Pound to Dollar Rate Tests Key 1.30 Break

- Written by: Gary Howes

Image © Adobe Images

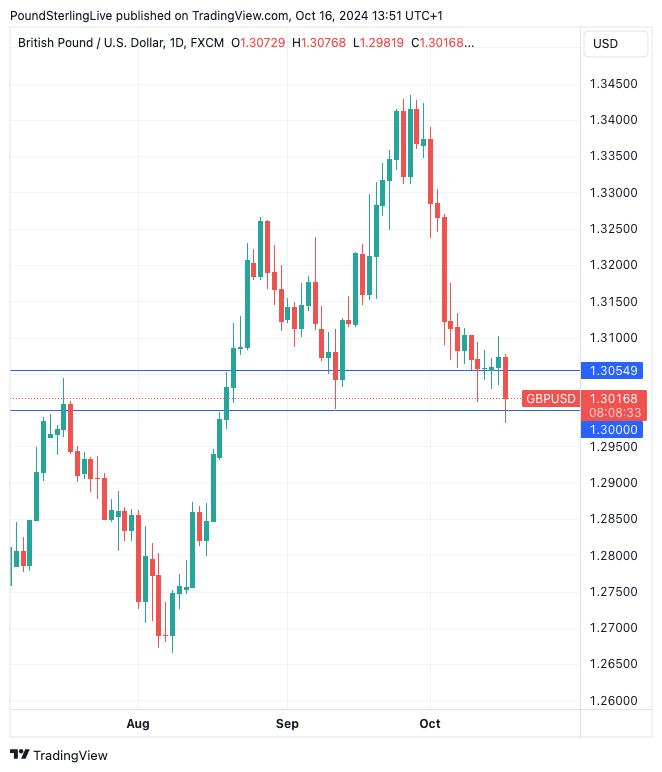

The Pound to Dollar exchange rate (GBP/USD) is testing the key level of 1.30, where a break opens the door to the 1.2820 level say analysts.

Pound Sterling dropped in midweek trade following the release of notably softer-than-forecast UK inflation data that raised the odds of two further interest rate cuts at the Bank of England in 2024.

"The British pound fell below the 1.30 level against the dollar after weak inflation data across indicators. This sent the pound to a two-month low on speculation that the Bank of England will cut interest rates further in the coming months," says Alex Kuptsikevich, Senior Market Analyst at FXPro.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

The 1.30 level, which is being closely watched by analysts and market participants as an important market.

The dip proved short-lived as buyers stepped in to defend the level, sensing that others would be selling around here, looking to book profit from riding the October selloff.

But strategists think sellers will emerge with vigour and enter the sell trade if 1.30 gives way.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

"Now we are through 1.30 in GBPUSD I think this can extend, we scaled up shorts," says a note from the JP Morgan currency dealing and trading desk.

"Through 1.30 the next level of interest is the 100d (moving average) at 1.2950 and then 1.2820/50 support band which would serve as a fair initial target," says JP Morgan's trading desk.

The Pound fell against the Dollar, Euro and all G10 peers after the UK's headline inflation rate fell to 1.7% year-on-year in September, while the Bank of England's closely-watched services inflation level dipped from 5.6% to 4.9%.

"Sterling might extend south towards 1.28 if UK inflation data comes in cooler than expected on Wednesday, as this would raise the risk of the Bank of England cutting interest rates twice before Christmas," says Robert Howard, a market analyst at Reuters.

A 25bp cut is now fully priced in for the November 07 Bank of England interest rate meeting, with a 70% chance of another 25bp cut now priced for December.

"However, the BoE’s endpoint is still priced at a relatively high level of 3.51% and remains 76bps above the HSBC forecast. This means GBP-USD can weaken further in the months ahead," says Nick Andrews, Senior FX Strategist at HSBC.

"We expect sterling to weaken by ~4% against the euro and ~1% against the dollar by end-2025. We expect yield gaps to move against sterling, particularly vis-à-vis the euro, over the next year. We think the Bank of England will lower interest rates by much more than what is currently discounted in money markets," says Joe Maher, Assistant Economist at Capital Economics.