Pound to Dollar Forecast: UK Wage and U.S. Inflation Figures Pose Risks in Week Ahead

- Written by: Gary Howes

Image © Adobe Images

We forecast further losses for the Pound against the Dollar in the coming week, but we think downside will be limited to 1.3036.

It's a busy few days for the Pound to Dollar exchange rate (GBP/USD), with an important UK wage report and U.S. inflation figures due for release, both of which will guide the outcome of decisions at the Bank of England and U.S. Federal Reserve later in September.

Ahead of the calendar risks, Pound Sterling is under short-term pressure against the Dollar and GBP/USD has fallen below the psychologically significant 1.31 level on Monday, as the strong sell-off we saw on Friday extends into the new week.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

The move is driven by an adjustment in U.S. Federal Reserve interest rate cut expectations, with the market lowering the odds of a 50 basis point rate cut on September 18, now preferring a more conventional 25bp move.

The extent of the selloff will first and foremost be determined by how much further the adjustment in U.S. rate expectations has to run. The market entered September with high hopes of a rapid and aggressive easing cycle from the Fed, but the reality is dawning that the U.S. economy is too healthy to warrant such an easing in policy expectations.

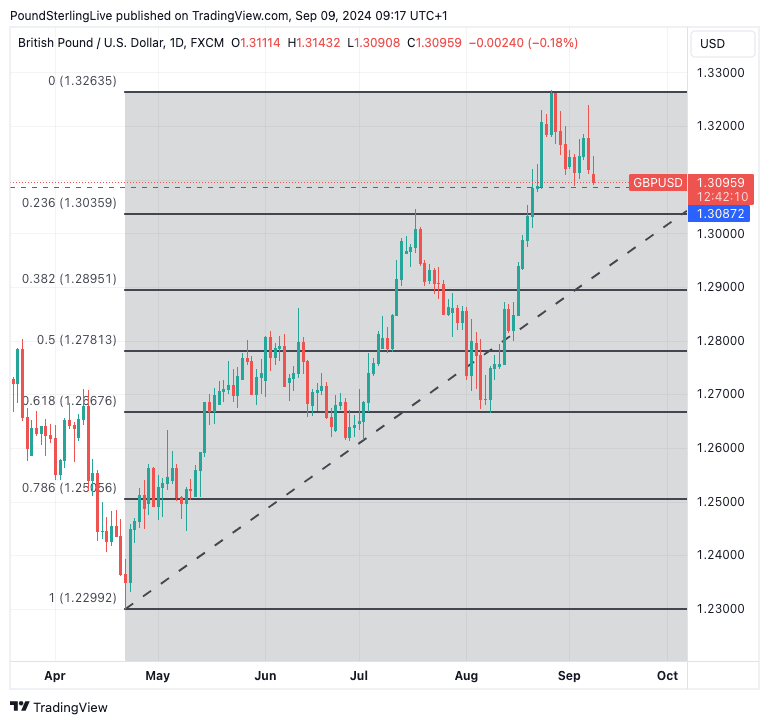

The net result is a stronger dollar, and immediate support for the resultant weakness in GBP/USD now comes in at 1.3087, which is the graphical horizontal support from which the GBP/USD exchange rate bounced last week. We also saw it come into play in late August, and there is a chance that some buyers can step into the fray here.

Above: GBP/USD at daily intervals with Fibonacci retracement levels.

But we are looking lower to 1.3036 as the more important support zone, as this is the 23.6% Fibonacci retracement of the big April-August rally. We note that the Fib retracement lines on this broader multi-month move have some predictive power and we will add it to our toolbox as a result.

Note that when 1.3036 is reached, the best dollar rate for retail buyers will start to slide into the 1.29s.

Tuesday will potentially see the Pound dominate proceedings with the release of UK wage and job figures. The market looks for employment to have risen 84K in the three months to July, with the unemployment rate at 4.1%.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

However, it will be the job figures that will potentially be of more significance for the Pound as this is something that Bank of England will be watching closely. The Bank is not expected to cut rates again, but there is some debate over whether they will move again in October and November.

A weaker-than-forecast wage print could boost the odds of an October rate cut, which will weigh on the Pound. Average earnings is predicted to have risen by 4.1% in the three months to July, down from 4.5%. Wage pressures have been coming down, but some economists are concerned that they are not coming down fast enough.

If this is the case, then the data can beat expectations and lower the odds of an October rate cut, which can boost the Pound against the Euro and other currencies. "Another decline in nominal pay could ease UK inflation fears and allow the BOE to cut rates later this year, although we still believe that they will cut rates at a slower pace than the ECB and the Federal Reserve," says Kathleen Brooks, an analyst at XTB.

Wednesday will see the release of UK GDP figures for July, with the market looking for 0.2% growth, up from the previous month's flat 0% outturn. On paper, the GDP figure is secondary to the wage release, but any sizeable surprises (i.e. more than 2pps) can shake the market, with Sterling likely to weaken on any disappointments and rise on any surprising strength.

The bigger release of the day is the U.S. monthly inflation report, due at 13:30 BST, and given the importance of global drivers, this could ultimately prove to be the highlight of the week for Pound exchange rates. Should U.S. inflation undershoot forecasts, market expectations for a 50 basis point rate cut at the Federal Reserve on September 18 will increase, boosting equity markets and supporting Pound-Euro.

However, should the data come in stronger, expect further selling pressures as the odds of a 50bp cut are completely erased, in which case stocks and the Pound can come under further pressure.

Last week, we heard from an influential member of the Federal Reserve's rate-setting committee that although rates need to come down, the path of progress remains dependent on the data. Markets read this as a signal that the Fed is not concerned enough to pursue 50bp cuts and will prefer to stick to more conventional 25bp increments. The adjustment to this view can extend if inflation figures beat expectations, which raises the odds of another strong week for the USD.

Analysts also say September is historically a month in which global equities fall, which can keep the Pound-Dollar under pressure in the coming three weeks in sympathy with the adjustments that are underway. However, we think that supportive UK interest rate expectations can limit the downside in GBP/USD and we still see weakness as a pullback in a bigger cyclical trend of appreciation that will ultimately restart.