Pound to Dollar Rate "in Danger" of Falling to 1.30 on "Puzzling" Bailey Comments

- Written by: Gary Howes

Above: File image of Governor Andrew Bailey. Image: OeNB/Gruber. Reproduced under CC licensing.

Markets think there is now a chance the Bank of England cuts 50 basis points before year-end, courtesy of Governor Andrew Bailey's latest comments.

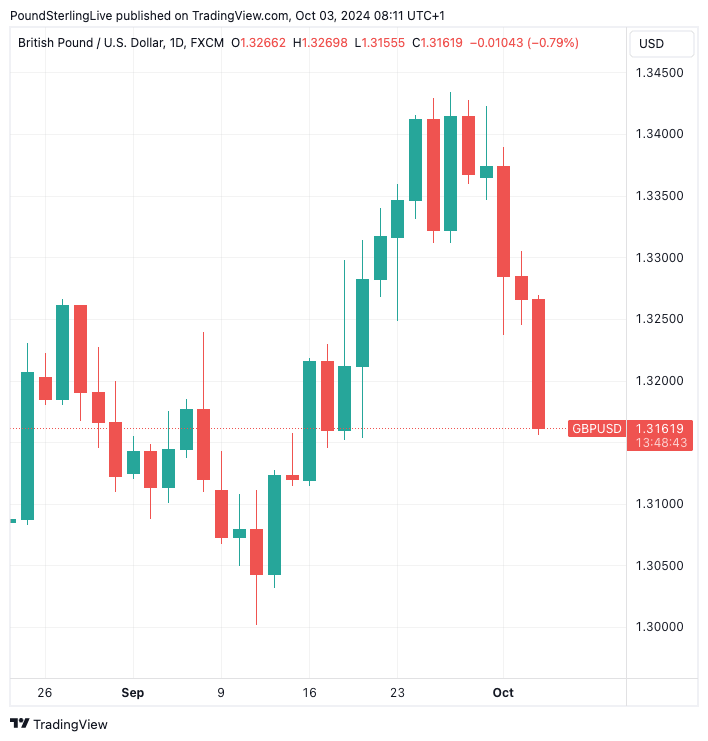

The Pound to Dollar exchange rate (GBP/USD) has extended this week's selloff after Bailey said the Bank can "be more activist" in cutting interest rates if inflation pressures ease further.

Markets have interpreted the comments as signalling a shift in the Bank's thinking, from being cautious about cutting rates owing to still elevated inflation to wanting to stimulate economic growth.

"This has been a bruising week for the pound, and $1.35 seems like a mountain to climb from here," says Kathleen Brooks, research director at XTB.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

GBP/USD has fallen to 1.3173, having been as high as 1.3422 on Monday.

"The pound has taken another leg lower and dropped below $1.32 vs. the USD on Thursday, as safe haven flows into the US dollar, along with dovish comments from the Bank of England governor Andrew Bailey, rattle sterling," says Brooks.

"By talking up rate cuts, the danger now is GBP/USD retreats to 1.30," says Kenneth Broux, a strategist at Société Générale.

Analysts find Bailey's latest intervention to be a curious turn of events. The central bank had steadily rebuilt credibility on interest rates and inflation thanks to months of consistent messaging that rates would come down gradually as inflation was still too high.

"For sterling, the strength of the currency ought to be good news for a central bank that is struggling to defeat inflation. Hence the timing of Governor Bailey’s comments and choice of words in the Guardian are puzzling," says Broux.

"He obviously disapproves with the shallower path of market pricing of future cuts (vs Fed and ECB) which is uncharacteristic of him to say so," adds Broux.

Brooks says the Pound is now at risk of losing its yield differential:

"Bailey’s comments have also undermined the pound’s yield differential with the US and Europe. The market has fully priced in a rate cut from the BOE next month, and there is a 61% chance of another cut in December, up from 47%."

Crucially, the market is pricing in more than 25bps in cuts for next month’s meeting. This means the market now sniffs a 50bp cut in play.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

The Pound is 2024's best-performing currency, held aloft by a series of better-than-exepected data releases and still elevated inflation, all of which encouraged an air of caution at the Bank of England.

Should the Bank rapidly cut interest rates from here, this source of support risks evaporating.

There has definitely been a change in tone: on September 24, Bailey said, "I do think the path for interest rates will be downwards, gradually."

Contrast this with today's message that there was a chance of the Bank becoming more "a bit more activist" in its approach to cutting interest rates.

"The market has used Bailey’s comments as a green light to price in more monetary loosening. GBP/USD has already sold off sharply this week, so further downside could be limited in the short term, however, Bailey has made it harder for the pound to recover," says Brooks.