Confidence in the Fed to Wane Further: Macro Hive's FOMC Preview

- Written by: Dominique Dwor-Frecaut, Macro Hive

Image © Adobe Stock

The Fed sticking to its current policy plans at next week’s meeting is likely to deepen the market’s loss of confidence and therefore see the curve steepen further.

- The Fed has already pre-announced the start of quantitative tightening and a 50bp rate hike at the FOMC meeting on Wednesday as part of its plan to curb high inflation.

- The real uncertainty is whether the Fed raises its expectations of how high the federal funds rate, and the neutral rate of interest, will get.

- This seems unlikely, which could deepen market concerns about the Fed’s ability or willingness to combat inflation.

- Loss of market confidence in the Fed’s inflation-fighting mojo could steepen the yield curve.

Quantitative Tightening

As usual, the Fed hinted at its policy changes ahead of the FOMC meeting on Wednesday. Based on the March minutes, quantitative tightening (QT) is likely to start.

This is where the Fed tries to shrink its securities portfolio.

QT will likely proceed as follows:

- Monthly reinvestment caps would be $60bn for Treasuries, $35bn for mortgage-backed securities (MBS).

- The cap would be phased in over three months ‘or modestly longer if market conditions warrant.’

- When Treasuries principal repayments fall below the $60bn cap, the difference with the cap is to be made up by not reinvesting TBills.

- Because MBS redemptions are likely to remain well below the cap, and because in the long term the Fed wants to hold only Treasury securities, the Fed intends to proceed with outright sales of

- MBS ‘after balance sheet runoff is well under way’.

- The meeting is likely to specify the details, including of the phase-in period, which could be, e.g., $30bn in May, $60bn in June and $95bn thereafter.

Moving to a 50bp Hike

In addition, before the pre-meeting blackout, Chair Jerome Powell expressed support for a 50bp hike on Wednesday. The market has already priced that in. I find the risk of 25 or 75bp low:

With inflation at 8.5%, if the Fed delivers less than the market expects, it will further lose credibility. Also, while financial conditions have tightened, the Fed finds the labour market very tight and expects GDP growth above potential this year: with high inflation, the Fed put is effectively gone.

Meanwhile, FOMC members have been pushing back against 75bp, possibly because their current understanding of inflation implies that it is not necessary.

Also, markets are now pricing 50% chance of a 75bp hike at the next FOMC meeting in June, and presser participants are bound to ask about it.

I do not expect Powell to support 75bp so soon in the cycle largely because it would be an implicit admission of policy error.

How High Could the Fed’s Interest Rate Get?

The more interesting info to be gleaned from the meeting is whether the Fed has changed its estimates of the neutral rate, 2.4%, and the terminal rate, 2.8% (the anticipated high point of the federal funds rate (FFR)).

Pre-meeting FOMC chatter implied that the FFR would be brought to neutral by end-2022.

The Fed has effectively revised up its end-2022 target to 2.4% from 1.9% at the March meeting and 0.9% at the December meeting.

Following the publication on Friday of an Economist editorial highly critical of the Fed – and predicting a 5-6% terminal FFR – Powell is likely to face strong pushback during the presser.

I expect Powell to respond with his usual ‘we will adjust policy as needed in order to ensure a return to price stability with a strong job market’ rather than signal a large change in either neutral or terminal rate.

This is because the current estimates reflect the Fed’s strong beliefs in its inflation models, namely the expectation-augmented Phillips curve and a low neutral rate (Terminal Fed Funds to Approach 8%).

