Fed's Williams Sends Euro-Dollar Lower into the Weekend

- Written by: Gary Howes

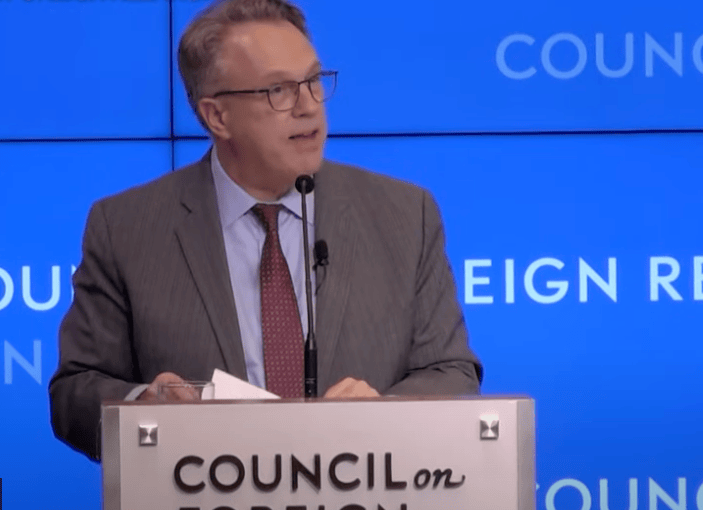

Above: NY Fed President John C. Williams. Source: Council on Foreign Relations.

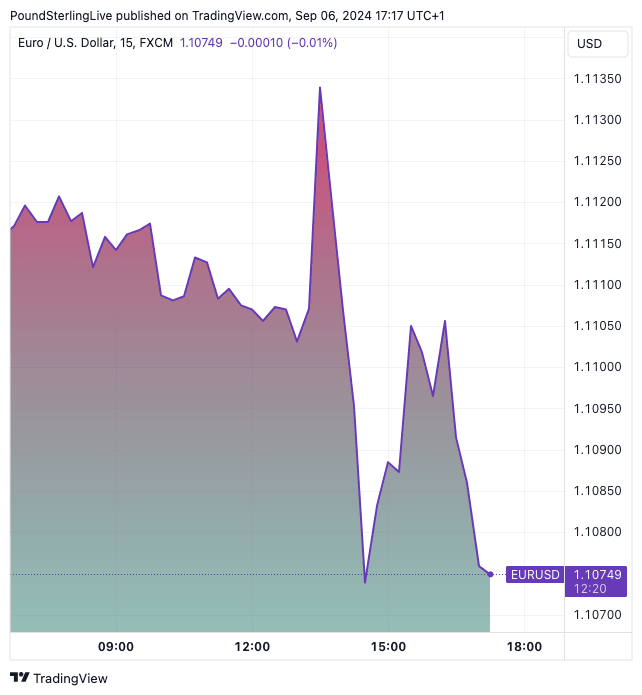

The Dollar rose against the Euro and other G10 currencies after a speech by the New York Federal Reserve's John C. Williams.

Williams - a voting member of the Federal Reserve's policy-setting committee - said the time to cut interest rates had come, but he showed little enthusiasm for commencing the cycle with a sizeable 50 basis point cut.

"With the economy now in equipoise and inflation on a path to 2%, it is now appropriate to dial down the degree of restrictiveness in the stance of policy by reducing the target range for the federal funds rate," Williams said in a speech to the Council on Foreign Relations.

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

What markets were looking for was any signal that the Fed was prepared to cut by 50bp. Instead, Williams said, "the stance of monetary policy can be moved to a more neutral setting over time depending on the evolution of the data, the outlook, and the risks to achieving our objectives."

He is signalling there is no need to panic on the economy and the prospect of a more conventional 25bp cut appears to have disappointed a market that saw the odds of a 50bp move closer to 50%.

Stocks fell as expectations for a more aggressive pace of easing receded. U.S. Treasury yields rose, as did safe haven currencies such as the Franc and Dollar. The Euro to Dollar exchange rate relinquished a high of 1.1154 to trade at 1.1080 at the time of writing.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Ahead of his speech, the all-important U.S. job report for August was released, and there was no 'smoking gun' for proponents of a 50bp move.

Sure, the headline payroll figure undershot expectations for 160K at 142K, but this was up on July and no major surprise. In addition, the unemployment rate fell to 4.2% from 4.3%, and earnings beat expectations at 0.44% month-on-month, which was stronger than an expected 0.3% print.

"Ongoing resilience in consumer spending buoyed by rising income, underpinned by an overhang of liquidity that will prove inflationary once the short end of the yield curve swings positive, will keep the Fed cautious and only go 25," says Steven Blitz, an economist at TS Lombard.

However, Blitz thinks the direction of travel in the economy means the Fed should be more decisive and go with a 50bp cut.

"Markets are pricing a run of good fortune – Fed cuts, economy grows, inflation is stable at 2% by mid-2025. This may be the easiest bet, but it is the most unlikely combination to occur. A recession or a bounce with more inflation is the more likely outcome, depending on the Fed," he explains.

Eyes now turn to next week's inflation numbers, where a sizeable undershoot can reinvigorate bets for a 50bp move, which can, in turn, boost the Euro-Dollar exchange rate.

However, anything close to the consensus will lock-in a 25bp move, which could keep the pair under pressure as the USD extends its September comeback.