Yen Trend Flip

- Written by: Gary Howes

Image © Adobe Images

The Japanese Yen could be on the cusp of a trend shift, helped by expectations that further Bank of Japan interest rate rises are on the way.

This is according to a new assessment from Japanese bank MUFG and comes as the Yen soars in value, with gains accelerating following the Bank of Japan's July 31 interest rate hike.

Guidance from the Bank suggested further hikes are incoming. "The yen’s gains accelerated yesterday after the BoJ’s hawkish policy update at which they indicated a greater willingness to keep raising rates to normalise monetary policy in Japan," says Lee Hardman, a currency analyst at MUFG.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"In light of the BoJ’s policy update we are now pencilling in two further BoJ hikes in the current fiscal year," he adds.

MUFG also brings forward its expected timing for the next cut to either October or December.

Bank of Japan Governor Ueda laid the ground for further hikes, saying the current real policy rate adjusted for inflation remains "profoundly negative" and "far below" the uncertain levels of the neutral rate in Japan.

"It leaves room for rates to continue to adjust higher if Japan’s economy continues to evolve in line with the BoJ’s updated economic outlook," says Hardman.

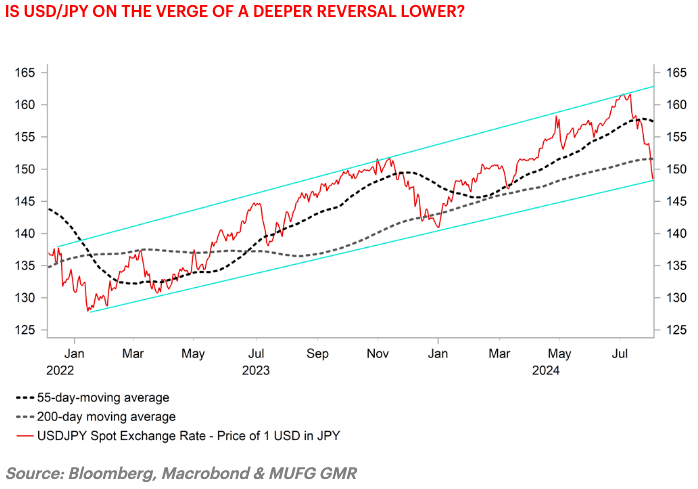

The strength of the Yen's recent gains means some key Yen-based exchange rates could flip trend.

"The yen’s gains accelerated after USD/JPY broke below technical support from the 200-day moving average which came in at around 151.50. The pair has since fallen further overnight and tested support from the uptrend line joining the lows from in early 2023 and late 2023 which comes in at around 148.50," says Hardman.

He thinks a decisive break below that level would bring an end to the up trend that has been in place since the start of 2023, "and would signal a more significant reversal lower for USD/JPY heading into year-end towards the mid-to low 140.00’s."