Australian Economic Recession Now 50/50 Odds Says AMP

- Written by: Gary Howes

Image © Adobe Images

The Australian economy is now at a very real risk of sliding into recession according to analysis from AMP in the wake of the Reserve Bank of Australia's decision to raise interest rates a further 25 basis points Tuesday.

AMP Limited - an Australian retail wealth management and banking provider with approximately 1.5 million customers - says the pace of interest rate hikes at the RBA has been unprecedented and won't be without consequences for the economy.

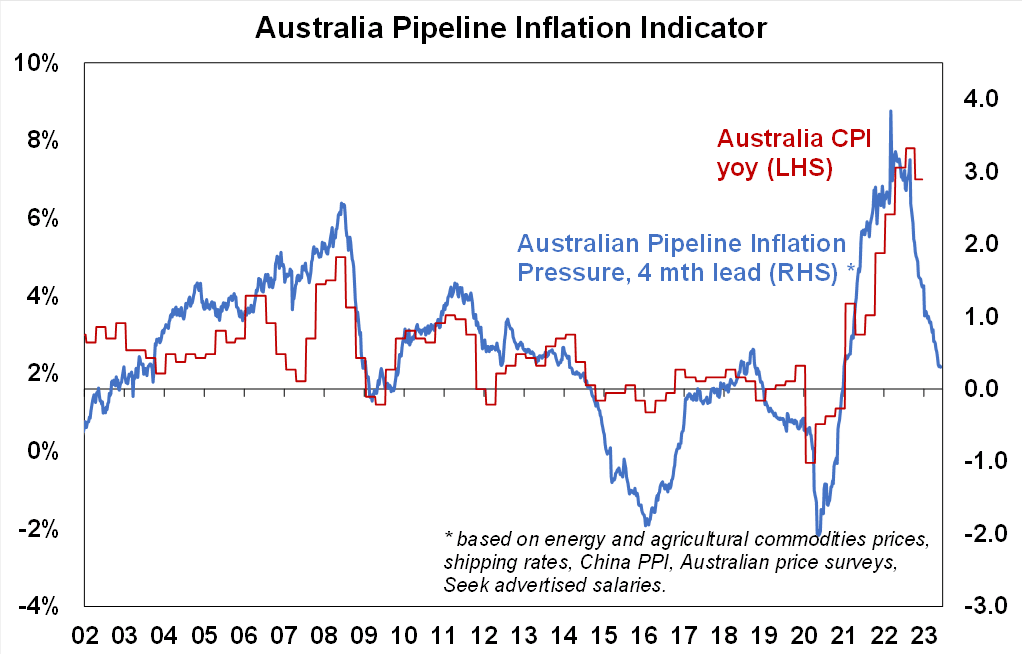

The call comes after the RBA surprised markets and lifted the cash target rate to 4.10% citing its concerns that service sector inflation was becoming increasingly embedded in the economy.

Image courtesy of AMP.

The RBA also pointed out house prices are rising again, a potential signal that it believes the economy is proving more resilient than previously anticipated.

Nevertheless, this was the 12th rate hike since the start of the hiking cycle in May 2022 and it takes Australia's base interest rate to its highest level since 2012.

