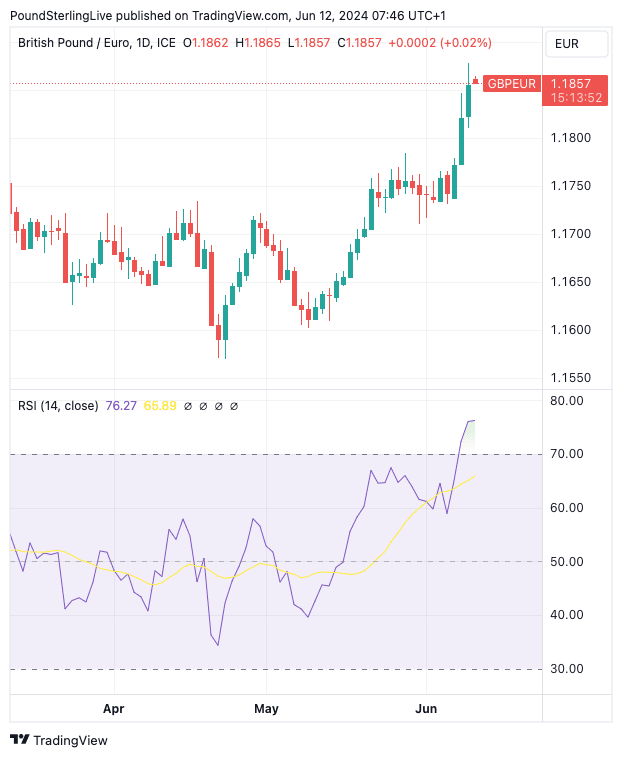

Above: GBP/EUR at daily intervals. The RSI in the lower panel says the exchange rate is now overbought and warns of a consolidation or correction lower. Track GBP/EUR with your own custom rate alerts. Set Up Here

Developments raise investors' fear that France will enter a period of political uncertainty at a time when the country's debt burden expands, which authorities in Brussels see as a threat to the coherence and functioning of the Eurozone.

At the same time, Pound Sterling has benefited from the rise in Eurozone political instability, with the July 04 vote in the UK seen by investors as being of marginal consequence to the economic outlook as both main parties have shown a clear commitment to fiscal prudence.

"The UK is for once looking like a beacon of potential stability and it was noticeable that GBP rose +0.52% against the Euro," says Jim Reid, a strategist at Deutsche Bank.

"The GBP has emerged as one of the better-performing G10 currencies so far in June. The currency did particularly well vs the EUR after the latter was dragged down by returning political risks in the wake of the snap election announcement in France for 30 June and 7 July. The deteriorating EUR sentiment contrasted with growing market hopes that political stability would return to the UK after the 4 July general election," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole.

Borrowing costs for the French government on Tuesday climbed to their highest level since last November following Macron's surprise decision to call a parliamentary election.

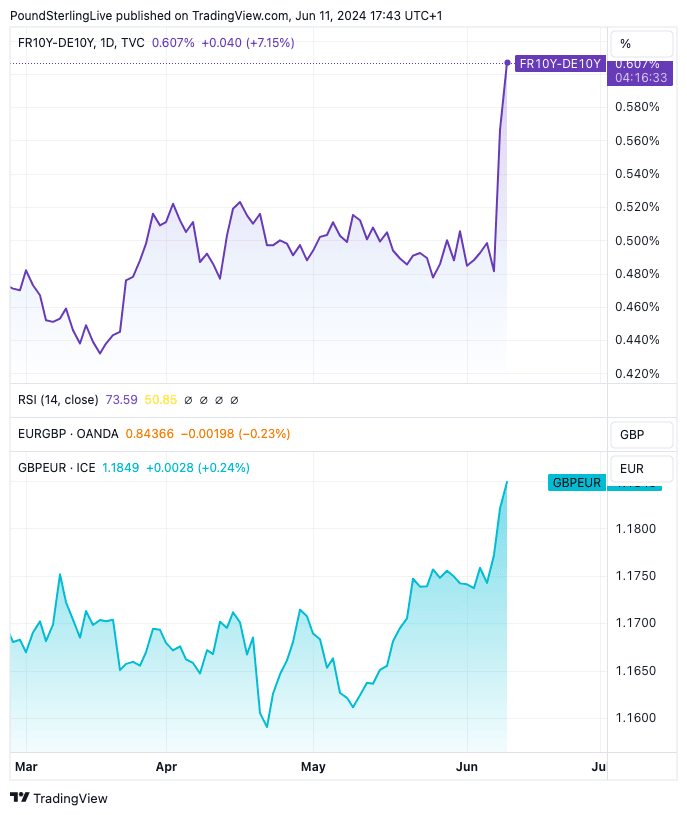

"Concerns about Europe’s political future have been highlighted, for example, by the EUR/GBP falling to its lowest level since August 2022 amid plunging French bonds and stocks. The yield on the benchmark 10-year French bonds jumped another 10 basis points as bond prices fell for the fourth day," says Razaqzada.

At one stage, the yield on 10-year French bonds - that is, the return investors receive for holding French debt - was up as much as 10 basis points at 3.2%.

The comparable German bond yield rose by far less, meaning investors are demanding greater compensation for what they view as riskier investments in the form of French bonds.

This 'spread' between French and German bond yields can be seen surging in the below graph (top panel). We also show the Pound to Euro exchange rate and the corresponding rise to the mid-1.1850s:

Reid also points out investors were already getting nervous about French debt, noting the country's debt burden has ballooned recently. In fact, it has now reached levels that will force the European Commission to place France in an Excessive Deficit Procedure next week.

These steps happen when a country's debt burden rises (France hasn't run a budget surplus since 1974), with the EU viewing it as a systematic threat to the currency bloc, which depends on all constituent countries maintaining a credible fiscal policy.

In late May S&P downgraded the French credit rating from AA to AA-. "The European Commission will likely place France in an Excessive Deficit Procedure next week anyway, as they question France’s fiscal sustainability and adherence to EU fiscal rules. This is an additional risk that is impacting the markets," says Razaqzada.

"We have seen further widening of the bond yield spreads between German and French debt today. Investors are clearly worried about a sustained period of political uncertainty," he adds.