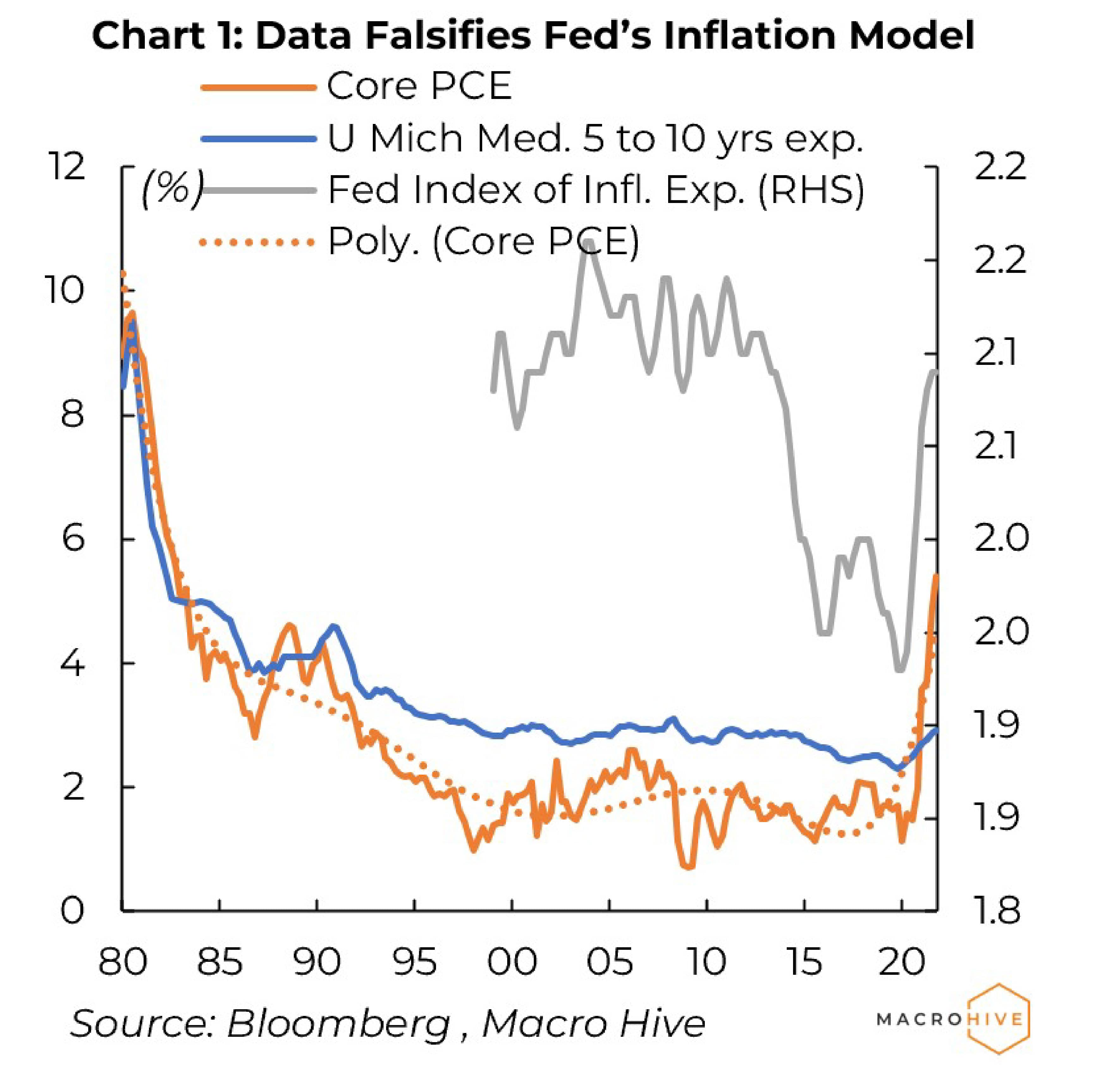

The Fed inflation model implies that, as long as inflation expectations are anchored, inflation should be self-correcting. The data has falsified this: inflation has been surging against stable inflation expectations.

Nevertheless, stronger evidence will likely be needed for the Fed to raise its expectations of the terminal rate close to my 8% forecast, for instance the FFR above 3% and core inflation stable above 4%. These may not become available until end-2022.

Instead, I expect the Fed to follow the market that is currently pricing 50bp hikes in May, June and July. As inflation remains high, I expect the market to gradually price 50bp hikes at the remaining policy meetings and the Fed to follow the market.

