Surging Wheat Prices to be Another Source of Support for Australian Dollar

- Written by: Gary Howes

Image © Adobe Images

The Australian Dollar's extraordinary run higher is set to extend as Australian farmers are set to cash in on near-record high wheat prices.

Wheat prices surged a further 12% on Friday as physical traders scrambled to access a commodity that will become increasingly scarce over coming weeks and months owing to the war in Ukraine.

Australia's farmers are meanwhile celebrating a bumper harvest that will attract a premium in a global market that is prepared to pay a premium for their output.

"Australian farmers have also had a very strong growing season and will benefit from higher prices for their wheat," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole.

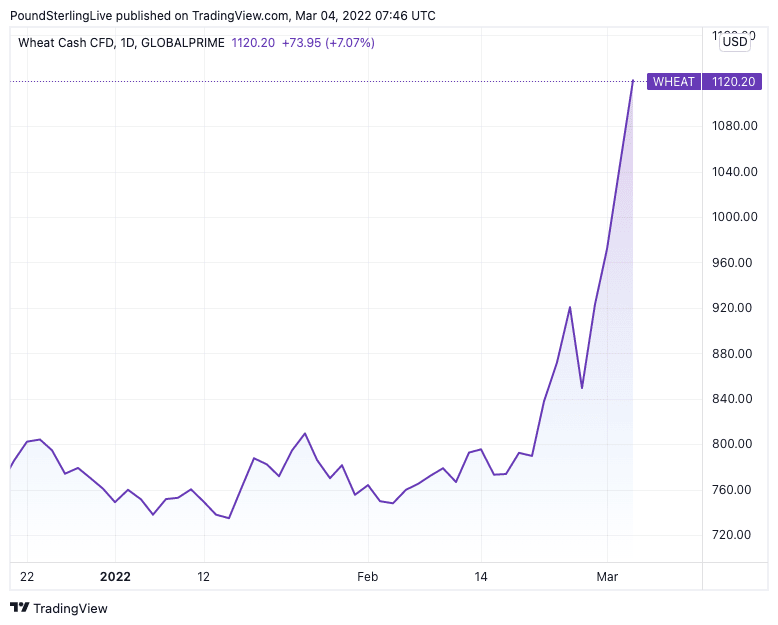

Since Russia invaded Ukraine wheat prices have risen by 40% with a 12% surge coming on Friday March 04 alone.

The war in Ukraine is only set to intensify with Russia on Friday morning attacking Europe's largest nuclear power facility, a move that propelled commodities ever higher.

"There are profound implications for sectors such as energy, wheat and barley, fertilizer, and metals. Physical supply disruptions combined with sanctions will see substantial and sustained price increases, on top of already high CPI numbers," says Jan Lambregts, Global Head of Research at Rabobank Global Economics & Markets.

Above: Wheat prices have surged and are closing in on March 2008.

- GBP to AUD reference rates at publication:

Spot: 1.8083 - High street bank rates (indicative band): 1.7450-1.7577

- Payment specialist rates (indicative band): 1.7920-1.7993

- Find out about specialist rates, here

- Set up an exchange rate alert, here

Amidst the developments the Australian Dollar and New Zealand Dollar continue to surge in value, establishing a status as outperformers during times of European conflict.

"Most major commodity currencies have actually appreciated against the dollar, which is unusual in an environment of worsening risk sentiment," says Jonathan Petersen, an analyst at Capital Economics.

The Pound to Australian Dollar exchange rate fell a further 0.40% on Friday to quote at 1.8116, having been as high as 1.92 on January 28.

The Australian to U.S. Dollar exchange rate is up a further quarter of a percent at 0.7354, having been as low as 0.6967 on January 28.

The overall CRB Food Index has also risen to a new record high as the impact of grain shortages are expected to feed through to other food products.

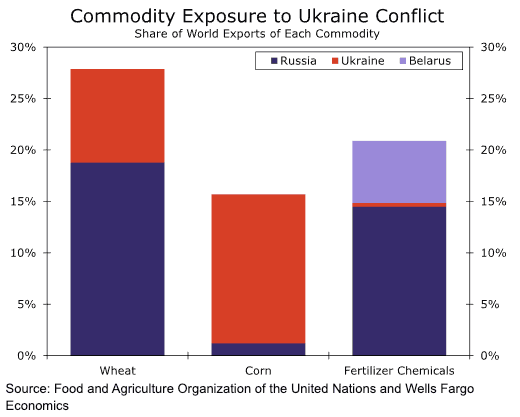

"With grains an important source of feedstock comes the prospect of higher protein prices down the line," says Sarah House, Senior Economist at Wells Fargo Securities.

