Australian Dollar Rallies on News of "Ambitious" Chinese Property Rescue

- Written by: Gary Howes

Image © Adobe Stock

The Australian Dollar is outperforming major peers as supportive news regarding China's property sector pips domestic wage figures to take the driving seat in midweek trade.

The Pound to Australian Dollar exchange rate was lower by nearly a third of a per cent at 1.8955 on news China is considering an "ambitious" attempt to rescue its beleaguered property sector. The Australian-U.S. Dollar exchange rate (AUD/USD) was a quarter of a per cent higher at 0.6643.

"AUD/USD and NZD/USD received a boost from the stronger CNH," says Kristina Clifton, FX strategist at Commonwealth Bank of Australia. Clifton says the Renminbi rose following media reports that the Chinese government is considering buying unsold homes from distressed developers at a discount using loans from state-owned banks.

According to the report, local state-owned enterprises would be asked to help purchase unsold homes from distressed developers at steep discounts using loans provided by state banks. Many of the properties would then be converted into affordable housing.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

While China has made previous attempts to stabilise the country's property sector, the new proposal would "be much larger in scale," reports Bloomberg. The deflating of China's property sector has weighed on the economy, particularly that part of the economy Australia's raw material exports are exposed to.

Hopes for a property revival are, therefore, supportive of Australian terms of trade and the Australian dollar if they lead to a pick-up in activity.

"However, the reports have not been confirmed so it is unclear if the purchases will go ahead," says Clifton. AUD could unwind some of the gains made on the back of this news if the reports ultimately prove unfounded.

The next China-related risk event for the Australian Dollar is Friday’s Chinese data dump. "We expect the Chinese activity data to show a continued recovery led by industrial production and public investment, supporting CNH," says Clifton.

The next major midweek risk event will be the release of U.S. CPI inflation data. Any undershoot in the figures could boost AUD in a material manner, while a strong figure would prove disappointing and potentially see AUD's midweek gains unwind.

Domestically, Australia's wage figures undershot expectations.

The wage price index rose 0.8% quarter-on-quarter in the first quarter, which was down on Q4's 1.0% growth and below expectations for 0.9%.

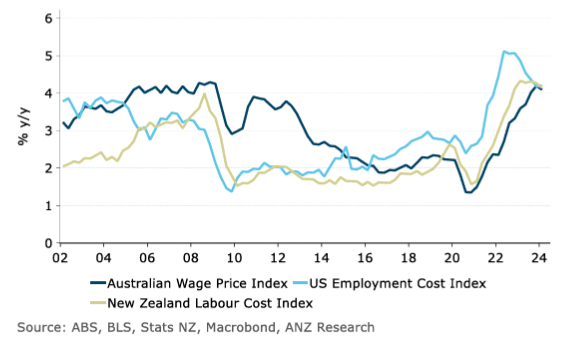

"Today’s data suggest annual wage growth peaked last quarter and that Australia is unlikely to record the elongated peaks seen in some other economies," says Catherine Birch, an economist at ANZ.

Central banks consider high wage growth to be inflationary and a reason to delay interest rate cuts. On balance, this undershoot is unsupportive of AUD, all else equal.

Birch says this downside surprise is the preferred outcome for the RBA as it confirms its view that wage growth has peaked.

"But we don’t think that will be enough to shift the RBA’s thinking, and still see the cash rate on hold at 4.35% until November," she adds.

"Wages growth is easing more rapidly than the RBA had anticipated. While this will forestall any further policy tightening, we still expect the Bank to wait until next year before lowering interest rates," says Marcel Thieliant, Head of Asia-Pacific at Capital Economics.

The AUD can remain supported on the domestic higher-for-longer rates story until the market materially changes its views and starts to price rate cuts more aggressively. But this will take a notable slowdown in the domestic data pulse, which is lacking so far.