The US Dollar's Run Higher against the Japanese Yen Stalls, Why?

The USD/JPY pair has been rising as the US Dollar finds buyers owing to the positive economic outlook in the United States.

However, the rise has stalled of late and some analysts are now adopting a more neutral view of the pair.

Analysts at Credit Agricole (CA) have told clients they now see the possibility of USD/JPY weakening due to the Bank of Japan (BOJ) taking a more “constructive” line “with respect to inflation.”

If the BOJ do talk about higher inflation this will support the Yen as it will signal the possibility of the BOJ raising interest rates.

Higher relative interest rates support currencies as they attract more foreign capital inflows seeking a better return on their money.

CA further see the possibility of a recovery in the Yen, on the back of a fall in global risk appetite due to the likelihood of the anti-Euro PVV party now failing to secure a majority in the Dutch general elections on Wednesday, since recent polls have seen support for the party decline sharply.

If PVV fail to get into government on Wednesday, March 15 it will take some of the risk off the table for the Eurozone and help lift risk appetite globally.

Given the Yen’s link with risk such an outcome would lead to its appreciation.

Still Bullish the Dollar

CA, however, are still bullish on the Dollar overall, as they do not think the market has adequately priced in the possibility of the Fed becoming more agressive when it comes to raising interest rates over coming months and have as result substantially upgraded expectations for the trajectory of future interest rate hikes.

“There is less room for disappointment this week, however, with the market having been cautious about pricing in more FOMC hawkishness or a higher dot plot,” said CA referencing the March Fed policy meeting.

Technically Neutral

Analyst Steven Knight of Blackwell Global has shifted his outlook from positive to neutral for the pair, mainly on technical signals which show USD/JPY could be on the overbought side.

“From a technical perspective, price action appears to have formed a temporary top around the 115.49 mark before retreating back to its current level. In addition, the RSI Oscillator remains predisposed to the upside, but it should be noted that the indicator is nearing overbought levels. Subsequently, our initial bias for the week ahead is neutral as the current phase could turn consolidative,” says Knight in a client note seen by Pound Sterling Live.

Impact of Oil

A drastic drop in the price of Oil could support the Yen against the Dollar as Japan is a major Oil importer, and so a fall will help increase its trade surplus.

Crude Oil is currently falling rapidly on the back of OPEC oversupply fears and a large increase in shale oil production in the US.

If the trend continues, as it is likely to, it could well put pressure on USD/JPY as the yen appreciates on the back of weaker oil prices.

Chart Watch

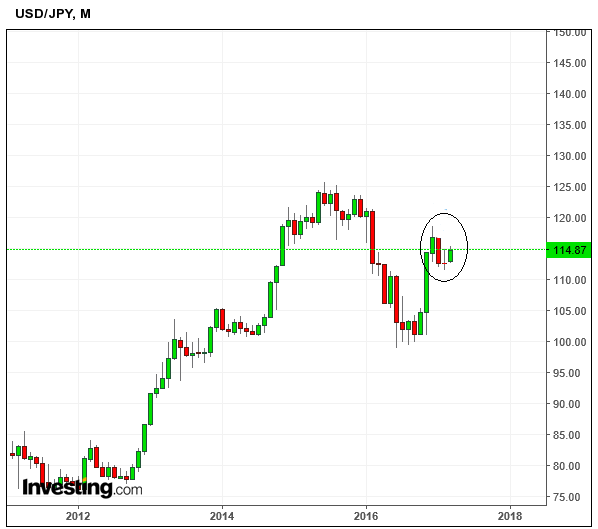

Despite the neutral, even bearish stance of some analysts, our technical outlook remains broadly constructive, at least in the medium term.

The monthly chart shows that March is more likely to be an up-month rather than a down-month, due to the two preceding months of Jan and Feb closing down and yet the overall trend being up since the July lows.

This set up is called a ‘One step forward, two steps back’ and has a roughly 66% success rate at calling the next month’s close correctly.

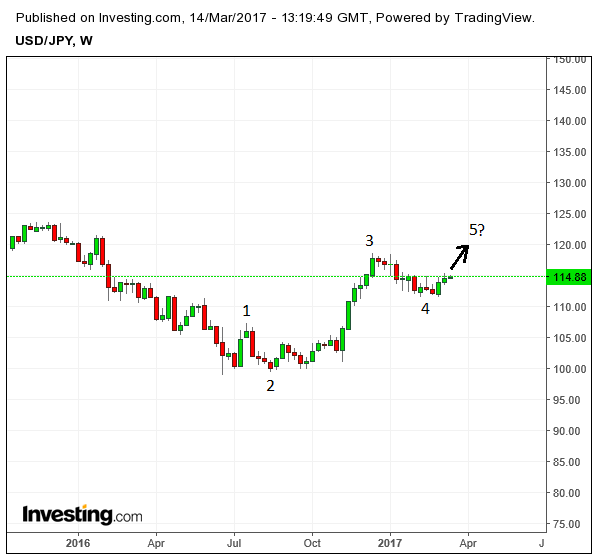

On the weekly we note a very clear bullish Elliot Wave unfolding from off the July lows, with price action currently unfolding in the final fifth wave higher.

Wave five has a high probability of reaching at least as high as the top of wave three – at 118.60, so this is another bullish indicator for the pair.

On the daily chart the pair looks like it has formed a double bottom reversal pattern at the lows and is in the process of breaking out above the neckline and the R1 monthly pivot.

We still see a chance of a strong breakout higher occurring with confirmation of such a move coming from a break above the 115.50 highs, and an initial target at 116.40.

The MACD momentum indicator is also supporting more upside now that it has moved above the zero-line, which indicates a change of the primary trend from bear to bull.