Market Consequences

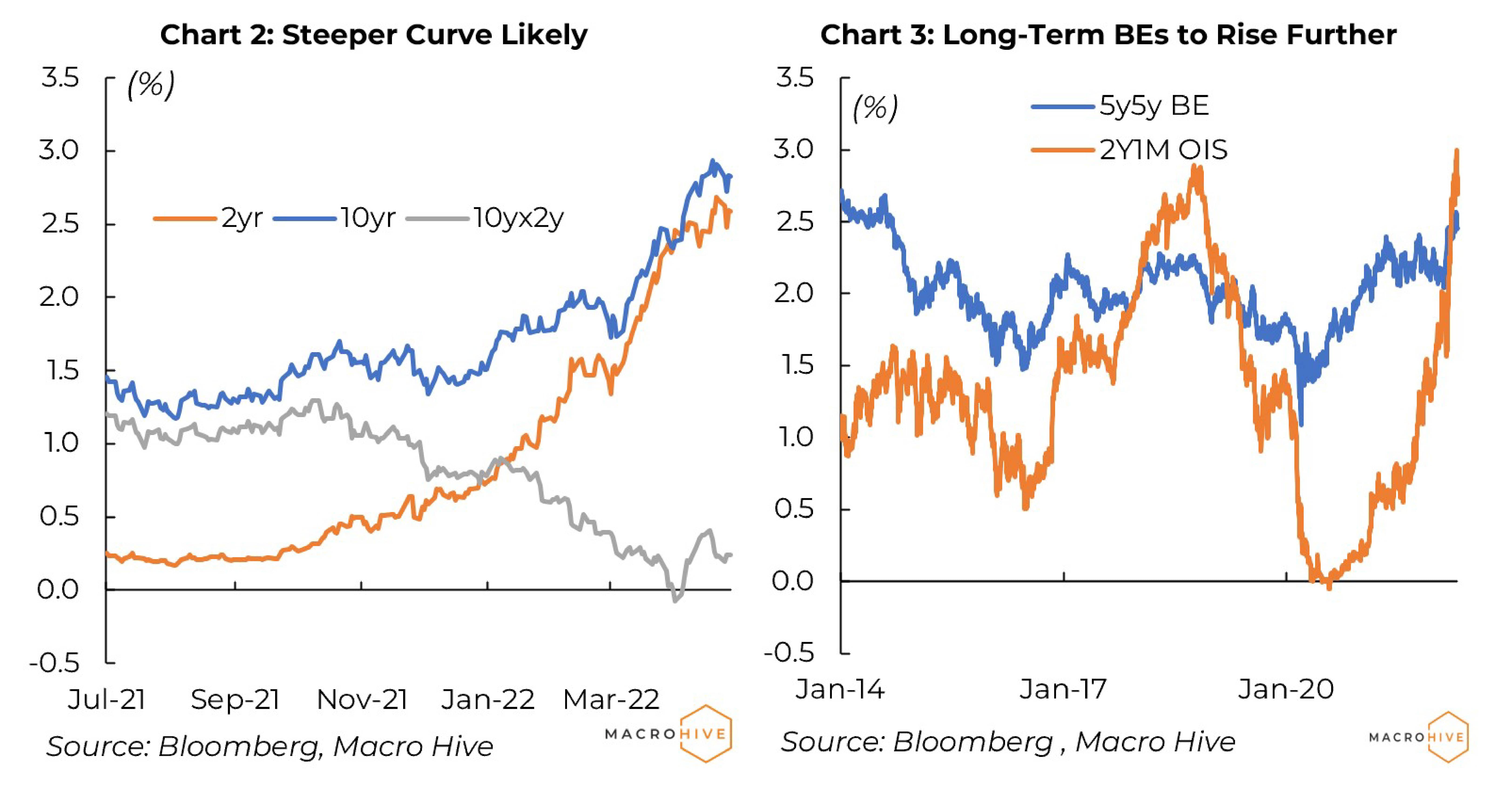

The yield curve has recently steepened. I think that reflects a loss of confidence in the Fed’s ability to control inflation based on its current policy framework (see chart 2).

The loss of market confidence is shown by 5y5y BEs breaking the 1.5-2.3% range of the past five years even though expectations of the long-term policy rate, e.g., the 2y1m OIS forward swap, have increased to post-GFC highs (see chart 3).

Basically, the market is less and less convinced that a terminal rate of 2.8% can slow inflation currently at close to 8.5%.

The Fed sticking to its current policy plans at next week’s meeting is likely to deepen the market’s loss of confidence and therefore see the curve steepen further.

This article is syndicated to Pound Sterling Live by Macro Hive.

Dominique Dwor-Frecaut is a macro strategist based in Southern California. She has worked on EM and DMs at hedge funds, on the sell side, the NY Fed , the IMF and the World Bank. She publishes the blog Macro Sis that discusses the drivers of macro returns.