RBA Hikes: Australian Dollar Rebound Pressures GBPAUD Lower

- Written by: Gary Howes

Image © ArchivesACT, Reproduced under CC Licensing, Editorial, Non-Commercial

The Reserve Bank of Australia (RBA) raised the cash rate target to 4.10% and said it was open to hiking rates further, a decision that triggered a rally in the Australian Dollar.

The central bank opted to hike rates as it felt inflation risks remained too high:

"Recent data indicate that the upside risks to the inflation outlook have increased and the Board has responded to this. While goods price inflation is slowing, services price inflation is still very high and is proving to be very persistent overseas. Unit labour costs are also rising briskly, with productivity growth remaining subdued," the Bank said in a statement.

The decision was something of a surprise in that the market was nearly split as to whether or not the RBA would hike or not, as detailed in our preview, here. Surprises tend to drive currency readjustments, therefore the decision by the RBA is having an impact on the Aussie Dollar.

The Pound to Australian Dollar exchange rate (GBPAUD) slipped two-thirds of a per cent to 1.8666 as it extends the pullback from last week's multi-month highs.

"AUD is the main outperformer overnight, on an RBA hike that was only 30% priced," says Elsa Lignos, currency strategist at RBC Capital Markets.

The Australian Dollar is meanwhile 0.80% higher against the U.S. Dollar at 0.6670 and 0.66% higher against the Euro with EUR/AUD down at 1.6083.

"AUD/USD jumped by around half a cent after the Reserve Bank of Australia unexpectedly increased its cash rate by 25bp to 4.10%," says Joseph Capurso, FX Strategist at CBA. "AUD/USD can track higher to 0.6726 this week."

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

Further rate increases are possible with the final paragraph of the Statement left unchanged from May:

"Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe, but that will depend upon how the economy and inflation evolve. The Board will continue to pay close attention to developments in the global economy, trends in household spending, and the outlook for inflation and the labour market. The Board remains resolute in its determination to return inflation to target and will do what is necessary to achieve that."

The RBA has been one of the more inconsistent central banks as it paused its rate hiking cycle in April, a development that left the Australian Dollar struggling as it was deprived of support from the interest rates channel.

But, the RBA's latest hike and commitment to further rate hikes could mean it finds itself better supported from here.

Australia’s CPI inflation was surprisingly strong at 6.8% year-on-year in April amidst a jump in housing costs, transport and food. This was above the consensus expectation for inflation to have risen to 6.4% from 6.3% in March.

"We expect another 25bp increase from the RBA," says Adam Boyton, Head of Australian Economics at ANZ Bank.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

Expectations for a further rate increase were boosted last week by the pay commission's decision to lift the minimum wage by at least 5.75%.

"There is also a clear nod to the upside surprise from Friday's minimum wage decision," says RBC's Lignos, with the RBA noting that "the annual increase in award wages was higher than it was last year.” and public sector wages are expected to “pick up further."

The RBA also appears compelled to hike rates having noted house prices are "rising again".

"Short and direct, a tightening bias remains with the labour market, wages and inflation firmly in the spotlight as the RBA tries to gauge how restrictive policy settings need to be. We retain another 25bp hike in our profile in July although it could come a bit later, depending on the data," says Lignos.

These developments are, on balance, supportive of the Australian Dollar. The trend in GBPAUD remains to the upside, however, a pause in that rally can now be expected amidst short-term gains by the Aussie.

But a new headwind is emerging as economists predict that the Australian economy is now at a very real risk of sliding into recession due to the break-neck speed of recent rate hikes.

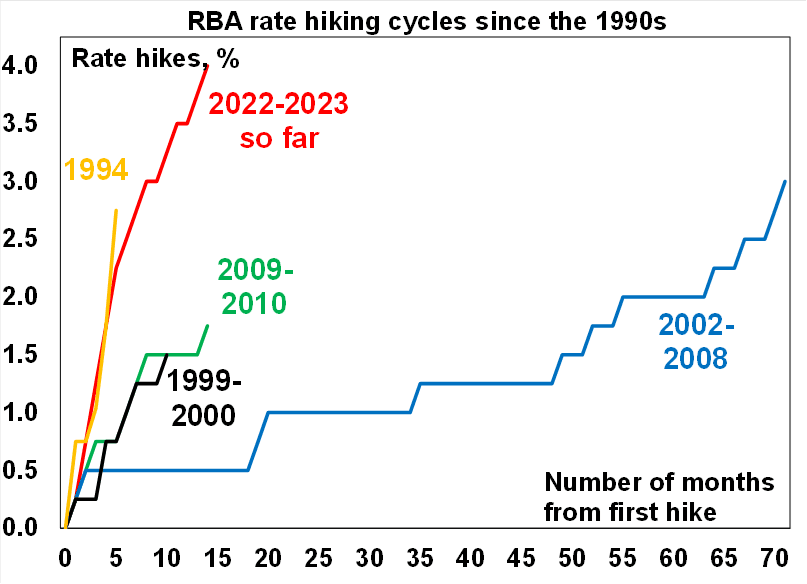

Image courtesy of AMP.

AMP Limited - an Australian retail wealth management and banking provider with approximately 1.5 million customers - says the pace of interest rate hikes at the RBA has been unprecedented and won't be without consequences for the economy.

This was the 12th rate hike since the start of the hiking cycle in May 2022 and it takes Australia's base interest rate to its highest level since 2012.

The RBA has now hiked rates by 400 basis points since May 2022, a pace of increase that surpasses all previous hiking cycles since the 1990s.

"The 4% increase in interest rates since May last year means it is becoming much harder for the economy to remain on an "even keel" as the RBA and most are forecasting and runs the real risk of tipping the economy into a recession, which we assign a 50% risk to in the next 12 months," says Diana Mousina, Deputy Chief Economist at AMP Australia.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes