Yen Weakens On Bank of Japan Hesitation

- Written by: Sam Coventry

Above: File image of Bank of Japan Governor Ueda. © European Central Bank, reproduced under CC licensing

The Japanese Yen is softer following the Bank of Japan's latest policy decision.

The Bank maintained its base rate at 0.50% but was noncommittal about the prospect of further interest rate hikes, suggesting its guidance has passed 'peak hawkishness'.

"The yen has continued to weaken overnight following the BoJ’s latest policy meeting," says Lee Hardman, Senior Currency Analyst at MUFG Bank Ltd.

For the Yen to have rebooted its 2025 outperformance, markets might have wanted to see the Bank encourage the market to bring forward bets for a 25 basis point rate hike.

Instead, that next hike remains anchored in September following the midweek policy update that saw rates left unchanged on a unanimous vote on the policy committee.

"The limited room for a further upward adjustment to BOJ rate expectations curtails JPY upside," says Elias Haddad, Senior Markets Strategist at Brown Brothers Harriman.

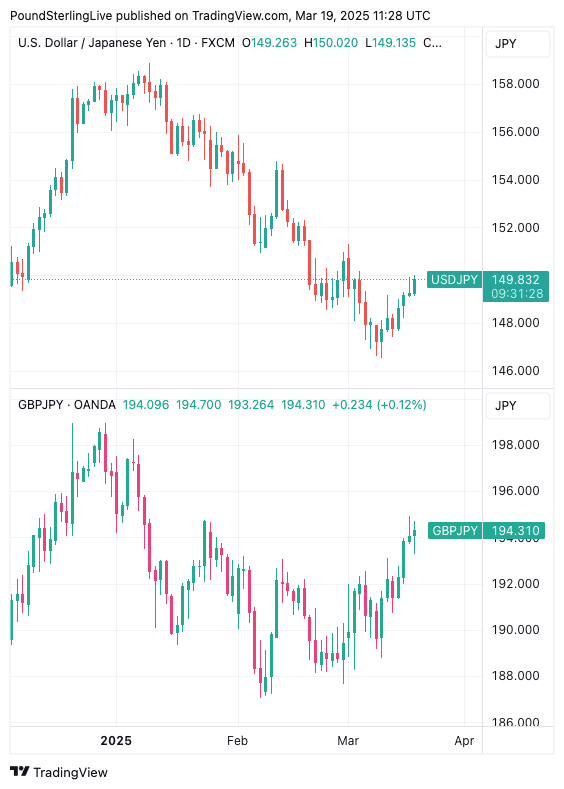

The Pound-to-Yen exchange rate fluctuated in a wide range around 194.27 in the wake of the decision and has since edged higher to extend a rally that has been in place since late February.

The Dollar-Yen rises to 149.86, taking it to the highest level since the start of the month. "USD/JPY whipsawed within a 0.60% range," says Haddad. "The Bank of Japan delivered a cautious hold."

The decision to maintain rates was unanimous, and guidance confirmed further rate hikes would come if the outlook for economic activity warrants such a move.

"There remain high uncertainties surrounding Japan's economic activity and prices, including the evolving situation regarding trade," said the Bank.

Above: The Yen's recovery stalls and reverses against USD (top) and GBP.

Market pricing sees the Bank's terminal rate between 1.00% and 1.25% within the next two years. The next full 25bp hike is priced for September.

"The limited room for a further upward adjustment to BOJ rate expectations curtails JPY upside," says Haddad.

Like all global central banks, the Bank of Japan is keeping a wary eye on U.S. tariff policy which is proving a major source of uncertainty.

Governor Ueda will feel that now is not the time to signal any major commitments owing to this uncertainty.

"There was more unease displayed over overseas uncertainties, which were described as rising quickly," says Hardman.

"Overall today’s BoJ policy meeting has not provided much further clarity over the timing of the next BoJ hike. The BoJ will be in a better position to assess the potential impact from President Trump’s tariff policies at the next policy meeting in May. The lack of guidance over the timing of the next BoJ hike and displaying more concern over overseas uncertainties initially weighed modestly on the yen," he adds.