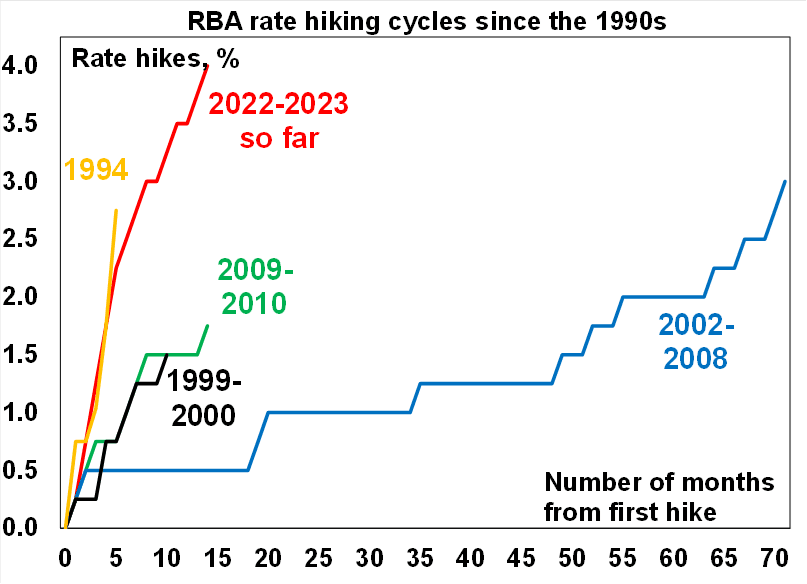

The RBA has now hiked rates by 400 basis points since May 2022, a pace of increase that surpasses all previous hiking cycles since the 1990s.

"The 4% increase in interest rates since May last year means it is becoming much harder for the economy to remain on an "even keel" as the RBA and most are forecasting and runs the real risk of tipping the economy into a recession, which we assign a 50% risk to in the next 12 months," says Diana Mousina, Deputy Chief Economist at AMP Australia.

Image courtesy of AMP.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

And more rate hikes could be forthcoming as the RBA maintained a tightening bias noting that "some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable time frame".

Mousina says this means a further lift to the cash rate can't be ruled out in the next few months, bearing further pressure on indebted households.

"There is also an inequality aspect to interest rate decisions. The impact of rate hikes is very unequal with all of the burden from higher interest rates being placed on indebted Australian households (around 1/3 of total households) and also put further upward pressure on rents," she says.

Image courtesy of AMP.

AMP reckons June's interest rate rise will add another $100 to an average loan of a $600,000 loan and will take the total increase since April last year to an extra $1,310 a month or $15,720 a year.

"While many borrowers received discounts on their mortgage rates, even allowing for this, a 0.50% cut to their mortgage rate, this would take repayments up by $13,320 a year since April last year," says Mousina.

The impact of past rate hikes will meanwhile accumulate as policy works with lags:

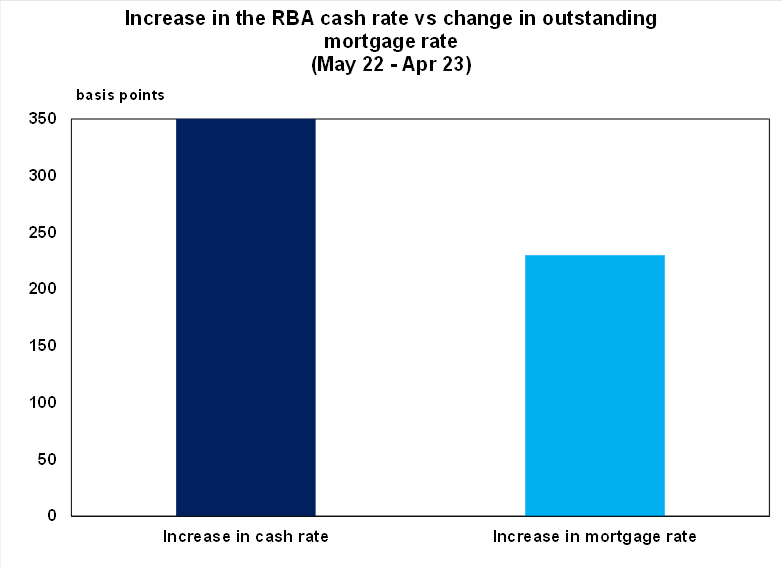

"As at April, when the RBA had hiked by 3.50%, the outstanding mortgage rate had only gone up by 2.30% which reflects indebted households receiving discounts on variable rates, the lags between when the RBA makes its decision and when the bank passes on the rate changes (usually ~3 months) and the higher-than-usual share of households on fixed rates (many which roll-off in the next few months)," says Mousina.

