GBP/AUD Week Ahead Forecast: Bracing for the Next Leg Lower

- Written by: Gary Howes

Image © Adobe Images

The Australian Dollar is on a hot streak, and we expect it to make further gains against Pound Sterling in the coming weeks, although the coming days could see a recent consolidation extend.

The Aussie has been buoyed by rising hopes the Federal Reserve will cut interest rates and news of significant efforts by Chinese authorities to bolster its flailing residential property market; both developments are supportive of global investor sentiment.

The Australian Dollar is the ultimate procyclical 'high beta' currency that tends to benefit in times of improving sentiment, making it the G10's outperformer of the past month.

"The strongest currencies since mid-April have been the Australian dollar and the New Zealand dollar. Indeed, the Australian dollar has rallied by 3.7% versus the US dollar, and the New Zealand dollar by 2.9%," says Georgette Boele, Senior FX Strategist at ABN AMRO.

That said, the Aussie's rally has stalled recently, allowing the Pound to Pound to Australian dollar exchange rate (GBP/AUD) the chance to consolidate and form a horizontal support line.

We suspect this period of consolidation can extend into the coming days and potentially even deliver some upside for GBP/AUD:

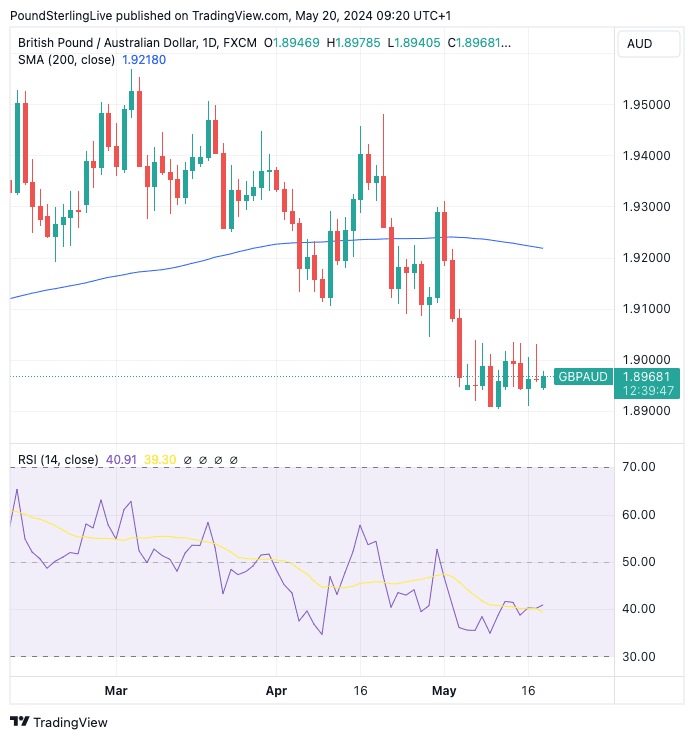

Above: GBP/AUD at daily intervals. Track GBP/AUD with your own custom rate alerts. Set Up Here

Note the Relative Strength Index (RSI) in the lower panel has turned up, which is consistent with easing downside pressure and the potential for a small recovery.

Support is seen at 1.89070, and resistance is at 1.90, and we expect moves on either side of these levels to fade (the obvious caveat being a surprise in the midweek UK inflation release, see more below).

The majority of technical signals we follow show the Australian Dollar as being the preferred currency in the pair. GBP/AUD resides below its key moving averages and momentum indicators remain pointed lower; we therefore see any gains as being a counter-trend correction that will ultimately fade and take the market below 1.89070.

There are no significant releases due out of Australia this week and the focus for GBP/AUD falls on Wednesday's UK inflation report.

The market expects CPI inflation to fall to 2.1% year-on-year in April from 3.1% in March, and the core inflation rate to fall to 3.7% from 4.2%.

Any deviation from these expectations can influence the currency, with the Pound gaining on upside surprises and falling on any undershoot as this will firm the odds for a June interest rate cut.

The Reserve Bank of Australia is meanwhile only likely to cut interest rates in late 2024 or early-2025, meaning the AUD can look forward to a supportive interest rate market setup in the coming months, further pressuring GBP/AUD.