Australian Dollar: Still Not Too Late to Jump on the China Stimulus Trade

- Written by: Gary Howes

Image © Adobe Images

It's not too late to participate in the China stimulus rally, and the Australian Dollar is a good currency for this purpose.

This is according to a number of analysts we follow, given the fresh efforts by Chinese authorities to stimulate the economy and the Reserve Bank of Australia's resistance to cutting interest rates.

"China’s stimulus may have limited impact due to its small size and likely low multiplier, but rising EPS, cheap valuations and investor underexposure means the equity rally continue," says Andrea Cicione, an analyst at TS Lombard.

"We add longs on AUD vs CHF and JPY in light of Chinese stimulus and a hawkish RBA," he adds.

🎯 GBP/AUD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

The Australian Dollar has been one of the foreign exchange market's top-performing currencies, with investors a stimulus rollout by Chinese authorities that could stimulate demand in the world's second-largest economy.

"For FX investors, the Australian Dollar (AUD) is often seen as the go-to expression for China-related trades," says Huw Roberts, Head of Analytics at Quant Insight.

China has rolled out a number of monetary stimulus measures that have received mixed reviews from economists. It is hoped that the lowering of interest rates and mortgage requirements will encourage Chinese consumers to open their wallets and start spending again, in turn stimulating a demand-driven upturn.

However, most economists agree that a fiscal stimulus (government spending / tax cuts) is required to support these monetary policy changes. It is believed that next week will see such a fiscal package announced, the details of which will impact the Aussie Dollar.

"We have been bullish on the Australian dollar this year with a long-held target of around AUDUSD 0.70 by year-end. With the pair approaching this target, we lift our forecasts as we believe the rally is not over yet," says Wayne Gordon, Strategist at UBS AG in Singapore.

🎯 GBP/AUD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

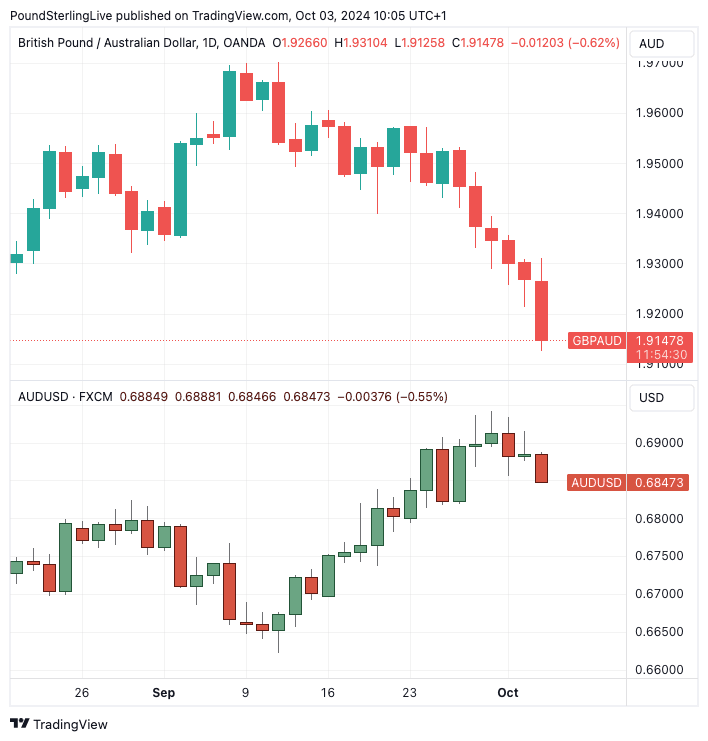

AUD/USD reached its highest level in almost two years on 30 September at 0.6910, while the GBP/AUD exchange rate has fallen to a three-month low of 1.9145 at the time of writing Thursday. EUR/AUD is also under pressure at 1.6107 and looks to be testing a support line that has been in place April 2023.

The Aussie is the 'in form' currency of the moment, and China's plans to increase fiscal spending or accelerate current plans "could reinforce the AUD’s current upward momentum in the coming weeks," says MUFG Bank Ltd.

MUFG opened a "long AUD/USD trade idea" last week, based on "building investor optimism towards the growth outlook in China and globally" after recent policy changes in the U.S. and China.

Above: GBP/AUD (top) and AUD/USD.

However, other analysts see signals that suggest the Aussie's rally might be overextended in the near term.

"After the Chinese stimulus plan, AUDUSD once again appears to have rallied too-far-too-fast relative to prevailing macro conditions. Qi’s Fair Value Gap is over one standard deviation – AUD rich to macro," says Roberts at Quant Insights.

Danske Bank says now is the time to sell Australian Dollars because "we doubt the stimulus-driven optimism in China will end up overcoming the economy’s structural challenges."

"We think risk-reward of going short AUD/USD spot is attractive after the latest rally," says Antti Ilvonen, Senior Analyst at Danske Bank.

Ilvonen also says the U.S. economic "soft landing is priced to perfection."

For Ilvonen, the Federal Reserve's easing cycle is "already priced to perfection," and further weakness in global growth indicators "could start to weigh on cyclical FX," a basket of currencies that would include AUD.

Another risk to the Aussie is if the U.S. economy once again proves more resilient than expected. "This would lift the level that markets think the Fed will end its interest rate-cutting cycle, which could bolster the U.S. Dollar and weigh on Australia's currency."