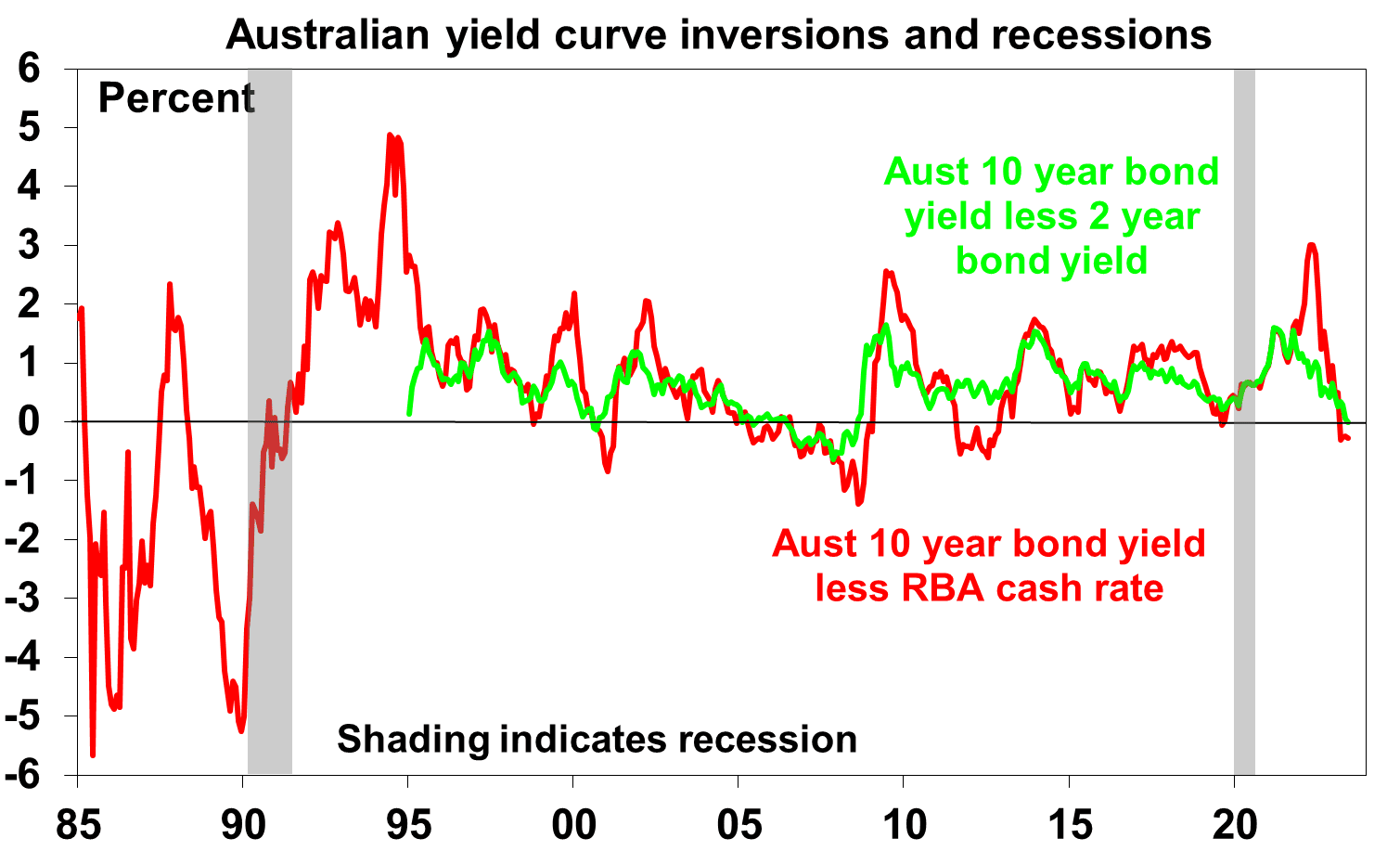

The analyst meanwhile notes the market is moving to price in a rising risk of an Australian recession with a recent inversion of the 10-year less 2-year yield after the 10-year less RBA cash rate yield also went negative recently.

"While Australian yield curve inversions have been less of a reliable guide to recessions in the past (compared to US yield curve inversions), prior Australian recessions have seen the yield curve invert," says Mousina.

Image courtesy of AMP.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes