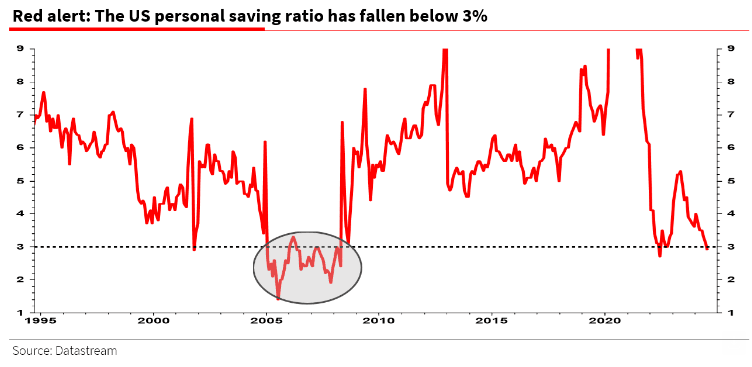

Plummeting Savings Rates "A Very Loud Warning Klaxon"

- Written by: Gary Howes

Image © Adobe Images

U.S. consumers are saving money at unsustainably low levels, and when they start to set aside money again, the economy will take a hit.

This is according to Albert Edwards, an economist and global strategist at Société Générale, after clocking that the U.S. personal saving ratio (SR) slid below 3.0% in July.

"July's decline below 3% should be sounding a very loud warning klaxon in the ears of investors to not forget what happened in 2007 when the SR fell this low," he says in a new note to clients. The SR data is contained in the Personal Income and Outlays report issued by the BEA.

Edwards says this is a particular area of expertise of his, as he started his career 40 years ago by working in the personal sector at the Bank of England.

He points out that the fall in the SR to below 3% was only previously seen on a sustained basis in the "giddy days of misguided euphoria in 2005-07 prior to the 2008 GFC."

He says the U.S. household sector balance sheet is nowhere near as overextended as it was back in 2007, but the fall in the SR nevertheless could have significant implications for the outlook.

"It would be a fair to say that the US consumer has surprised on the upside this year growing by a heady 2.7% yoy in July. But where has this strength come from at a time when real incomes have been growing by a paltry 1% yoy?" he asks.

He says history suggests when the SR sinks this low, it usually proves unsustainable with a subsequent rise triggering a recession.

"The slide in the SR from 4% at the start of this year was not due to households dipping into to their pandemic-era excess savings, which have been long since spent. But it seems that households have become used to running down their savings and can’t break the habit," says Edwards.

He explains that a rising SR slows consumer spending growth below income growth (and vice versa) "so it’s a likely recessionary event when real personal incomes are currently only growing by a miserly 1%."

The August data is due out on Friday 27 October, and Edwards says to keep an eye on developments.