Pound Sterling Outperforms, Haskel Says No to August Rate Cut

- Written by: Gary Howes

Above: File image of Jonathan Haskel. Image copyright: Pound Sterling Live, Still Courtesy of Imperial College Business School.

The British Pound was boosted Monday after a Bank of England interest rate setter said it is too soon to cut interest rates next month.

Jonathan Haskel told an audience at King’s College London he would "rather hold rates" steady at 5.25%.

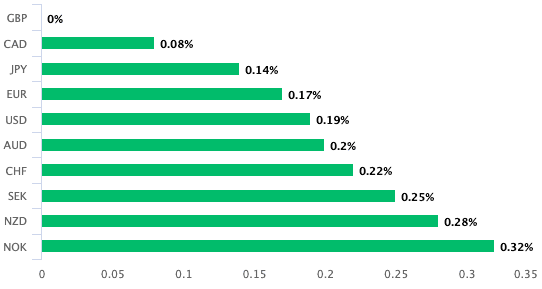

Following the comments, the pound extended its advance against the euro and climbed to 1.1840. It is also higher against the U.S. dollar at 1.2840. In fact, Sterling is the best performing major currency on Monday.

Haskel is the first of the Bank's Monetary Policy Committee (MPC) to discuss the matter owing to a pre-election purdah for civil servants that prevented any discussion on the matter.

In a speech at the Economic Statistics Centre of Excellence, Haskel said he is still concerned that the jobs market "continues to be tight," which would create the environment for wage increases and potentially fuel inflation.

Above: GBP vs. the G10 on Monday, July 08.

According to market pricing, the odds of a 25 basis point rate cut next month stood at above 60% ahead of Haskel's speech.

"I would rather hold rates until there is more certainty that underlying inflationary pressures have subsided sustainably," said Haskel. "The labour market continues to be tight, and I worry it is still impaired."

The Pound tends to rise in value when the odds of rate cuts decline. But, over recent days the Pound has continued to outperform its peers even as the odds of a cut taking place next week have risen.

This suggests that last week's election is seen as market-friendly, and investors are pricing out a political risk premium from the Pound and other UK assets.