Pound / Euro Hits New Post-Brexit High On Fears of Chernobyl Redux

- Written by: James Skinner and Gary Howes

- GBP/EUR seen near 1.21

- Highest level since Brexit referendum night

- Amid blaze at Europe’s largest nuclear plant

- ”It will be 10 times larger than Chernobyl!”

Above: Ukraine nuclear plant Zaporizhzhia under Russian attack. Photo: Daniel Arrhakis. Sourced: Flickr, March 04, 2022. Licensing: Creative Commons Attributive Non-Commercial 2.0 Generic.

The Pound to Euro exchange rate reached its highest level since the immediate aftermath of the Brexit referendum when Sterling changed hands around 1.21 in the early hours of Friday morning after a blaze broke out at Zaporizhzhia nuclear power plant in Ukraine, one of the world’s ten largest.

Pound Sterling appeared on course for a fifth consecutive gain over the Euro in the early hours Friday after fierce fighting around the perimeter of the Zaporizhzhia power plant - on the bank of the Kakhovka water reservoir and close to the Dnieper river - ignited a fire insight of the plant.

"If it blows up, it will be 10 times larger than Chornobyl! Russians must IMMEDIATELY cease the fire, allow firefighters, establish a security zone," Dmytro Kuleba, Ukraine's minister of foreign affairs, said in a social media post.

According to Ukraine's National Nuclear Energy Generating Company (Energoatom), the facility is among the 10 largest in the world "operating four nuclear power plants with 15 power units in total."

UK Prime Minister Boris Johnson spoke with Ukrainian President Zelenskyy "in the early hours ... about the gravely concerning situation at Zaporizhzhia" said a statement from Number 10 Downing Street.

Johnson said he would be seeking an emergency UN Security Council meeting in the coming hours, and that the UK would raise this issue immediately with Russia and close partners.

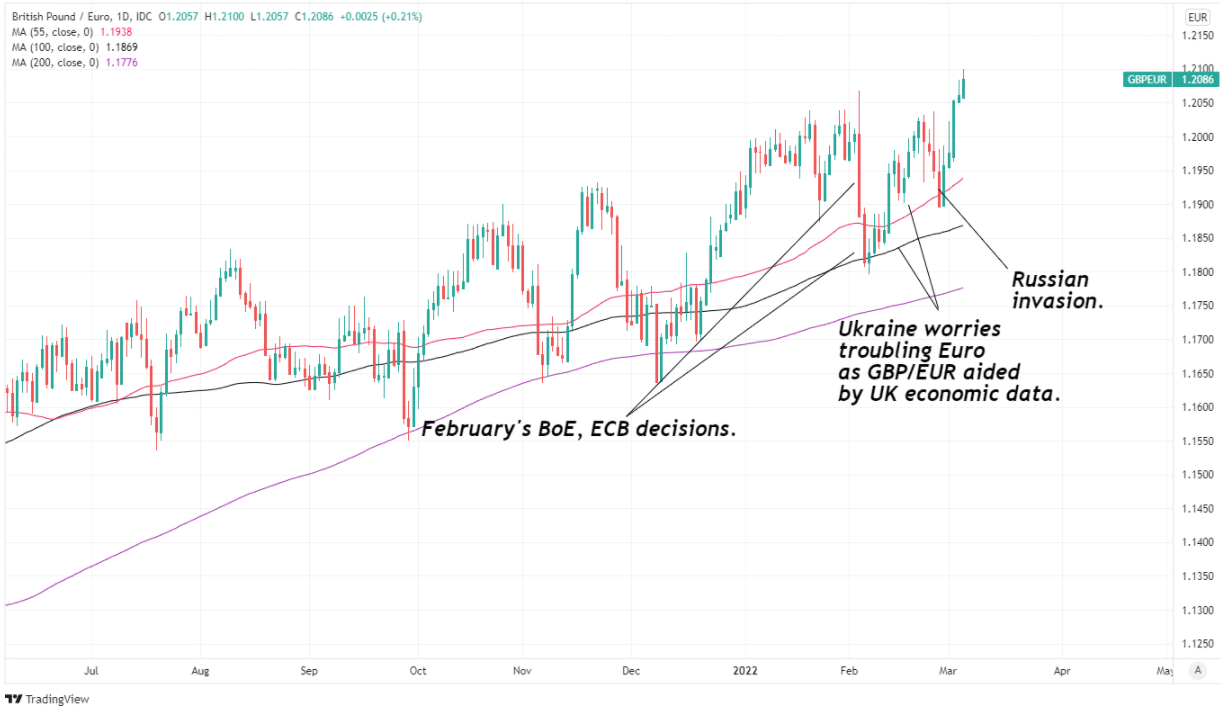

Above: Pound to Euro rate shown at daily intervals. Click image for closer inspection.

- Reference rates at publication:

GBP to EUR: 1.2102 - High street bank rates (indicative): 1.1778 - 1.1863

- Payment specialist rates (indicative): 1.1993 - 1.2040

- Find out more about specialist rates and service, here

- Set up an exchange rate alert, here

“At the moment, the wind from the side of the station is blowing towards the south-eastern part of Ukraine and in the direction of large Russian cities: Rostov-on-Don and Krasnodar,” an Energoatom spokesperson said, without irony, in a Telegram post.

