GBP/USD Week Ahead Forecast: May Rise Further in the Coming Days

- Written by: James Skinner, Contributions from Gary Howes

- GBP/USD volatility possible in wide March range

- U.S. bank bail-ins supporting short-term recovery

- U.S. inflation brings 'price of not dying' into focus

- UK budget & jobs data set to decide BoE outlook

Image © Adobe Images

The Pound to Dollar exchange rate has rebounded sharply from 2023 lows and may rise further in the days ahead but volatility could also be likely later this week as U.S. inflation data and the UK budget come into focus.

Dollars were sold widely to open the new week while Pound Sterling was bought heavily as the currency market further reversed last week's sell-off following a joint statement on Sunday from the U.S. Treasury, Federal Reserve (Fed) and Federal Deposit Insurance Corporation (FDIC).

"We are taking decisive actions to protect the U.S. economy by strengthening public confidence in our banking system. This step will ensure that the U.S. banking system continues to perform its vital roles," the statement says in part.

"The U.S. banking system remains resilient and on a solid foundation, in large part due to reforms that were made after the financial crisis that ensured better safeguards for the banking industry. Those reforms combined with today's actions demonstrate our commitment to take the necessary steps to ensure that depositors' savings remain safe," it concludes.

Sunday's joint action provides for shareholders and bondholders of troubled banks like Silicon Valley Bank to be fully bailed-in in order to make depositors whole while pledging the full faith and credit of the U.S. government and Federal Reserve as collateral for any difference.

Above: Pound to Dollar rate shown at 2-hour intervals with selected moving averages. Click image for closer inspection.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

"The collapse of SVB stokes fears of unknown unknowns. As well as the usual non-bank tourist traders perturbed about: i) large ratios of liabilities to equity of banks relative to other sectors; and ii) the impact of rising interest rates and inverted yield curves on bank profitability," says Alessio Farhadi, co-founder and CEO writing for the Speevr Intelligence newsletter.

"A number of big Wall Street names have been rumored to be looking at a post-bankruptcy acquisition of SVB. Morgan Stanley (MS) seems to be most strategically credible to us as a form of ‘vertical' integration – from early stage venture investments to private wealth services. (They're much better at the tech banking stuff than calling markets.)," Farhadi writes in a Monday note.

Sunday's action draws a line under recent global market concerns about the stability of the U.S. financial system by bailing out all bank depositors while simultaneously ensuring owners and other creditors are bailed-in to the fullest extent possible in the event of any institutional failures.

These concerns were a major burden for the Pound to Dollar exchange rate last week and their unwinding could be a significant boon early in the new week but much about the short-term outlook for Sterling will also depend on data due out from both sides of the Atlantic on Tuesday.

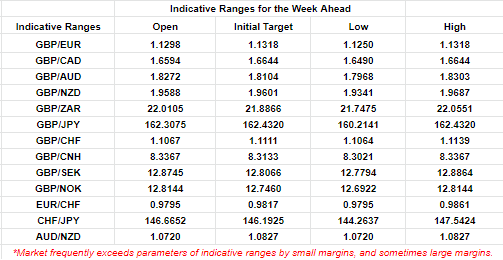

Above: Financial model-derived estimates of probable trading ranges for selected currency pairs this week. Source Pound Sterling Live. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

Tuesday's UK employment and wage data for January is likely to be influential of this month's Bank of England (BoE) interest rate decision but the subsequent publication of U.S. inflation figures for February is likely to be at least as consequential for Sterling and the Dollar.

The data is also likely to be an influential arbiter of whether the Fed raises its interest rate by just a quarter or a percentage point in March or if it opts for a larger half percentage point move.

"GBP/USD can ease this week if the U.S. CPI for February is stronger than expected. A softening in UK employment and earnings on Tuesday can also weigh on GBP/USD," says Joseph Capurso, head of international economics at Commonwealth Bank of Australia.

"There is downside support at 1.1824 (50% Fibbo). AUD/GBP can head higher towards 0.5629 (100 day moving average) if the UK employment and wages data soften," Capurso and colleagues write in a Monday research briefing.

Above: Pound to Dollar rate shown at daily intervals with selected moving averages. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.

While the Pound to Dollar rate is likely to be sensitive to Tuesday's inflation figures and employment numbers, these are just a precursor to the highlight for Sterling, which is Wednesday's annual fiscal update from HM Treasury.

A more resilient than anticipated economy has placed the Chancellor is in a better-than-expected position ahead of this but he is also constrained by lingering risks of inflation and Office for Budget Responsibility pessimism about the long-term prospects of the economy.

However, the risk for the Pound is perhaps of a less austere stance of fiscal policy that keeps the balance of risk for the BoE Bank Rate tilted to the upside.

"The short-term fiscal outlook has brightened, thanks in part to falling energy prices," says Andrew Goodwin, chief UK economist at Oxford Economics.

"We think Hunt will use some of this improvement to continue the long-running freeze on fuel duty for another year, scrap plans to reduce the generosity of the Energy Price Guarantee in April, and perhaps give one off-bonuses to public sector workers," Goodwin writes in a Friday research briefing.