Pound to South African Rand Week Ahead Forecast: Buoyant Above 21.7652

- Written by: James Skinner

- GBP/ZAR could remain buoyant near 18-month high

- Global market risk aversion set to support short-term

- U.S. inflation, Fed policy & SA industrial data in focus

- UK's employment data & annual budget posing risks

Image © Adobe Images

The Pound to Rand exchange rate entered the new week on the front foot and could remain buoyant close to 18-month highs up ahead as Sterling and its South African counterpart navigate a busy schedule of domestic economic risks and a turbulent global market backdrop.

South Africa's Rand ceded ground to most of its G20 counterparts in the opening session of the week despite widespread losses for U.S. Dollar exchange rates and steep declines for sovereign bond yields across the globe.

Monday's Rand losses enabled GBP/ZAR to edge back above the 22.0 handle and could help to keep it buoyant between roughly 21.76 and the recent high around 22.33 up ahead if this week's flurry of official data for January confirms a widely expected South African economic slowdown is underway.

"Right now its about position reduction and that is what is driving today's moves," says Brad Bechtel, global head of FX at Jefferies.

Above: Pound to Rand rate shown at 2-hour intervals alongside USD/ZAR. Click image for closer inspection.

Above: Pound to Rand rate shown at 2-hour intervals alongside USD/ZAR. Click image for closer inspection.

"The fact that USD/ZAR is pressing the recent lows around 18.2190 tells me this is more about position reduction and is therefore temporary," he adds.

While the Rand underperformed on Monday, this was despite it also benefiting from widespread losses for U.S. Dollar rates and broad declines in market-based measures of expectations for the Federal Reserve (Fed) interest rate.

Falling U.S. rate expectations offered relief to non-Dollar currencies after the U.S. Treasury, Fed and Federal Deposit Insurance Corporation (FDIC) pre-emptively guaranteed close to a full bailout of all U.S. bank depositors.

"SVB is the largest US bank to have failed in over a decade. Its collapse added to worries that the already tighter lending environment, on the upwards interest rate cycle, would cause other banks to pull back on lending to start-ups and SMEs," says Annabel Bishop, chief economist at Investec.

Above: Pound to Rand rate shown at daily intervals with selected moving averages and Fibonacci retracements of February rally indicating possible areas of short-term technical support for Sterling. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.

Above: Pound to Rand rate shown at daily intervals with selected moving averages and Fibonacci retracements of February rally indicating possible areas of short-term technical support for Sterling. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.

"The rand has settled just above R18.00/USD, heavily undervalued on both high risk aversion in global financial markets, and particularly negative investor sentiment against SA on its worsening growth outlook as its productive capacity deteriorates," Bishop writes in a Monday research briefing.

The risk for the Rand, Sterling and others, however, is that Tuesday's release of U.S. inflation figures for February leads to a rebound by the Dollar that would potentially scupper the Monday decline in USD/ZAR and keep GBP/ZAR elevated near present levels or above.

This would be less likely, however, if Tuesday's release of gold, mining and manufacturing production numbers show the South African economy weathering a new year spike in load-shedding at national electricity provider Eskom better than markets and economists have so far feared.

"Last week, there was a staggering contraction in the Q4 GDP, indicating a possible recession on the cards. On Thursday the current account for Q4 was released and there was a massive deficit as production was down drastically as the effects of continuous blackouts started filtering through," says Sebastian Steyne, an FX risk and hedging specialist at Sable International.

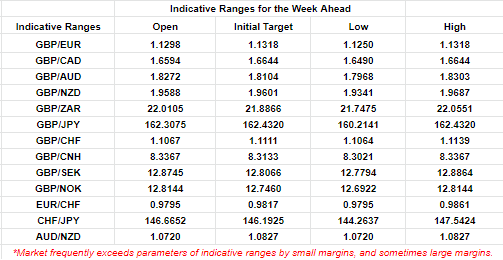

Above: Financial model-derived estimates of probable trading ranges for selected currency pairs this week. Source Pound Sterling Live. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

"In addition, S&P downgraded South Africa’s credit rating from positive to stable, which further did not help the global view of the country.

Retail sales data will be released on Wednesday and is expected to decline. This week, global factors and local political factors will drive the Rand rather than economic data," Steyne writes in Monday market commentary.

With the U.S. and South African data aside, GBP/ZAR is also likely to be highly sensitive this week to outputs from a busy UK calendar including the implications that Tuesday's employment figures and Wednesday's budget could have for the Bank of England (BoE) Bank Rate outlook.

Any further moderation of UK wage growth or decision by the Chancellor to push ahead with earlier planned tax increases and reductions of energy price subsidies could have the effect of dampening expectations for the BoE Bank Rate and vice versa with implications for Sterling.

"The market still expects the Bank of England to push ahead with a 25bp hike on 23 March. This still may be at risk of being priced out, given the BoE was not far away from a pause anyway," says Chris Turner, global head of markets and regional head of research for UK & CEE at ING.

Above: Pound to South African Rand rate shown at weekly intervals alongside USD/ZAR. Click image for closer inspection. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

Above: Pound to South African Rand rate shown at weekly intervals alongside USD/ZAR. Click image for closer inspection. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)