GBP/USD Selloff Accelerates on Signs U.S. Economy is Gaining Momentum

- Written by: Gary Howes

Image © Adobe Images

The Dollar extended an already sizeable daily advance against the British Pound after new data showed U.S. economic growth found fresh momentum.

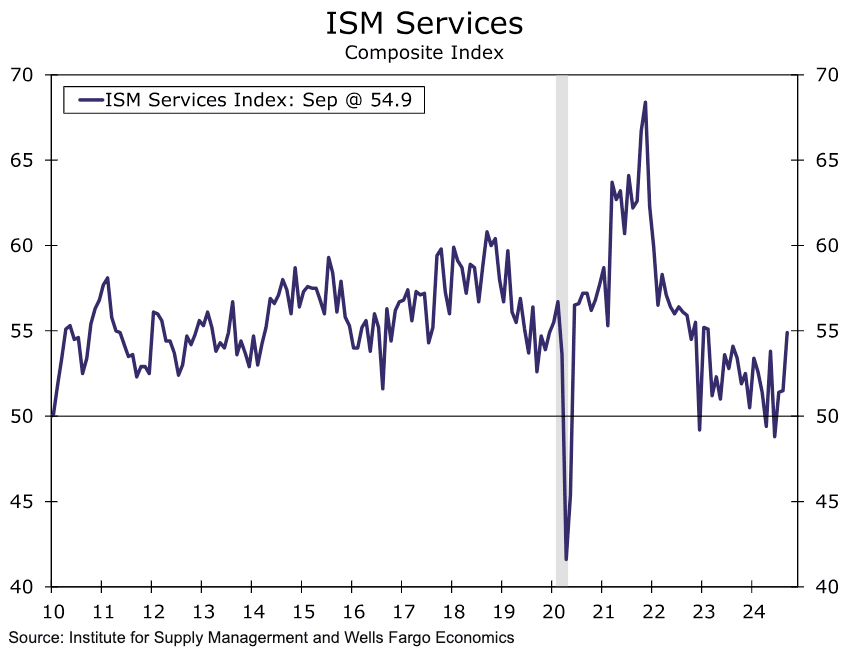

The GBP to USD conversion (GBP/USD) sank to 1.31 (-1.20%) after the ISM survey of the U.S. services sector came in at 54.9% in September, up from 51.5% and easily trouncing expectations for 51.5%.

This was the strongest reading since February 2023, and it was hardly the signal one would expect from a stalling economy in need of lower interest rates.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

The prices paid component of the report showed a stark pickup in price pressures, rising to 59.4% from 57.3% and sailing past expectations for 56.3%.

The Dollar was broadly higher following the data, a sign that investors are wary that the Federal Reserve might have to slow the pace at which it intends to cut interest rates in the coming months.

"The rise in the business activity and new orders components by over six points highlights that overall activity and demand conditions remain solid," says Tim Quinlan, an economist at Wells Fargo.

Respondents to the survey suggest the decision by the Federal Reserve to cut rates by 50 basis points helped bolster sentiment.

Should markets pare back expectations for the quantum and pace of future Fed rate cuts, the Dollar can recover further.

Federal Reserve Chair Jerome Powell spoke at the National Association for Business Economics annual meeting this week, where he reiterated his message of “recalibrating” monetary policy and emphasised that the Fed was not “in a hurry to cut rates quickly."

In an unfortunate turn of events for GBP/USD 'bulls', the message from the Bank of England is quite different. We have seen a rise in expectations that the Bank of England is about to step up the pace it cuts interest rates after Governor Andrew Bailey said the Bank could be "more activist" in cutting interest rates going forward.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

This looks to be a pivot away from a carefully nurtured and unambiguous message from recent months that the Bank will proceed slowly on interest rate cuts owing to still-high inflation.

"We’ve always thought that once the BoE becomes more comfortable with the path of inflation, it will signal a more aggressive rate cutting cycle. Bailey’s comments are a clear move in that direction," says Nick Andrews, Senior FX Strategist at HSBC.

HSBC expects markets to continue to price a more aggressive UK monetary easing cycle pushing GBP/USD lower, "possibly to 1.31 and a break of 1.30 would open up our year-end target of 1.28," says Andrews.