Is Now the Time to Buy Dollars? Cover Some GBP/USD Exposure says Horizon Currency

- Written by: Gary Howes

Image © Adobe Images

After a poor August, the Dollar has roared back into life and is pushing the Pound lower. Does this mean the end of the Pound's 2024 rally?

Analysis from Horizon Currency - an international payment solutions provider - shows the Pound to Dollar exchange rate could be set for further weakness in the near term as the current market selloff has some space left to run.

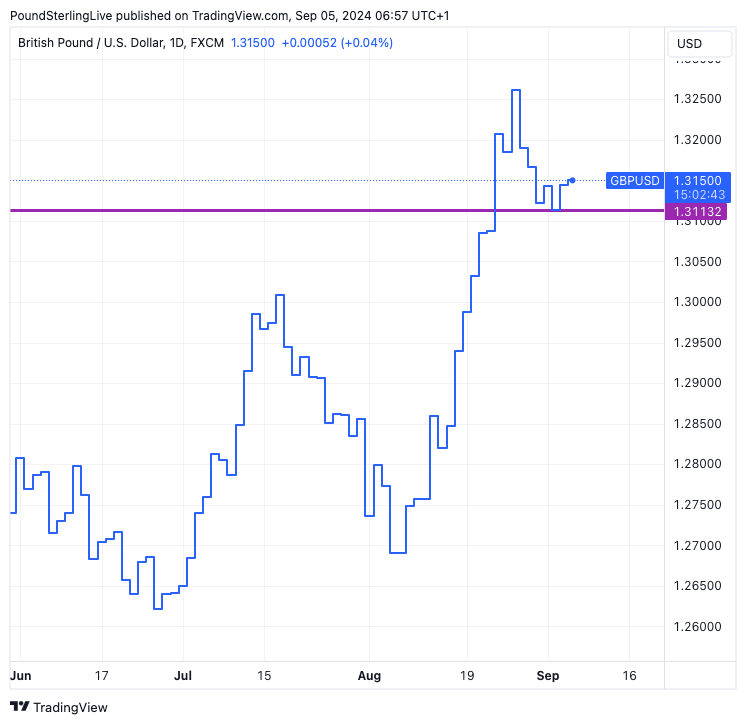

This leaves those who were looking to buy dollars well off recent highs: GBP/USD peaked at a 29-month high at 1.3266 in August and the pullback takes us back to 1.3150 at the time of writing:

Above: GBP/USD at daily intervals. The pullback can extend, but the pair remains in an uptrend for the longer term.

As the above shows, some graphical support has emerged at 1.3115. Ahead, the market will be watching the ISM services PMI report due Thursday and the U.S. job report on Friday.

Heading into this event, risk dollar buyers should remember these are still strong levels on a relative basis: the pound's purchasing power is stronger than it was a mere two weeks ago.

"Clients are nervous as they wonder if the good run has ended; they are asking if now is a good time to send money," says Louisa Ballard, Director at Horizon Currency. "We tell them the exchange rate is still higher than where it has been for much of the past two years. I think locking in today's rate on 50% of your exposure will ease some anxiety for those about to transact."

She says Horizon Currency offers better exchange rates than Revolut on bigger payments, and her team will match the Wise fee, allowing them to deliver the same amount of currency into your recipient bank account but with the added bonus of providing personal support. "You can WhatsApp me directly with any payment queries by clicking this link," she adds.

The Pound's September selloff against the Dollar gathered pace on Tuesday following the release of economic data that suggested the U.S. was at risk of entering a recession.

The market experienced a classic 'risk-off' move evolve after a survey of U.S. manufacturers showed the sector was slowing and price pressures were once again rising, creating a potential stagflationary macroeconomic setup.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

"A trifecta of weak economic data. Aug. PMI & ISM manufacturing both came out even weaker than expected, while July construction spending unexpectedly fell. It's becoming clear the economy is entering a recession just as inflation is poised to turn higher," says Peter Schiff at Euro Pacific Asset Management.

Markets rallied strongly in the second half of August on the expectation that the Federal Reserve would prevent any slowdown with decisive interest rate cuts. The risk to this view is that the guarantee of Fed rate hikes is less assured if inflation starts to rise again.

Short-term, the Pound can fall further, but ultimately it remains in a technical uptrend that can continue over a multi-month timeframe.

"A short-term pause can’t be ruled out, but graphical level near 1.2900 should cushion downside," says Tanmay Purohit, a technical analyst at Société Générale. "Defence of 1.2900 could mean persistence in up move. Next potential objectives are located at projections near 1.3320/1.3360 and 1.3580."