Australian Dollar Faces New 2024 Low on RBA's Pivot

- Written by: Gary Howes

RBA Governor Bullock speaks forllowing the RBA's December 10 decision. Source: RBA.

The Australian Dollar dropped in value after the wind changed direction at the Reserve Bank of Australia (RBA). Chinese stimulus promises are limiting downside.

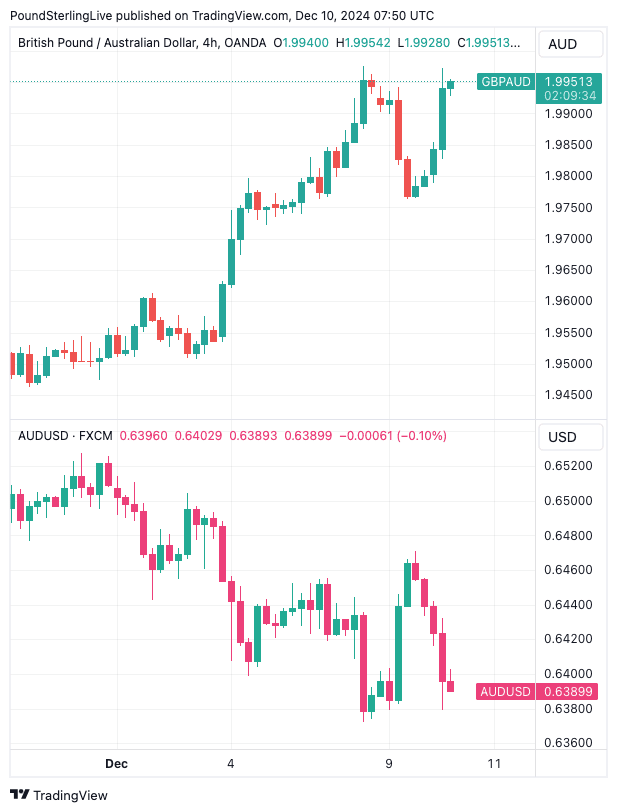

The Pound to Australian Dollar exchange rate (GBP/AUD) jumped to 1.9944 (+0.75%) after the RBA said at its final interest rate decision of the year that it was "gaining some confidence that inflation is moving sustainably towards target."

The RBA kept interest rates unchanged at 4.35%, but the FX market was always more interested in whether or not the central bank would alter its guidance. The shift in tone means the RBA has effectively dropped neutral guidance and has engaged an easing bias.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

Australian two-year government bond yields fell by 9bp as markets brought forward the expected start date for the first cut, with odds of a February move rising.

Falling bond yields, in turn, weighed on Australian Dollar exchange rates.

"AUD/USD briefly fell to 0.6380 after the RBA left the cash rate at 4.35% and provided a dovish tilt in its post‑meeting statement. AUD/USD may ease further and set a new year-to-date low below 0.6350," says Joseph Capurso, FX strategist at Commonwealth Bank of Australia.

Above: AUD faces new lows against GBP (top) and USD.

Additional evidence of a shift in stance was the dropping of the phrase that is "not ruling anything in or out", as it had in every statement since March.

The word "vigilant" has also been cut from the post-meeting statement.

"We are getting closer to the point that the RBA will be comfortable cutting rates. And in a shift in view that will surprise almost nobody, it no longer feels the need to flag the possibility of a rate hike," says Luci Ellis, Chief Economist at Westpac.

🎯 GBP/AUD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Markets saw the potential for the RBA's stance to soften following last week's below-consensus Australian GDP release, which showed economic growth had slowed materially in the third quarter. What growth there was largely came from government expenditures.

"GDP overall was softer than consensus and, we suspect, the RBA's own expectations," says Ellis. "A Q4 bounce large enough to match the RBA’s forecasts for 2024 growth is unlikely to eventuate for either series. Further downgrades to the RBA’s near-term forecasts can therefore be expected in the February round."

Marcel Thieliant, Head of Asia-Pacific Research at Capital Economics, says all this opens the door to a rate cut at the Bank’s February meeting.

However, Capital Economics sticks with the view that the RBA will still wait until May before pulling the trigger.

Thieliant says the unemployment rate is still below the RBA's estimate of full employment, and the RBA will want to see a further loosening of the labour market before cutting interest rates.

"Accordingly, we're sticking to our forecast that the first rate cut won’t come until the Bank's May meeting," he says.

ANZ, one of Australia's largest banks, also maintains that the RBA will wait until May.

For AUD, whether the RBA moves in February or May will be a key driver of movement in early 2025.

China a Source of Support to AUD

The Australian Dollar's post-RBA decline might have been more significant were it not for the supportive tailwinds blowing in from China, where authorities are set to provide more support to the economy.

The Aussie and Kiwi Dollars were the top-performing G10 currencies on Monday after China's politburo said the country's monetary policy stance would shift from "prudent" to "moderately loose" for the first time since the global financial crisis.

It said the government would adopt a more "pro‑active fiscal policy."

"More accommodative policy will help support consumption and the broader economy. The pledges align with our expectations that the government will deliver more fiscal stimulus to counter the negative impacts of additional US tariffs on Chinese exports," says CBA's Capurso.

China could be a source of support for Australia in 2025, which would limit AUD downside in the event that the RBA cuts as early as February.