GBP/CAD Week Ahead Forecast: Eyeing 2024 Highs Again

- Written by: Gary Howes

Image © Adobe Stock

The Pound to Canadian Dollar exchange rate can extend its rally and potentially test its 2024 highs in the coming one to two weeks.

This is after a decisive improvement in the exchange rate's technical outlook and Friday's disappointing Canadian jobs report that raised the odds of another interest rate cut at the Bank of Canada later this month.

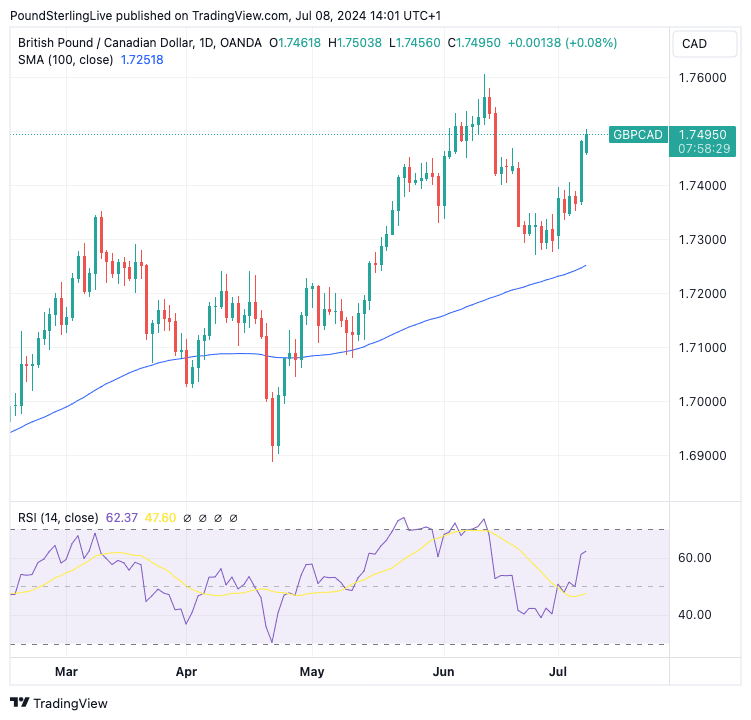

GBP/CAD rose 0.65% on Friday and extended these gains on Monday to quote at 1.7497. Technical signals are constructive and consistent with further advances to the 2024 high at 1.76.

To be sure, we don't think this is achievable this week, as such a move would require the exchange rate to enter overbought territory. Instead, we would think there is scope for gains to be more contained and interspersed with shallow pullbacks.

GBP/CAD at daily intervals. Track GBP/CAD with your own alerts, find out more here.

Weakness is unlikely to go below the 50-day moving average which looks to be the technical level that arrested the June decline. This is located at 1.7350 at the time of writing.

The British Pound received a boost on Monday after a Bank of England interest rate setter said it is too soon to cut interest rates as early as next month.

Jonathan Haskel told an audience at King’s College London he would "rather hold rates" steady at 5.25%. In a speech at the Economic Statistics Centre of Excellence, he said he is still concerned that the jobs market "continues to be tight," which would create the environment for wage increases and potentially fuel inflation.

Pound Sterling already had some wind in its sails, with sentiment towards the currency improving following last week's election.

"The pound could be about to stage a bigger recovery as it has momentum on its side now that the UK’s political risk premium has been eradicated," says Kathleen Brooks, an analyst at XTB.

The convincing win by Labour in last week's election sets the UK up for a period of political stability, with the new government saying it is already moving to establish closer ties with Europe. Analysts have written that closer EU ties can support the Pound in the coming months as the long-standing Brexit premium the Pound still carries fades.

"We have raised our GBP forecasts in part on better political stability ahead and in part on the signs of a stronger rebound in economic growth than we previously expected," says Derek Halpenny, head of FX research at MUFG Bank Ltd.

No calendar events are due from Canada until next week's inflation report.