Bank of Canada Cuts, GBP/CAD Jumps to 33-month High

- Written by: Gary Howes

File image of Tiff Macklem. Image © Bank of Canada

The Canadian Dollar fell across the board after the Bank of Canada cut interest rates and Governor Macklem said it was reasonable to expect further cuts if inflation continues to fall.

Following the decision to cut the base rate by 25 basis points to 4.75%, the Pound to Canadian Dollar exchange rate (GBP/CAD) ended the day 0.27% higher at 1.7510, its highest close in 33 months.

The U.S. Dollar to Canadian Dollar exchange rate rose as high as 1.3741 but pared the advance to trade at 1.3679, and the Euro to Canadian Dollar spiked to 1.4929 before paring gains to 1.4881.

CAD weakness reflects a partial surprise for the market, which was split 50/50 on whether the central bank would move now or in July. Crucially, the Bank indicated further cuts are likely, with Governor Tiff Macklem saying it is "reasonable" to expect further rate cuts if inflation continues to ease.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

"With continued evidence that underlying inflation is easing, Governing Council agreed that monetary policy no longer needs to be as restrictive and reduced the policy interest rate by 25 basis points," said the Bank of Canada.

The Canadian Dollar was always exposed to weakness in the event of a cut, given the market had some doubts about whether the Bank of Canada would move today, with some speculating it would try and deny rate cuts in order to get as close as possible to the first cut from the U.S. Federal Reserve.

However, the Bank of Canada notes that Canadian economic growth disappointed against its expectations in the first quarter of the year, and although wage pressures remain, they look to be moderating gradually.

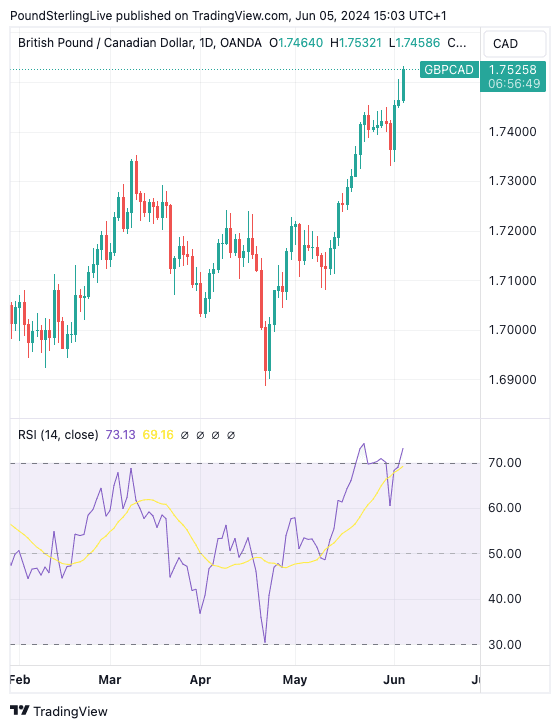

Above: GBP/CAD at daily intervals. Note the RSI in lower panel is suggesting the exchange rate is overbought. Track GBP/CAD with your own custom rate alerts. Set Up Here

Canadian CPI inflation eased further in April to 2.7% and the Bank’s preferred measures of core inflation also slowed and three-month measures suggest continued downward momentum.

Recent data has increased our confidence that inflation will continue to move towards the 2% target.

This observation can allow the market to be confident further interest rate cuts are in store, although it did ackowledge that risks to the inflation outlook remain and that it was particularly watchful of developments in core inflation.

"It is reasonable to expect further cuts to our policy interest rate. But we are taking our interest rate decisions one meeting at a time," said Macklem.

Despite his qualifications, economists say the scene is set for further cuts.

"Today’s interest rate cut from the Bank of Canada will be the first of many, and the dovish tone of the accompanying communications suggests that another rate cut in July is already nailed on," says Stephen Brown, Deputy Chief North America Economist at Capital Economics.

With the first interest rate cut now over, the pace and amount of future rate cuts will determine further CAD weakness.

"Our own expectation remains that there will be three more rate cuts this year to lower the overnight rate to a still restrictive 4% by the end of 2024," says Claire Fan, Economist at Royal Bank of Canada, adding that a follow-up July rate cut is to be expected.

Economists at Commerzbank say they can imagine a kind of "frontloading", i.e. two rate cuts in quick succession so that the Bank does not have to cut rates more sharply later if the real economy weakens more significantly without stronger support.

"For this to happen, however, inflation will have to play along and the risks cited by the BoC, such as wage pressures, inflation expectations or the still high price pressure on housing, will have to abate. If these factors develop favorably, the next meeting at the end of July promises to be just as exciting as yesterday's," says Michael Pfister,

FX Analyst at Commerzbank.