Japanese Yen Backed by a 'Hawkish' Bank of Japan

- Written by: Gary Howes

Above: File image of Kazuo Ueda, Governor at the Bank of Japan. © Sérgio Garcia/Your Image for ECB.

The Japanese Yen can count on a more 'hawkish' Bank of Japan being in its corner.

This is after the Bank raised interest rates again, committed to exiting its quantitative easing programme and said it would raise interest rates again as needed.

The Bank's board on Wednesday voted 7-2 to hike its policy rates to "around" 0.25%. It also revealed that its economists had raised 2025 CPI forecasts to just above target at 2.1%.

"The Bank will accordingly continue to raise the policy interest rate and adjust the degree of monetary accommodation," read a statement.

This represents a hawkish change from the March statement, which noted: "accommodative financial conditions will be maintained for the time being."

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The Bank committed to weaning Japan off quantitative easing, announcing a gradual tapering of bond buying by about Y400BN each quarter. This takes the Q1 2026 amount to about Y3TRN, down from current levels, which are around double the amount.

"This feels pretty aggressive from the BoJ and they may have done enough to keep JPY short sellers at bay for now," says Viraj Patel, a strategist at Vanda Research.

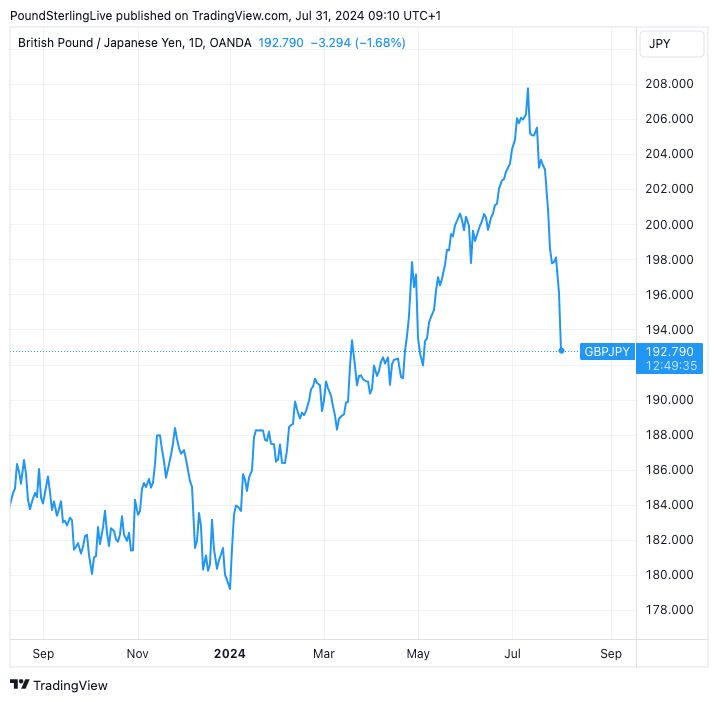

The Japanese Yen has soared over the course of the past two weeks, in part because investors saw the prospect of a more supportive central bank.

Above: GBP/JPY at daily intervals. The Yen has soared lately. Track GBP/JPY with your custom alerts; find out more here

The Yen has suffered thanks to Japan's ultra-low interest rates and persistent quantitative easing. Any exit from these policies can offer some respite.

The market had expected some of these changes in advance, which explains why much of the adjustment in the exchange rate has already taken place.

Hefty short positioning by investors and bloated carry trades meant the Yen was ready to benefit from a bonfire of this positioning.

The decision to hike will have surprised many in the market, as some economists had thought the Bank would rather wait until October before raising interest rates again.

"Today’s move will therefore raise questions as to how much political pressure BoJ Governor Ueda may have been under to hike rates in order to stabilise the JPY," says Jane Foley, Senior FX Strategist at Rabobank.

The Yen was mixed in response to the actual policy call but strengthened through the press conference hosted by the Bank's chief, Kazuo Ueda.

"It also appears to be strengthening on the back of Governor Ueda’s press conference, possibly due to relief that no overtly dovish remarks were thrown in," says Foley.