US Dollar Expected to Retain Robust Profile for Remainder of 2017 by HSBC

- Pound to Dollar Rate Today: 1.2435

- Euro to Dollar Rate Today: 1.0670

- US Dollar to Yen Rate Today: 110.68

HSBC have told clients they do not see the US Dollar breaking below key technical levels over coming months and therefore the under-performance seen thus far in 2017 is likely to fade.

Analysts have made the call backing the Dollar at a time of fresh stresses for the currency whose Effective Exchange Rate as per Bank of England data has fallen through the course of 2017.

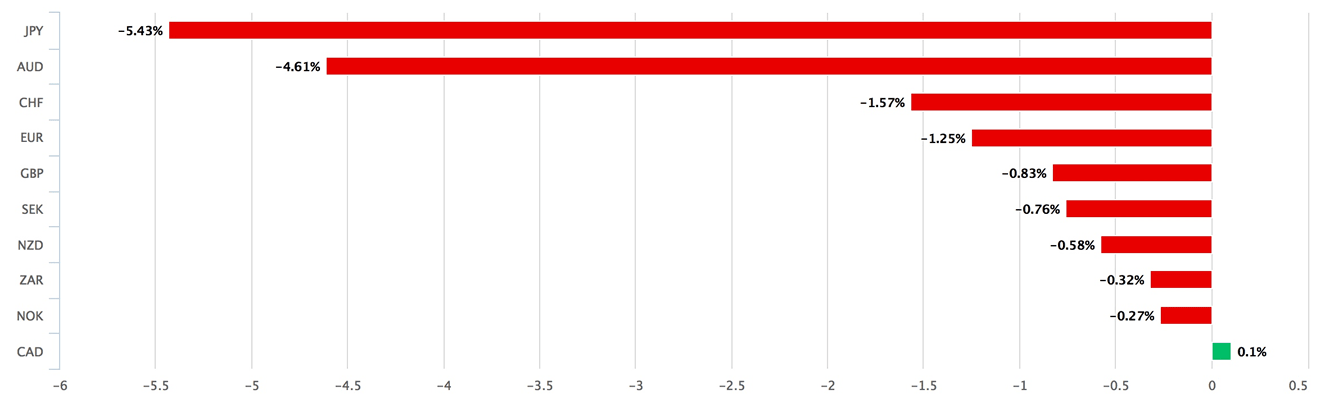

This year the Dollar is down against the majority of its main competitors and has only registered a slight gain on the Canadian Dollar :

But, betting against the Greenback at this juncture might prove problematic argues HSBC’s Strategist Daragh Maher.

“We do not believe the USD will weaken through key technical and psychological levels in the coming month,” says Maher.

Examples would include support at the 200-day Moving Average on the Dollar index - a measure of the Dollar’s value against a bunch of the world’s most important currencies.

This is mirrored by the 200-day Moving Average resistance on EUR-USD or a break below 110 on USD-JPY.

“Each of these levels will remain in play for USD bears, but we think the recent reprieve for the USD is likely to extend. In part this reflects our doubts about the merits of that earlier currency strength elsewhere,” says Maher.

HSBC had anticipated the Dollar to rise in March but concede their call was wrong.

Reasons for the Dollar’s failure to deliver further upside impetus include the US Federal Reserve settling on the idea that three interest rate rises in 2017 is appropriate when markets were looking for more to justify sending the Dollar higher.

“It suggests the bar will be rather high to any near-term shift given the strong consensus,” says Maher.

Nevertheless, HSBC do not believe the ingredients are yet in place for the USD to embark on a bear trend, as per the technical levels in the market we have already mentioned.

Furthermore, Maher and his team note a shift in the US policy focus to tax reform may already be re-energising USD bulls even if they will have to face a market more sceptical of the Trump administration’s ability to deliver its agenda into law.

The Dollar has underperformed ever since Trump failed to pass key healthcare legislation through Congress in a sign that he might not have the clear run at policy making that markets had expected.

But on tax, there are suggestions that the Republicans might stand united and pass the President's agenda.

HSBC are forecasting the USD/JPY to end 2017 at 110 and the EUR/USD to end the year at 1.10.

The GBP/USD is forecast to end the year at 1.10. So this is clearly a number that shouldn't be difficult to forget!

Capital Economics Back the Dollar into 2018

Also updating markets with bullish US Dollar expectations are the Capital Economics who have on April 4 confirmed they retain the view that the Dollar will strengthen in 2017.

So while they have tweaked their end-year forecasts against the Euro (to parity from 0.95) and the Yen (to 120 from 130), they still expect it to rally from 1.07 and 111.

They also think the Greenback it will rise against Sterling, from 1.25 to an unrevised forecast of 1.20.

“Next year, though, we now expect the Dollar to fall against the Euro and Sterling,” says John Higgins at Capital Economics in London.

Capital’s new end-2018 projections are 1.10 in EUR/USD compared to previous forecasts of 0.95.

For the GBP/EUR the end of 2018 should see a recovery to 1.30, up from a previously-held forecast of 1.20.