How "The Consumer Got Her Groove Back"

- Written by: Gary Howes

Image © Adobe Images

Revisions to savings, consumption and income data show "the consumer got her groove back", says an economist at Wells Fargo.

Today was a big day for U.S. data: although what was on offer on the data docket is often overlooked by markets, it offers a crucial insight into the health of the all-important U.S. consumer.

Headline PCE inflation, consumption, income and savings data from the BEA all undershot expectations and points to the likelihood of further aggressive easing from the Federal Reserve.

However, revisions to previous data could mean the market would be wise not to get ahead of itself.

The U.S. Personal Consumption Expenditures (PCE) index is the measurement of inflation that the Federal Reserve is mandated to keep at 2.0%. The rule of thumb is that interest rates must be in restrictive territory when PCE is above 2.0%, but must come down if the Fed is confident it is falling back to, or below, 2.0%.

Image courtesy of Pantheon Macroeconomics.

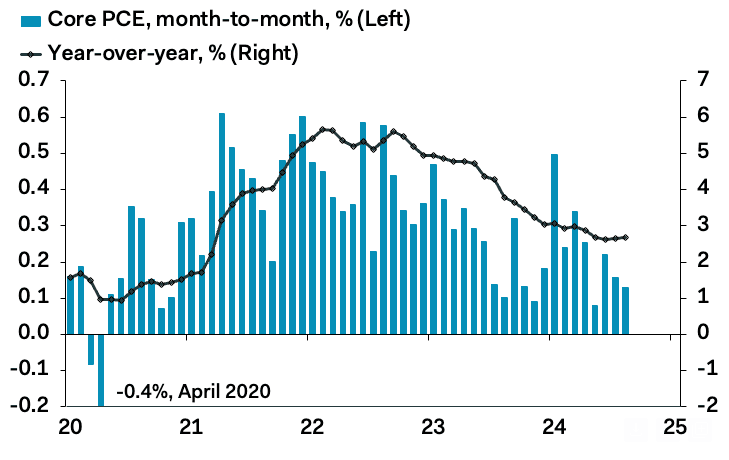

Both the headline PCE and the core measure, which excludes food and energy, rose by 0.1% in August, below the 0.2% expected by analysts and the figure recorded in July.

The annual PCE rate fell to 2.2%, which makes the lowest level since February 2021, down from 2.5% in the previous month and 2.3% expected by the market.

The PCE inflation figures come alongside separate data from the Bureau of Economic Analysis that showed consumer spending fell to 0.2% last month from 0.5% in July.

Consumption accounts for more than two-thirds of U.S. economic activity and this backs up the message from the inflation numbers that the U.S. economy could do with a boost from lower interest rates.

In fact, this marks the slowest pace in seven months and signals the mighty U.S. consumer could finally be tiring.

Big Upside Revisions

However, Tim Quinlan, Senior Economist at Wells Fargo, says the U.S. consumer is in a better position than previously thought. "Revisions: how the consumer got her groove back," he says.

"Look past the bland headline income and spending number for August to find data revisions that put the consumer on firmer footing. Income and spending are now stronger and households have been stashing away a bit more savings than previously thought," says Quinlan.

He explains that there are multiple revisions reflected in today's numbers, some of which change past data all the way back to the start of 2019, with real consumption revised up every month of this year.

Real consumption rose by 0.2%, below the consensus expectation for 0.3%, but the net revision higher was 1.2%. Personal incomes increased by 0.2%, also slightly below the consensus estimate of 0.4%, but the net revisions were 3.3%.

In level terms, real consumption for July is now 1.2% higher than previously reported, points out Quinlan, adding that real disposable income was revised higher as well and now looks more supportive of spending.

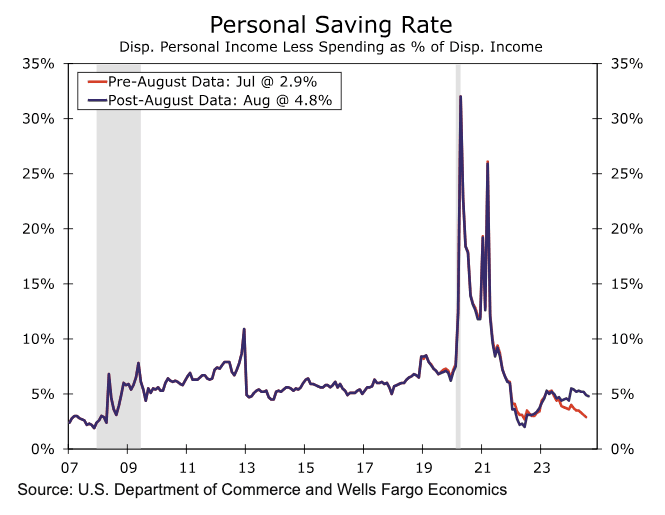

"With upward revisions to income being greater than those to spending, the data now suggest households have been saving a bit more each month than previously thought," says Quinlan.

The personal saving rate has been revised significantly higher from 2.9% in July to just under 5% in August.

We reported earlier this week that a decline in savings would have significant implications for the U.S. economy. The savings ratio rate had fallen below 3% in July, which, according to one economist, could signal recessionary conditions.

This "should be sounding a very loud warning klaxon in the ears of investors to not forget what happened in 2007 when the SR fell this low," says Albert Edwards, an economist and global strategist at Société Générale, of the sub-3% reading.

To be sure, the U.S. household sector balance sheet is far healthier than it was in 2007, but the fall in the savings ratio nevertheless could have significant implications for the outlook.

"It would be fair to say that the US consumer has surprised on the upside this year growing by a heady 2.7% y-o-y in July. But where has this strength come from at a time when real incomes have been growing by a paltry 1% y-o-y?" he asks.

He says history suggests when the savings ratio sinks this low, it usually proves unsustainable with a subsequent increase in savings triggering a recession.

On this basis, the revision to the savings data suggests recession is still some way off.