Dollar-Yen Rally Eyes 132.85 and then 135.00: Forex.com

- Written by: Gary Howes

Image © Adobe Stock

The Dollar to Yen exchange rate (USD/JPY) rallied strongly midweek, gaining nearly 150 pips. Mathew Weller, Global Head of Research at FOREX.com says the next levels of resistance to watch are at 132.850 and 135.00 if the near-term rally extends.

From a bigger-picture perspective, it’s not hard to see why the yen might be struggling in the current environment.

After all, outside of the Bank of Japan (BOJ), every other major central bank has raised interest rates aggressively over the last year, and even the new head of the BOJ, Kazuo Ueda, shows no signs of changing that any time soon.

Likewise, the Japanese economy remains moribund, struggling under the weight of ageing demographics, debt overhang, and a lack of innovation.

Be that as it may, the yen has shown a strong historical seasonal tendency to rally in the final week of March.

The fiscal year ends in Japan ends on March 31, and multinational Japanese countries tend to repatriate their profits around that time of year so they can pay taxes, creating marginal buying pressure on the island nation’s currency.

Likewise, the act of paying taxes removes yen from circulation, at least temporarily, creating both lower supply and higher demand at this time of the year.

Against that backdrop, the fact that the yen is the day’s, and week’s, weakest major currency is particularly significant.

It means that the factors leading to yen weakness may have had an even stronger impact on any other week.

Of course, the fiscal year is not yet over, so its worth watching USD/JPY’s strength carries over through the rest of the week, but as it stands, this week’s price action in the yen is providing a strong signal given the seasonal backdrop.

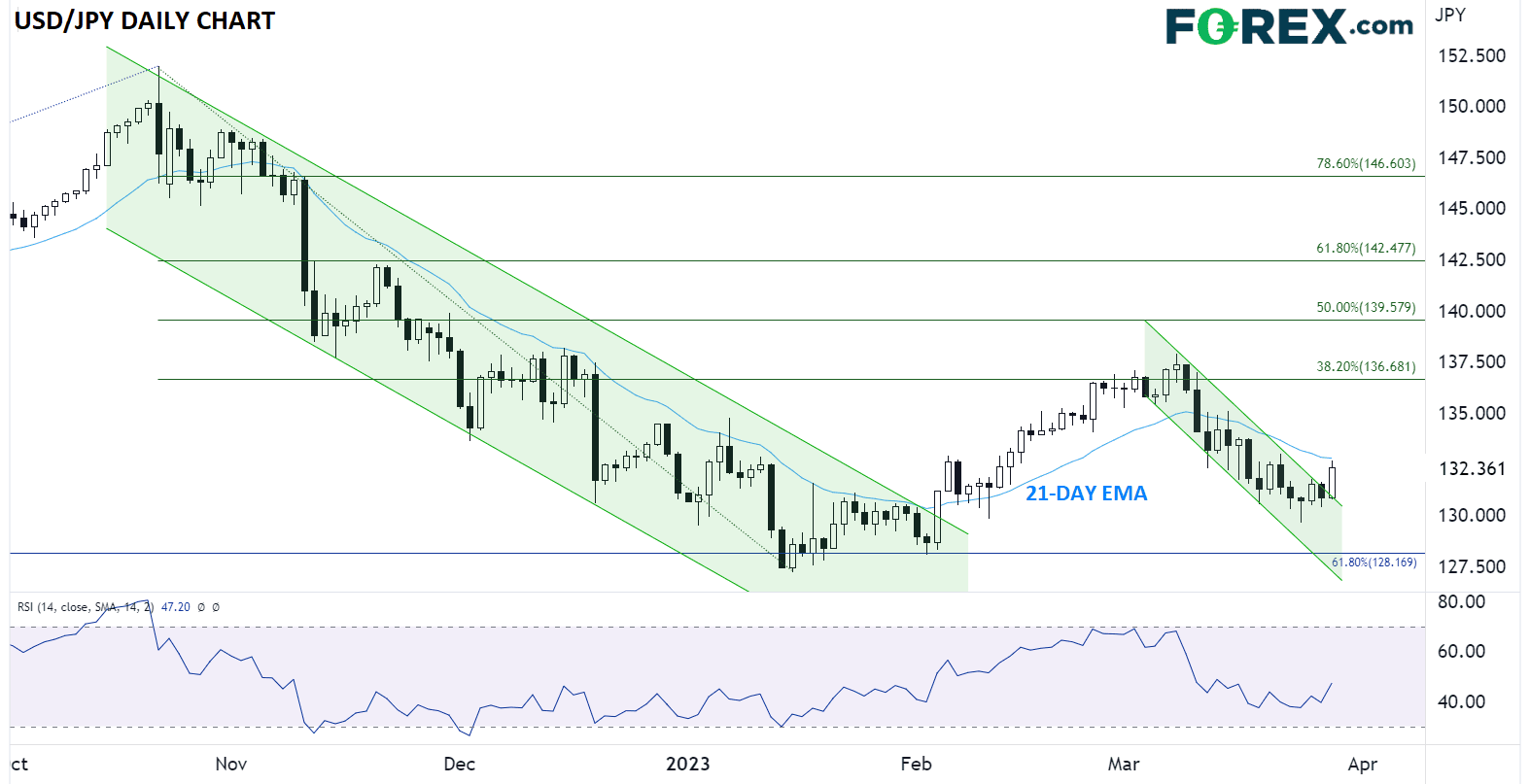

As the chart above shows, USD/JPY has broken out of its short-term descending triangle pattern, potentially opening the door for an extended rally from here.

Zooming out, there’s also a chance that Friday’s low marks a “higher high” for the pair, signalling a potential end to the medium-term downtrend off last October’s high.

The next level to watch will be the 21-day EMA near 132.80, with a break above that level paving the way for a potential continuation toward the mid-March highs at 135.00 next.

Meanwhile, a reversal back down into the channel would erase the near-term bullish bias and could even portend a retest of the 10-month lows near 128.00 in time.