The analyst says Russia and Belarus, the latter of which has also become a target of sanctions, are significant exporters of fertilisers, of which the agriculture industry is a major user.

"As such, the potential for supply disruptions—due to either physical damage, government sanctions, or businesses' self-sanctions—extend to the agriculture sector and threaten to drive up food costs even further," says House.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Pound Sterling Live reported ahead of Russia's invasion of Ukraine that Australia could be one of the beneficiaries of such a reckless move by President Vladimir Putin, as it shares a commodity export basket similar to that of Russia.

The war has since clogged Eastern European trade routes while sanctions imposed on Russia by the international community have severely impacted the country's ability to export.

Even those countries that are not directly sanctioning Russia will struggle to access its commodities as insurers are unwilling or unable to insure transportation in what is now a incredibly risky part of the world.

Finance merchants are also unwilling or unable to offer the necessary credit lines to physical traders dealing in Russian and Ukrainian commodities.

Russia and Ukraine together account for approximately 30% of the global wheat trade and the conflict could therefore stall grain exports to regions that are net importers such as Africa, Asia and South America.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The Australian Dollar is considered a commodity currency as Australia earns significant amounts of foreign exchange via the export of raw materials, all of which have risen in value in the wake of the Russian invasion of Ukraine.

"Higher energy and wheat prices due to Russia’s invasion of Ukraine as well as strong iron ore prices due to Chinese demand will continue to supply Australia with trade surpluses," says Marinov.

Gas prices have meanwhile surged and oil prices nearly hit $120 / a barrel on March 03.

"The AUD is usually well correlated with oil given its huge coal exports (which is a substitute good). Australia also exports LNG. In the current environment we expect the commodities currencies to remain well supported," says Jane Foley, Senior FX Strategist at Rabobank.

The Australian economy meanwhile appears less exposed to the surging inflation rates seen in other developing economies.

"Australia is not going to experience stagflation, and employers continue to struggle to find workers," says Marinov.

Another powerful driver of Aussie Dollar demand is meanwhile coming from a reappraisal by investors of their expectations for Reserve Bank of Australia interest rates.

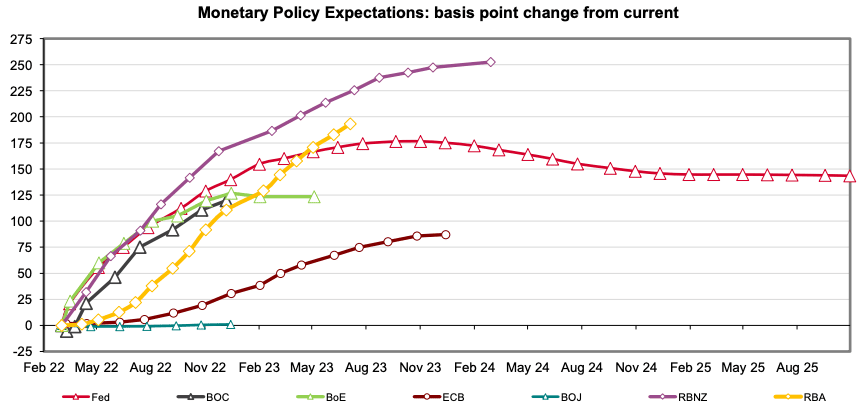

Money markets have aggressively lifted expectations for RBA rate hikes and have pushed Australia's 'yield curve' sharply higher:

Image courtesy of Westpac.

This is important as a rising yield curve is considered to be one that implies the outlook for both growth and inflation is positive.

This contrasts to a curve that rises and then starts to dip again, implying growth will ultimately start to slow again.

As can be seen in the above chart, the market anticipates a rapid rise in RBA rates to the extent that Australian interest rates will be higher than those in the U.S. by 2023, by which time U.S. rate hikes will likely have ended according to the flat Fed profile.

Another standout is the Reserve Bank of New Zealand where the projections are also pointed higher.

Both the Fed and Bank of England projection lines meanwhile rise and then dip.

The shape of the curves could help explain why the New Zealand and Australian Dollars are rapidly appreciating in value against the Pound, Dollar and Euro.

There are now 111 basis points of hikes anticipated to come out of the RBA by the end of 2022, this compares to the 127 expected from the Bank of England.

Looking back to the start of February the data show there were 100 basis points of hikes expected from the RBA and the amount expected from the Bank of England was similar to what it is now.

The Australian Dollar will have likely benefited from this relative shift higher in rate hike expectations over recent weeks.