Yen Skids, Dollar on a Steadier Footing

Image © Adobe Stock

Rising confidence that authorities have done enough to stem a wider systemic crisis in the banking sector sparked a selloff in the safe-haven Japanese yen on Wednesday.

The yen is sliding against all its major peers, particularly against the US dollar, which got battered from the banking episode.

The dollar is testing the 132-yen level today, lifting its index against a basket of currencies.

However, the greenback appears to be regaining some footing against other currencies as well, with the euro and pound also slipping.

The move could just be a technical correction, or it could be playing catchup with the solid rebound in Treasury yields this week that pushed the 2-year yield back above 4.0%.

The second worst performer after the yen is the Australian dollar, which came under pressure from domestic CPI data.

Inflation in Australia moderated further in February, easing to 6.8% y/y.

It follows sluggish retail sales figures a day earlier, leaving investors with little doubt that the Reserve Bank of Australia will keep rates on hold when it meets next week.

The stronger dollar also weighed on gold, which is reversing most of yesterday’s gains.

However, oil prices are heading higher for a third consecutive day, amid improving optimism, while a dispute in Iraq between the Kurdistan Regional Government and Baghdad over crude exports via a Turkish pipeline is also boosting oil futures today.

The legal dispute is estimated to be affecting about 450,000 barrels of exports a day, in a significant hit to regional supply.

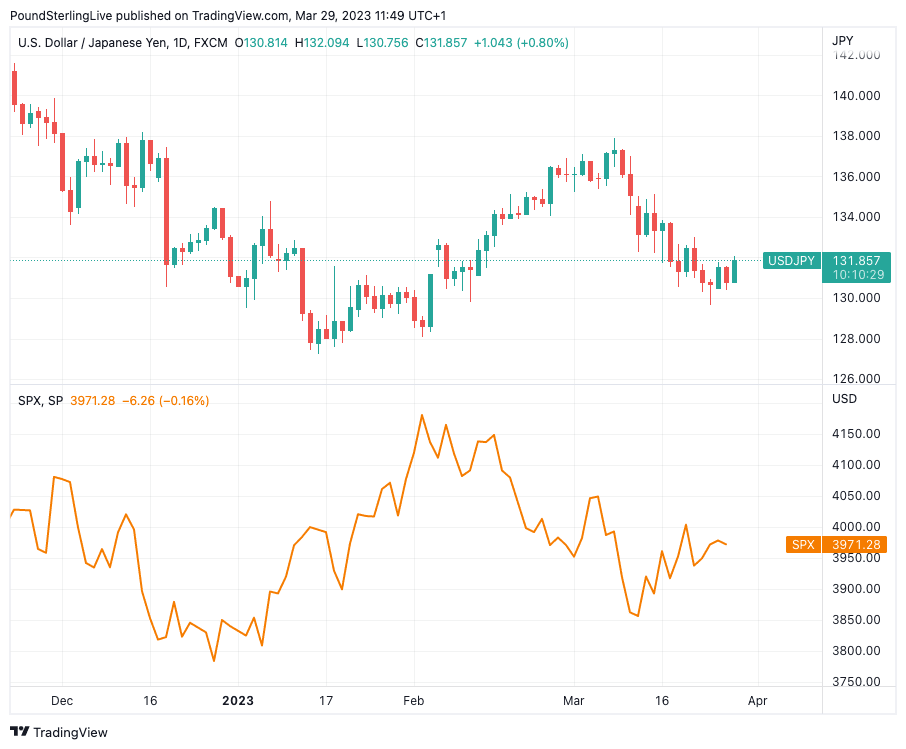

Above: USD/JPY (top) and the S&P 500.

US e-mini futures point to a higher open on Wall Street today but there is a sense that markets are overall lacking direction. With the quarter-end looming and the Q1 earnings season starting in two weeks’ time, investors might be reluctant to take this recovery much further.

However, stronger-than-expected data might also be curtailing upside attempts as they would be seen as ramping up rate hike bets for the Fed.

A surprise uptick in the Conference Board’s consumer confidence index on Tuesday might have countered Wall Street’s tepid advances, although investors remain split about whether or not the Fed will raise rates again at its next meeting.

St. Louis Fed President James Bullard took a leaf out of the ECB’s book, suggesting that macroprudential policy will be used for containing the banking crisis, while monetary policy will separately be targeting inflation in an essay published yesterday.

Global equity markets got off to a positive start on Wednesday, resuming a patchy rebound from the lows of the banking turmoil that has so far been less than convincing.

Stocks on Wall Street ended lower on Tuesday despite more calm being restored to the markets amid what appears to be a banking crisis that is now receding.

There can be no doubt that even as traders start to put the past month’s events behind them, they remain vigilant about what else could be lurking around the corner, as there is still some unease about the robustness of America’s regional banks and Europe’s banking giants.

European stocks have opened sharply in positive territory today, boosted mainly by a strong performance in Asia. Hong Kong’s Hang Seng index led the gains in Asia after shares in Alibaba surged on the announcement that the company will split into six business units, with some of them likely to seek IPOs.

The restructuring resolves a long-running standoff of the company with Chinese authorities and also signals a broader easing of the government’s crackdown on the country’s tech sector. Alibaba’s US-listed stock soared 14.3% yesterday, adding to the growing risk-on mood.