Australian Dollar: Rapid RBA Repricing Helps Drive Gains

- Written by: Gary Howes

Image © ArchivesACT, Reproduced under CC Licensing, Editorial, Non-Commercial

The Australian Dollar's ongoing strength can be linked to a number of factors such as the boost to commodity prices stemming from the Ukraine war, which is boosting the country's international trade account.

But the war in Ukraine risks overshadowing a potentially more powerful driver that is offering the Aussie Dollar support: the massive reappraisal in future Reserve Bank of Australia policy amongst investors.

Money markets have aggressively lifted expectations for RBA rate hikes and have pushed Australia's 'yield curve' sharply higher.

This is important as a rising yield curve is considered to be one that implies the outlook for both growth and inflation is positive.

This contrasts to a curve that rises and then starts to dip, which implies growth and inflation will first rise and then come down as growth slows again.

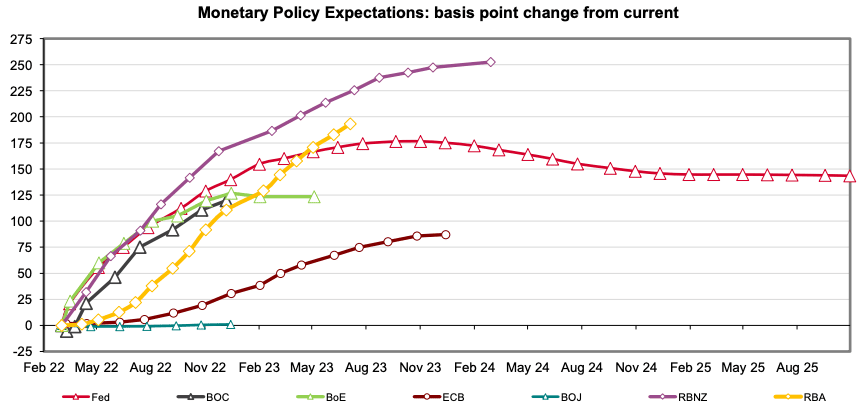

A look at various central bank rate projections is provided by Westpac:

- GBP to AUD reference rates at publication:

Spot: 1.8315 - High street bank rates (indicative band): 1.7674-1.7802

- Payment specialist rates (indicative band): 1.8150-1.8223

- Find out about specialist rates, here

- Set up an exchange rate alert, here

As can be seen, the market anticipates a rapid rise in RBA rates to the extent that Australian interest rates will be higher than those in the U.S. by 2023, by which time U.S. rate hikes will likely have ended according to the flat Fed profile.

Another standout is the Reserve Bank of New Zealand where the projections are also pointed higher.

Both the Fed and Bank of England projection lines meanwhile rise and then dip.

The shape of the curves could help explain why the New Zealand and Australian Dollars are rapidly appreciating in value against the Pound, Dollar and Euro.

In fact, the Pound to Australian Dollar has now fallen for ten days in succession amidst an ongoing surge in demand for the Aussie currency.

There are now 111 basis points of hikes anticipated to come out of the RBA by the end of 2022, this compares to the 127 expected from the Bank of England.

Looking back to the start of February the data show there were 100 basis points of hikes expected from the RBA and the amount expected from the Bank of England was similar to what it is now.

The Australian Dollar will have likely benefited from this relative shift higher in rate hike expectations over recent weeks.

Further gains are therefore possible should this dynamic continue.