GBP/AUD Rate Retreats on Aus Wage and RBA Developments

- Written by: Gary Howes

Image © Adobe Images

Improved global investor risk sentiment and rising bets that the Reserve Bank of Australia (RBA) will hike interest rates on June 06 helped the Australian Dollar rally ahead of the weekend.

The Australian Dollar joined other risk-sensitive currencies and financial assets in a rally following news the U.S. Senate passed legislation to suspend the U.S. debt ceiling and impose restraints on government spending through the 2024 election, ending a drama that threatened a global financial crisis.

"US markets have touched a nine-month high, as US lawmakers voted to raise the debt ceiling and avoided a challenging default. The relief from investors showed up in both the S&P 500 and the Nasdaq composite, with gains around 1% seen on each," says Sophie Lund-Yates, lead equity analyst at Hargreaves Lansdown.

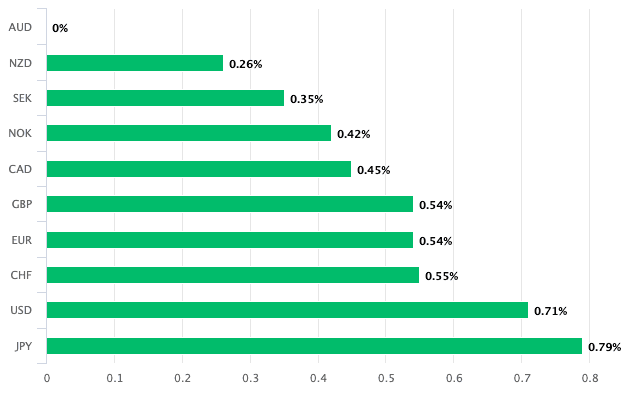

The Australian Dollar recorded gains against all its peers, with a 0.71% advance seen against the U.S. Dollar at the time of writing Friday. Gains of half a per cent are recorded against the Pound and Euro.

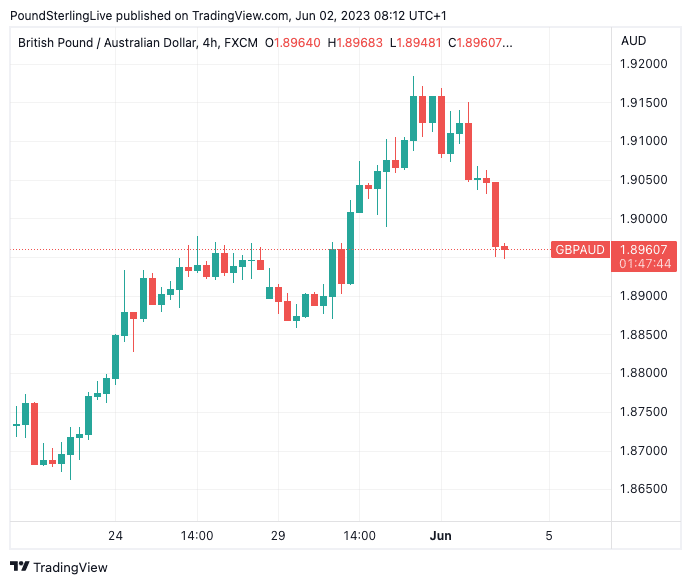

The Pound to Australian Dollar exchange rate's ongoing rally took GBPAUD as high as 1.9183 by the midweek session, a new multi-month high, but the pair is back at 1.8962 at the time of writing.

A sharp fall in GBPAUD mirrored a broad jump in Australian Dollar value early on Friday after Australia's Fair Work Ombudsman decided on a minimum wage increase of at least 5.75%.

"Get set for a minimum wage increase," the Ombudsman announced, "the National Minimum Wage will be increased to $882.80 per week or $23.23 per hour."

This pay award is considered inflationary in that it sets wage increases far above the 2.0% inflation target of the RBA, suggesting to investors the central bank will most likely respond with further interest rate increases.

The market has moved to price in a 40% chance of a 25bp RBA hike next week (June 06) compared to 25% prior to the wage decision.

Interest rate expectations are a primary driver of global foreign exchange at present, therefore rising RBA hike expectations understandably offer the Aussie currency some support.

Above: AUD performance on Friday June 02.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

Analysts at RBC Capital Markets say they now see a 25 basis point hike at the RBA in June as a result of the pay award.

However, other economists are not yet convinced, confirming we are heading towards another touch-and-go RBA event that suggests the Australian Dollar will be the currency to watch next week as it is set for a surprise either way.

"AUD/USD lifted to near 0.6605 because of a positive repricing of RBA rate hikes and a stronger CNH," says Carol Kong, FX strategist at Commonwealth Bank of Australia (CBA). "Next week's RBA policy meeting is now 'live' in our view."

Above: GBPAUD retreats from its highs.

Kong says the Australian Dollar faces some downside next week "if the RBA stays put as we expect."

"The meeting is live in that the case for a further rate increase is likely to be seriously discussed. However, we expect the Board to decide to hold the cash rate steady at 3.85% while continuing to emphasise its tightening bias," says Bill Evans, Chief Economist at Westpac.

"There is too much uncertainty for the RBA Board to raise the cash rate again next week. In particular, the outlook for household spending is very worrying, especially with inbuilt lags associated with this unique cycle. An extended pause to allow full evaluation of these lags is the best policy," he adds.

Given the market is split on whether the RBA will hike, any decision to forgo a hike could see the Australian Dollar retreat and GBPAUD potentially test its recent highs again.

A hike would, on the other hand, potentially put GBPAUD back under pressure, particularly if global risk sentiment enters a benign period.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes