Yet More Australian Dollar Outperformance

- Written by: Gary Howes

- AUD outperformance continues

- As terms of trade remains strong

- But Australia is becoming a 'net saver' - BNY Mellon

Image © Adobe Images

Although the Reserve Bank of Australia kept interest rates unchanged this week, the Australian Dollar continues its winning streak and extends gains against its major peers.

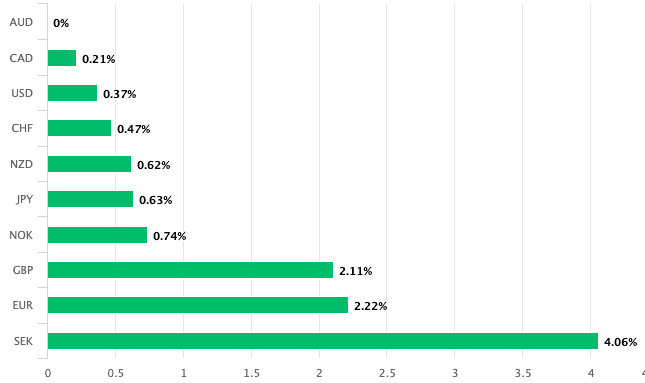

The gains have even come amidst the ongoing geopolitical uncertainty linked to the Russian invasion of Ukraine; in fact the Australian and New Zealand Dollars are proving to be outright winners in this crisis.

Providing some context as to why the Australian Dollar is outperforming is the RBA's observation made at its Tuesday policy update that the Russia-Ukraine crisis presents the prospect of faster inflation rates rather than any material impact on growth.

The RBA kept its base interest rate at 0.10% and noted that recent geopolitical tensions were a major new source of uncertainty.

The central bank's statement also noted that prices of commodities have increased further due to the war in Ukraine.

Where this hits countries such as the UK (the Pound is amongst the worst performers during the crisis) it has the effect of boosting Australia's terms of trade as the commodities Australia exports invariably become more valuable.

"The external tailwinds appear to be strengthening for the Australian economy," says Geoff Yu, FX and Macro Strategist for EMEA at BNY Mellon.

- GBP to AUD reference rates at publication:

Spot: 1.8344 - High street bank rates (indicative band): 1.7700-1.7830

- Payment specialist rates (indicative band): 1.8180-1.8252

- Find out about specialist rates, here

- Set up an exchange rate alert, here

Yu says China's policy direction is also increasingly favouring adding to current support, which was confirmed at the Politburo meeting last Friday.

China's Xinhua news reported last week China's top decision-making body will implement a strategy to expand domestic demand, and promote steady growth in foreign trade and foreign investment.

This suggests to BNY Mellon that Chinese demand for Australia's two premier exports of iron ore and coal will remain supportive.

"In the 2021-2022 rebalancing, for the RBA’s index of commodity prices (ICP), LNG and crude oil comprise 20% of the basket. From the price effect alone, in theory we would expect AUD to remain one of the main beneficiaries of the global inflationary (or stagflationary) environment," says Yu.

Although the RBA is coy to signal any intention to raise interest rates money market pricing shows investors are calling their bluff: there are now little over 100 basis points of hikes priced for 2022.

"The Australian rate market is more confident though that inflationary conditions will encourage the RBA to begin raising rates by the summer," says currency analyst Lee Hardman at MUFG.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

"The RBA did not express any concern that the outlook for growth in Australia would be disrupted by the fallout from Ukraine conflict. The RBA described the Australian economy as resilient with the unemployment rate falling to a 14-year low of 4.2%," he adds.

The message then is that the commodity market is supportive, the Australian economy's trade surplus is healthy and investors are seeing numerous rate hikes over coming months.

This is a supportive cocktail for the Australian currency.

"The global trend has been an underestimation in the consumption recovery and as social restrictions are permanently removed, upside price and demand surprises from reopening, of both domestic and international borders, will continue to bring forward the RBA’s path, and the central bank presently has sufficient optionality to adjust as needed," says Yu.

But Yu also notes a longer-term shift is underway that might have implications for the currency over coming months and years: Australia is now becoming a 'net saver'.

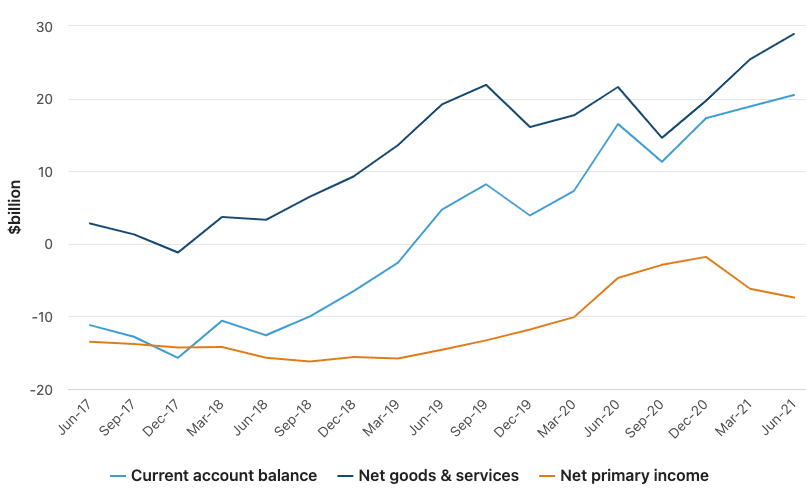

"Australia has now transitioned to a savings economy as the current account surplus continues to widen," says Yu.

Above: Australia's current account balance has widened over recent years. Source: ABS.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Australia's current account is its bank balance with the rest of the world; when in surplus it implies it is earning more from exports than spending on imports. Because the balance is increasing it implies the proceeds from Australia's international trade are not being reinvested, but rather saved.

"The process was well underway before the pandemic, but it has since accelerated on account of the general demand suppression seen globally," says Yu.

"Considering current valuations in AUD, the economy suffers from a broader investment gap and a lack of real income growth continues to limit inflation impulse," he adds.

This transition suggests to the BNY Mellon analyst that commodity prices and broader terms of trade gains provide very little marginal benefit for the currency because the economy has transitioned away from these sectors.

This is because the RBA would not - over a long-term period - be required to adjust interest rates higher.

During the commodity boom of the early 2010's the Australian Dollar was near parity with the U.S. Dollar; the difference between then and now is that back then the RBA was offering significantly higher interest rates.

This in turn proved a source of support for the Aussie Dollar.

But remove that rates support and it becomes clear the commodities boom is not providing the potent support for the Australian Dollar it once did.

A key risk for the Aussie currency therefore is that the situation in Ukraine settles down and global commodity prices pare gains, suggesting the currency has vulnerabilities over the longer term.