The GBP/USD Rate Forecast to 1.30, Just as Planned

- Written by: Gary Howes

Pound Sterling has traded back above 1.26 over the course of the mid-week session as the recent jawboning of US trade official Peter Navarro and a Federal Reserve briefing that offered no crumbs to Dollar bulls continues to weigh on the Greenback.

As is always the question in foreign exchange markets - where do we go next?

There was a danger that the US Dollar rally was reasserting itself earlier in the week, hence the GBP/USD rate put in some sharp declines from last week’s high at 1.2675.

However, analyst Fawad Razaqzada at Forex.com was not convinced this signalled an end to the GBP’s rally.

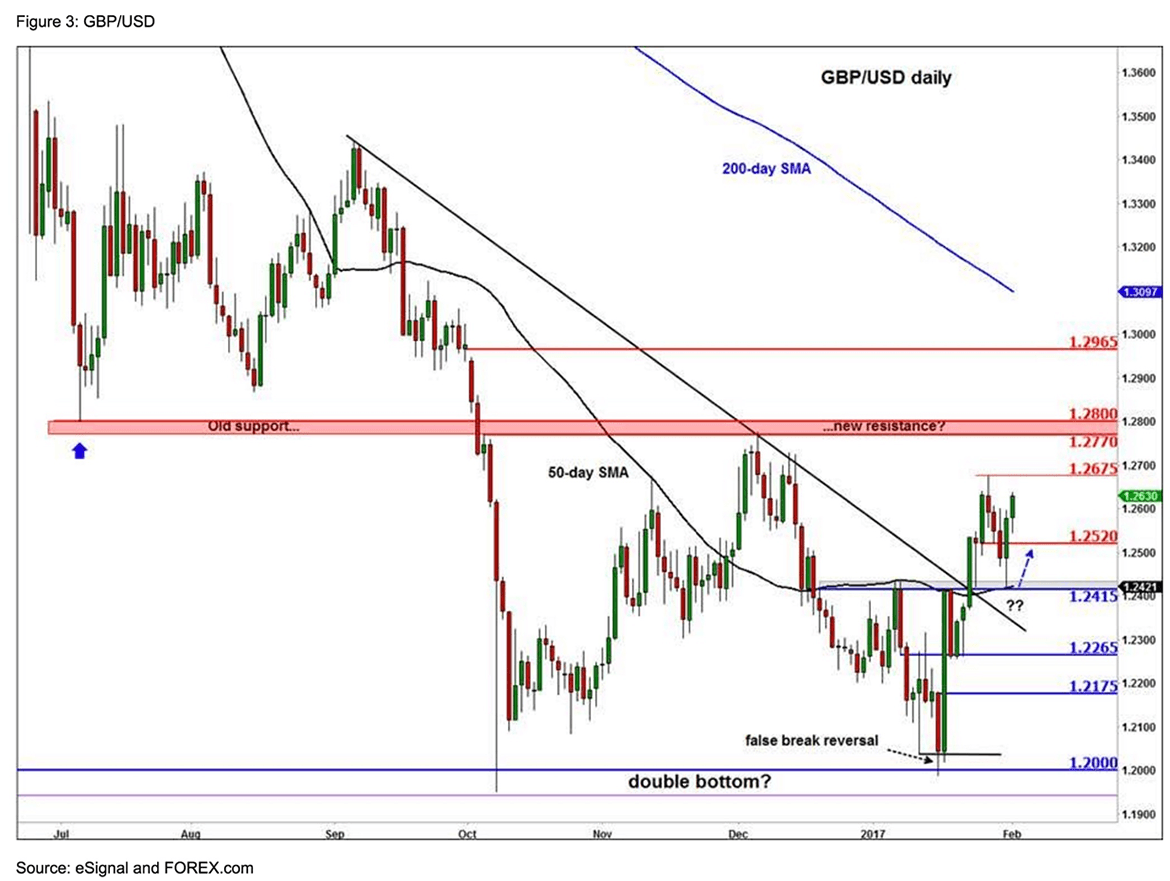

“As far as the GBP/USD is concerned, well this pair has so far behaved in the way we had expected it to do after it formed that double bottom formation at 1.20. The cable held the old resistance level of 1.2415 as it bounced sharply from here,” says Razaqzada.

Based on his studies Razaqzada believes the next level of resistance that the GBP/USD will be facing is at 1.2675, the high from last week.

A break above this will open up the prospect of further gains towards the resistance layered at the 1.2770-1.2800 area (shaded in red on the chart), which was previously support and resistance.

“But I still think that 1.30 is the level that the cable may be aiming for. My bullish outlook on the GBP/USD would become weak if the sellers now manage to reclaim the broken resistance level at 1.2415,” says Razaqzada.

A Shift in Sentiment

There is certainly a growing mood amongst commentators and traders alike that Sterling is due a period of relief.

"The Cable’s defiance of last session’s swing back to the dollar stands as a testament to the shift in underlying sentiment towards the embattled pair. Indeed, the market’s reaction to Parliament’s rather unified response to the Article 50 vote could be a bellwether of easing uncertainty and the return of some much needed optimism regarding the GBP’s future. As a result, the 1.30 handle may not be as far out of reach as it has been over the past few months," says Mathew Ashley, FX Research Analyst at Blackwell Global.

From a technical perspective, Ashley believes there is also some fairly tangible evidence of at least an end to the relentless selling pressure that has been besetting the Pound.

Notably, the GBP/USD's recent surge in popularity has seen it finally cross back above the 100 day EMA in accordance with its bullish Parabolic SAR bias.

"Combined with the bullish MACD readings and the configuration of the two shorter period moving averages, upside potential is certainly at its highest point in some time," says Ashley.