The UK's Ministry of Defence in a Friday morning update said the Ukrainian nuclear regulator and the International Atomic Energy Agency have stated that radiation levels remained within normal limits.

"By approximately 0430Z, according to Ukrainian authorities, the fire which was at a training building had been extinguished," said the MoD update.

The incident was reported around midnight and provoked an immediate decline across the European currency complex, hitting Central and Eastern European currencies such as the Polish Zloty especially hard but also weighing on the single currency too.

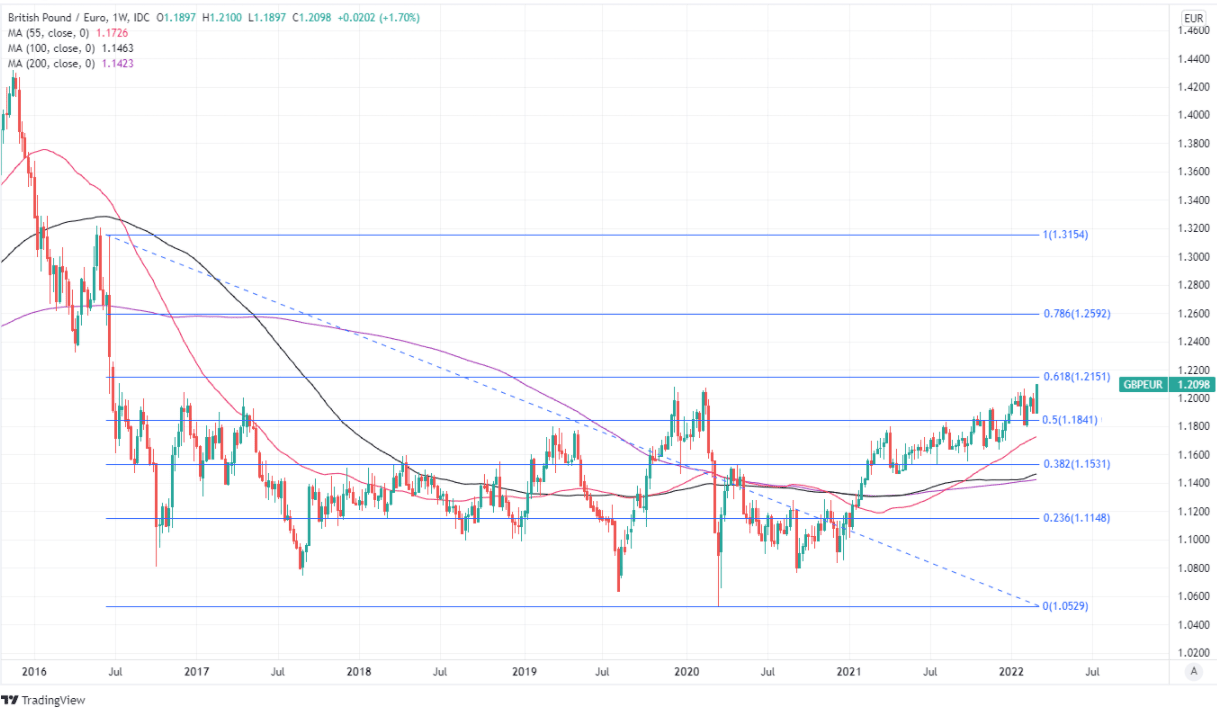

Europe’s single currency slumped around 50 points to 1.1012 against the Dollar, bringing EUR/USD into contact with a major medium-term level of technical support on the charts while also helping lift the Pound to Euro exchange to 1.21 for the first time since June 24, 2016.

The Pound to Euro rate tends to closely reflect the relative performance of EUR/USD and GBP/USD, the latter of which was less impacted than continental European currencies having dipped back to 1.3320 before bouncing.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

“We see GBP as remaining moderately better positioned vs. the EUR in the coming months as long as the crisis deepens and Russia’s pariah status persists. The GBP, however, is likely to remain on the back foot vs. commodity currencies,” says Jane Foley, head of FX strategy at Rabobank.

“Worries about Germany’s energy security increase the vulnerability of the EUR vs. the GBP. This will likely slow any recovery in EUR/GBP and opens downside potential in the near-term,” Foley said in a Thursday review of the EUR/GBP outlook.

Foley and colleagues say there’s a risk of further increases in the Pound to Euro rate over the short-term but cautioned that Sterling could be likely to struggle anywhere in between the 1.2121 and 1.2195 levels.

“Gyrations in money markets and the risk-off mood amid developments in Ukraine remain the main driver of GBP price action and are bound to remain so until the BoE’s decision in mid-March; we expect another 25bps increase then,” says Shaun Osborne, chief FX strategist at Scotiabank.

Above: Pound to Euro rate at weekly intervals with Fibonacci retracements of referendum-induced decline indicating likely areas of technical resistance for Sterling. Click image for closer inspection.