China Stimulus a Sugar Rush, Not a Bazooka

- Written by: Gary Howes

Image © Adobe Stock

Chinese authorities have announced a significant package of support measures to boost the economy, but economists say all they are likely to achieve is a short-lived sugar high.

The People's Bank of China (PBoC) announced a significant package of stimulus measures in an effort to rescue the country's aim of achieving 5.0% economic growth this year.

It lowered the reserve ratio requirements for banks by 0.5 percentage points, bringing it down to 9.5%. It also cut rates, reducing the 7-day reverse repo rate by 0.2 percentage points to 1.5%.

Both measures were delivered simultaneously, which has never been done. However, the package extended to the housing and stock markets in a sign that authorities want to bolster domestic confidence and spark a consumer-lead revival.

"The package of rate cuts, and more specific support for the weak housing market and stock market has helped to boost investor confidence by highlighting that domestic policymakers are stepping up efforts to support economic growth and avoid deflation," says Lee Hardman, a foreign exchange analyst at MUFG Bank Ltd.

In a show of intent, People’s Bank of China governor Pan Gongsheng detailed the decisions in a press conference alongside two other senior financial regulators.

The unusual press conference signals that he wants to get the message across that authorities are stepping up their efforts to boost the economy.

"These measures are by far the largest measures taken since the pandemic and signal a recognition by the CCP that the economy is not going to turn around without a shift in policy," says Richard Windsor, founder of Radio Free Mobile.

The PBoC announced it will provide at least 800BN yuan ($113BN) of liquidity support to the stock market. This included 300BN relending facility for listed companies to conduct stock buybacks.

Looking to support the property market, the PBoC lowered borrowing costs on as much as $5.3 trillion worth of mortgages by announcing a 10bps cut in the national floor for the second home down payment ratio to a record low of 15%.

It also delivered a 50bp cut in existing mortgage rates toward levels close to new mortgage rates.

The central bank also raised the pledged re-lending coverage on the social housing buyback programme from 60% to 100%.

Despite the measures announced today, economists remain skeptical that this will turn China's economic fortues around.

Sam Hill, Head of Market Insights at Lloyds Bank, says these raft of measures are "more accurately described as a 'sugar rush' than a 'bazooka'."

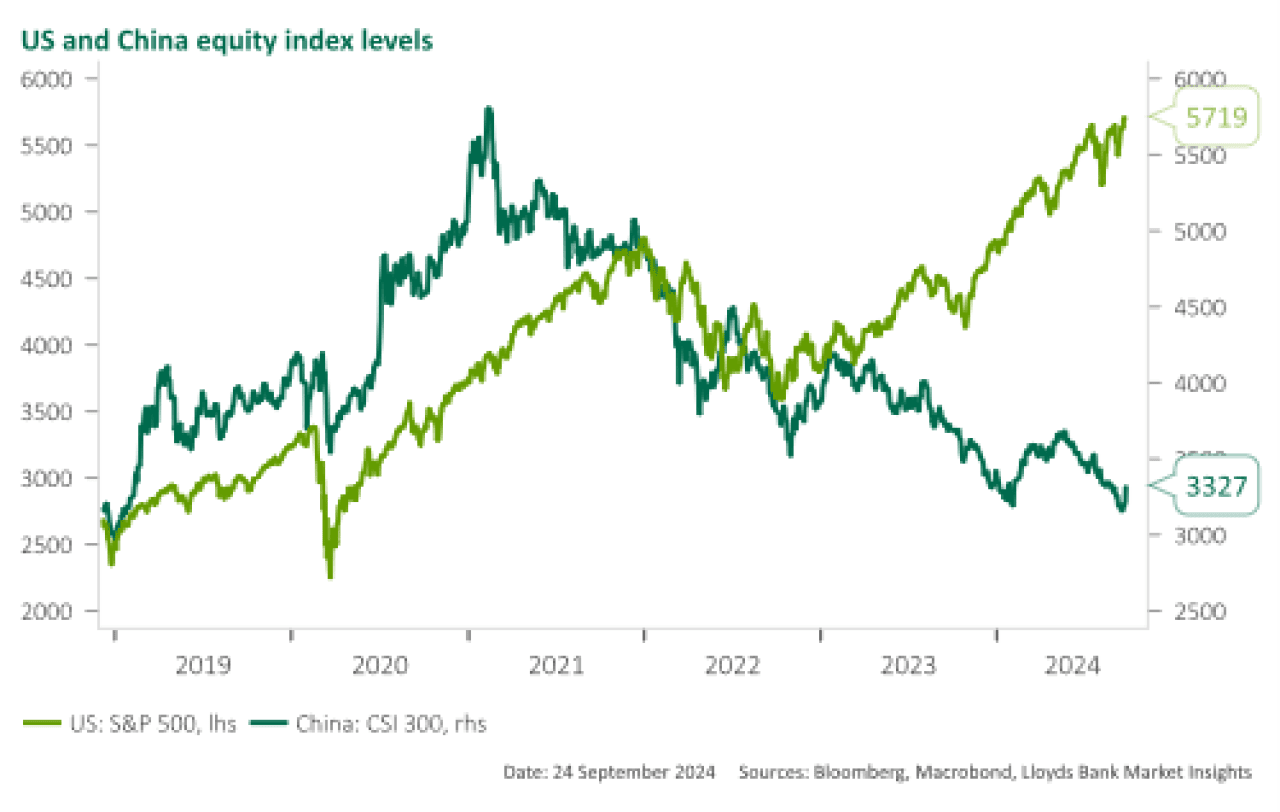

"It feels like we’ve been here before when it comes to headline-grabbing bouts of credit-driven stimulus and yet China’s housing slump continues to deepen and equity markets continue to underperform," says Hill.

"With shrinking multipliers from successive previous measures that have soaked the economy in credit, maybe this latest initiative should be referred to as a ‘sugar rush’ rather than a ‘bazooka’," says Hill.

"Previous measures have resulted in a burst of very short-term enthusiasm which quickly returns to depression as the measures have little long-term impact," says RFM's Windsor. "If China really wants to see a renaissance, it will need to give the private sector more space to invest, create, succeed or fail and critically, make money."

Windsor says the increasingly heavy hand of the Chinese state continues to hover above many of its industries and technology in particular.

"There is nothing in these measures that is likely to encourage founders to start companies again or for investors to relax the onerous demands that they are placing on start-ups in return for financing," he adds.

Bas van Geffen, Senior Macro Strategist at Rabobank, says he doubts that the PBOC has done enough to revive the real estate sector, kick-start the domestic economy, and to effectively mitigate the risks of deflation.

"Mortgage rates and borrowing restrictions may have been lowered, but will households really start purchasing (second) homes again if economic uncertainty is still this high?" he queries.

van Geffen says broader fiscal measures may be needed to revive consumer confidence, bolster the real estate sector, and to kick-start the domestic economy in order to achieve the government’s growth target.