Pound to Australian Dollar Week Ahead Forecast: 2.0 Eyed Again

- Written by: Gary Howes

Image © Adobe Images

The Pound to Australian Dollar (GBP/AUD) exchange rate could retest 2.0 this week.

Price action on Monday sees GBP/AUD rally alongside other Sterling exchange rates to hit 1.9910, having been as low as 1.98 earlier in Asia trade.

The retreat to 1.98 was the nadir of a brief pullback that hit the Pound in the wake of last week's disappointing economic growth data, which showed the economy contracted for a second consecutive month in October.

Although GBP/AUD limped into the weekend, the big headline of the week was that it had hit a new four-year best just north of 2.0 on Wednesday 11 Dec., as the broader multi-month GBP rally met an AUD pullback linked to signs that China was to devalue its currency.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

That rally to 2.0 was triggered earlier in the week when the Reserve Bank of Australia appeared to signal it had started on the road to an interest rate cut in early 2025.

So, it has been a relatively volatile time for AUD, which requires us to study the technical setup behind GBP/AUD to get a clearer picture of how the market is poised as it moves into the final full trading week of 2024.

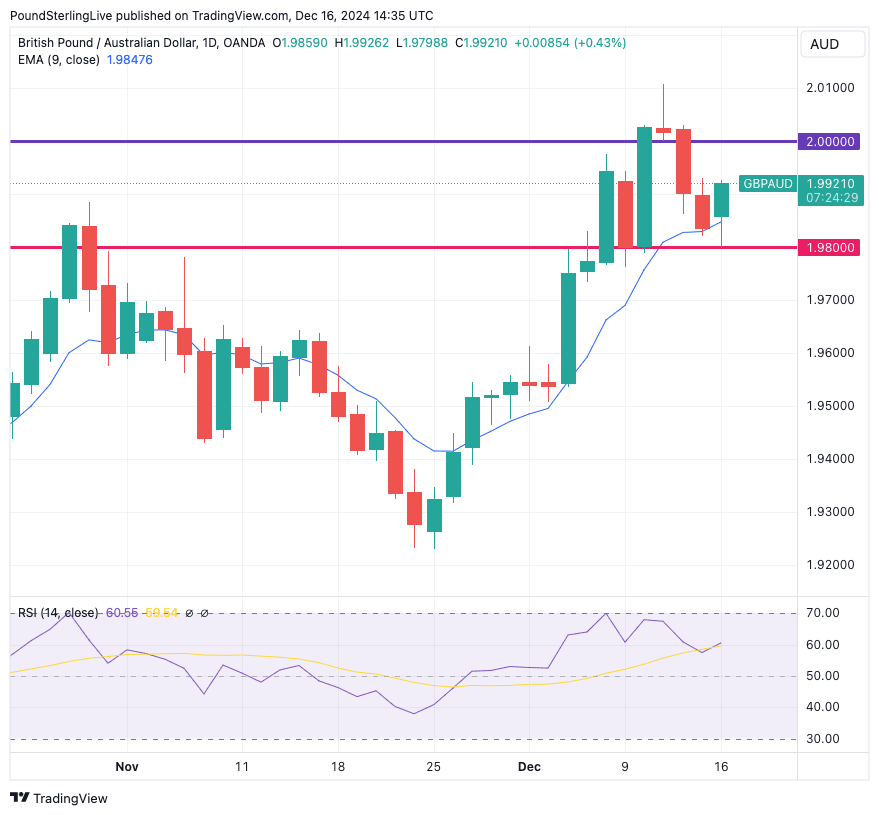

Here, we find the GBP/AUD is in a short-term bullish set-up, courtesy of Monday's recovery.

The exchange rate is above the nine-day exponential moving average (EMA), confirming the short-term market trend is bullish, and only a break below the nine-day EMA (at 1.9845) would have us realign our stance.

The Relative strength index is pointed higher and consistent with further upside at 60. It's also worth pointing out that last week's retreat from 2.0 came as the RSI hit overbought conditions at 70, which immediately signals we should be on watch for a pullback.

The has duly played out and overbought conditions are no longer a major concern for GBP/AUD.

Buying support comes in at 1.98, and our target is resistance at 2.0.

🎯 GBP/AUD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

It's a packed week for UK data, and we think this, alongside Wednesday's Federal Reserve decision, will be important for GBP/AUD direction.

A retest of 2.0 becomes possible if Tuesday's labour market statistics reveal an ongoing stubbornness in UK wages, which would be consistent with the Bank of England keeping interest rates unchanged on Thursday.

Wednesday will probably be the main test for the Pound, with UK inflation numbers due for release in the London morning. UK inflation is expected to tick up as it journeys back to the 3.0% level, putting it further out of reach of the Bank of England's 2.0% target and limiting the scope for the Bank to cut rates.

The U.S. Federal Reserve decision is due later on Wednesday and forms the main event of the week for the broader FX market.

Should the Fed prove more 'dovish' than expected, i.e. prompt the market to 'price in' more by way of rate cuts in 2025, then the AUD would potentially be the biggest beneficiary in the G10 space.

Thursday sees the Bank of England will give its latest interest rate decision. Here, rates are expected to remain unchanged.

The vote composition for the decision will potentially move GBP/AUD, with the risk being that more than one policy setter votes for a cut, which implies they are keen to get on with the job.

Yet, it is clear their hands are tied given the drift higher in inflation, and any weakness in GBP/AUD stemming from the Bank of England will be limited.

Indeed, the headline is that the Bank will likely cut only four times in 2025, which can ensure that the Pound retains much of its support from the UK's elevated interest rates.