Australian Dollar: RBA's Lowe Refuses to Budge on Interest Rate Guidance

- Written by: Gary Howes

- AUD remains a top performer

- As RBA stick to guidance on rates

- Says will be patient on hiking

- But markets see 125 points of hikes in 2022

- Poses scope for AUD disappointment

Image © Crawford Forum, Reproduced Under CC Licensing

The Australian Dollar remains a top performer but the Reserve Bank of Australia is sticking to its guidance on interest rate hikes which ooses scope for AUD disappointment.

In a warning that the market might be getting ahead of itself, RBA Governor Philip Lowe said he intends to remain patient when it comes to raising interest rates.

Delivering a speech to the AFR Business Summit on March 09 Lowe said the RBA "can be patient" on raising interest rates, "in a way that countries with substantially higher rates of inflation cannot."

Lowe said wages remain a critical component of the RBA’s thinking and the RBA has "scope to wait and assess incoming information."

"In our view, this points to the first rate hike being a Q3 rather than Q2 event," says David Plank, Head of Australian Economics.

Above: GBP/AUD daily (top) and RSI (bottom). The RSI is now well below 30 and signalling deeply oversold conditions. Technical enthusiasts will be looking for a rebound.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The Australian Dollar and New Zealand Dollar are the joint best performing major G10 currencies of the past month, proving surprising winners in an environment of deep investor angst.

Helping the two currencies is the view that their central banks are in a position to raise interest rates substantially without negatively impacting future economic growth rates.

This is largely because Australia's and New Zealand's economies are not at risk of the same stagflationary forces that European, UK and U.S. markets are presently exposed to.

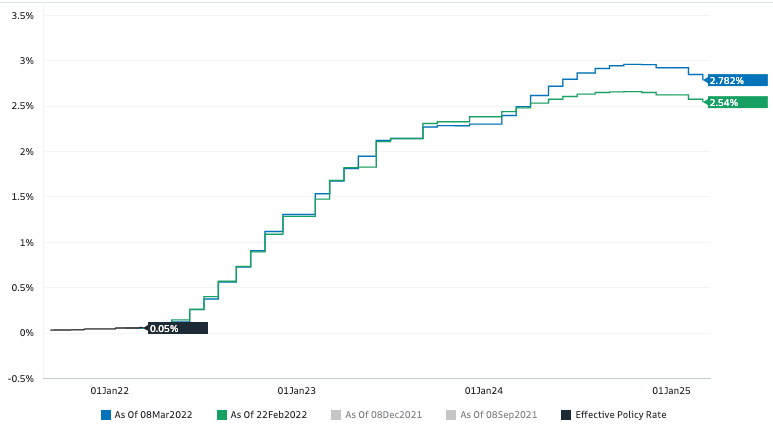

Money markets now price 125 basis points of hikes from the RBA for 2022, far more than Lowe and the RBA is currently guiding.

This suggests the market is happy to call the RBA's bluff and Lowe's speech has done nothing to deter these expectations.

Above: 3y Forward Expectations of RBA Policy Rate (%). Image courtesy of Goldman Sachs.

- GBP to AUD reference rates at publication:

Spot: 1.8000 - High street bank rates (indicative band): 1.7368-1.7450

- Payment specialist rates (indicative band): 1.7840-1.7910

- Find out about specialist rates, here

- Set up an exchange rate alert, here

The risk for the Australian Dollar therefore is that the RBA does stick to its guidance and massively disappoint against market expectations, which could trigger a recalibration in Aussie Dollar value.

Lowe said raising interest rates too early could put at risk "the opportunity to secure a lower rate of unemployment than has been the case for some decades."

He appears keen to wait and observe the impact a reopening of Australia's borders has on wages and employment.

The speech follows a period of impressive Australian Dollar strength that has direct links to Russia's invasion of Ukraine, with investors preferring the Aussie thanks to its geographical detachment from the conflict and Australia's substantial resources export basket.

"The outperformers were the Antipodean currencies on the back of higher commodity prices," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole. "Despite risk-off trading, the AUD remains well supported (as does the NZD) as investors run to commodity currencies.

The Australian Dollar has risen by 4.60% against the Pound over the course of the past month but is higher by 6.0% against the Euro.

Against the Dollar the Australian unit has risen 1.46%. In fact the only currency that has advanced against the Aussie over the past month is its New Zealand neighbour.

Above: Spectra Markets' Brent Donnelly produced this graphic showing geographic location relative to Ukraine can prove a solid explainer of recent currency market trends.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

"The vast improvement in the terms of trade and prospect of a first rate increase later this year support further appreciation of the AUD from attractive levels," says Kenneth Broux, a strategist with Société Générale.

But the Australian currency would be at risk of a retreat in the event sentiment regarding the war settles and investors start to price in the prospect of a peace deal.

Ukraine and Russia continue to talk and this could provide a backstop to any substantial moves and therefore ultimately provides a potential headwinds to further Aussie gains.

"AUD strength will likely be sustained if geopolitical risks remain elevated, as it draws on a combination of improving terms of trade and relative rates with US rates lower," says a research note from Barclays. "A deescalation should pose near-term headwinds".

The Pound to Australian Dollar exchange rate is quoted at 1.8012 at the time of writing, having been as high as 1.9221 on January 28, the Australian to U.S. Dollar exchange rate is at 0.7285, having been as low as 0.6967 on January 28.