GBP/CAD: Job Losses Trip the Canadian Dollar

- Written by: Gary Howes

Image © Adobe Images

The Canadian Dollar stumbled after official statistics showed unexpected job losses in June, raising the odds of another Bank of Canada interest rate cut.

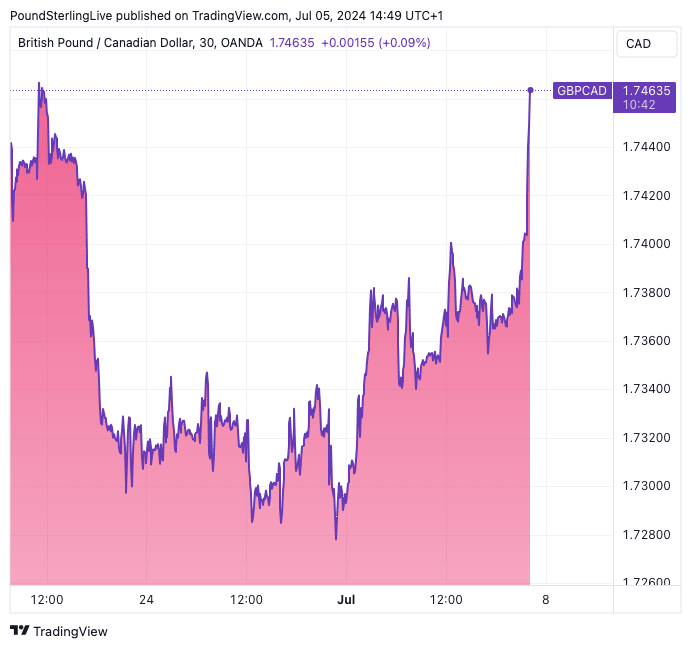

The Pound to Canadian Dollar exchange rate (GBP/CAD) rallied to 1.7441, its highest level since mid-June after Statistics Canada said 1.4K jobs were lost in June, less than the consensus estimate for growth of 22.5K.

It is also less than the 26.7K print from May, suggesting that the unexpectedly strong figure was an outlier that masked a clear trend in labour market deterioration.

Canada's unemployment rate rose to 6.4% from 6.2% previously, which will concern the Bank of Canada, which will now be more inclined to cut interest rates for a second time.

The Bank cut interest rates in June, but questions remain about the appropriateness of a successive cut.

"The modest decline in employment and rise in the unemployment rate to 6.4% in June raise the chance that the Bank of Canada will cut interest rates again this month," says Olivia Cross, North America Economist at Capital Economics.

Foreign exchange markets are highly sensitive to the relative levels and changes in global interest rate settings. When a central bank cuts faster and further than its peers, the currency it issues can find itself at a relative disadvantage. This is because money tends to flow to where returns (interest rates) are higher.

Canada's average hourly earnings growth rose to 5.4% y/y, but most of that was due to unfavourable base effects, and Capital Economics says earnings rose by just 0.1% m/m when seasonal adjustments are considered.

"The three-month annualised rate fell to 3.3% which, together with the forward-looking indicators pointing to a further softening in wage pressures, will give the Bank some comfort that wage growth will soon head in the right direction," says Cross.

Karl Schamotta, Chief Market Strategist at Corpay, says hopes for a rate cut in July are rising, with Bank of Canada officials looking more likely to favour easing policy in back-to-back meetings.

"The loonie is falling even as the greenback retreats, and its relative underperformance should continue," he adds.