Pound to Dollar Rate Unwinding Overbought Conditions

- Written by: Gary Howes

Image © Adobe Images

The British Pound is unwinding overbought conditions and could fall further in the short term; however, the bigger picture still favours the upside in the coming weeks.

The Pound to Dollar exchange rate hit its highest level in 29 months on Tuesday when it scaled a high of 1.3267, despite no major market-moving news being released.

Midweek trade sees the exchange rate dropping and retracing some of those gains, quoting 0.40% lower on the day at 1.32.

This is the pullback we expected in our Week Ahead Forecast, as there were signs heading into this week that the Pound was technically overextended against the Dollar.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

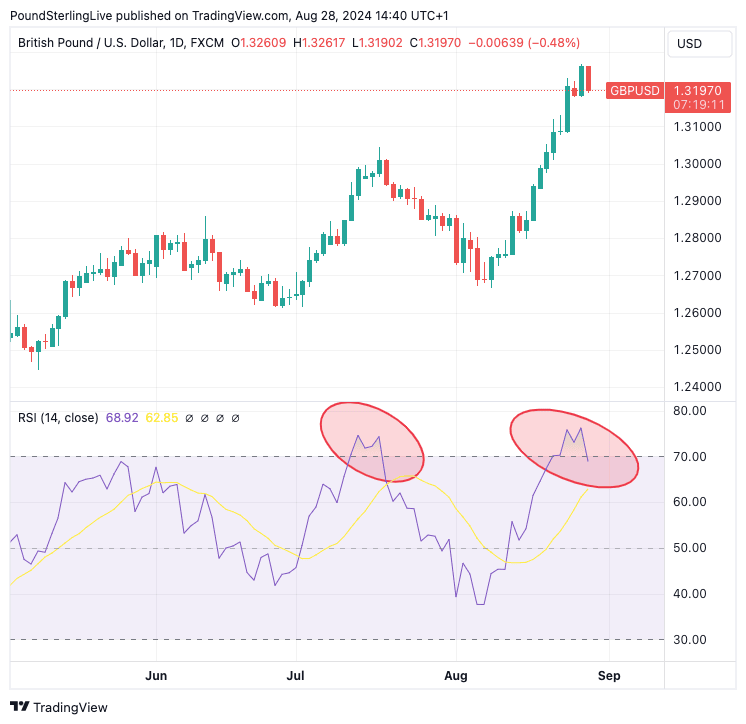

Pound-Dollar has been registering a RSI reading in excess of 70 for three days, which makes the Pound overbought from a technical perspective. The RSI rarely stays above 70 for long, and it can drop back if the exchange rate falls or starts to consolidate.

This process is underway and the breadth of the pullback will be difficult to quantify in the absence of any significant news.

"Buy dips back towards the 1.3145 pivot should be bought in the coming sessions," says a note from JP Morgan's currency dealing desk.

Above: GBP/USD at daily intervals, with RSI shown in the lower panel.

"Given the overbought nature of GBP/USD we would look to buy GBP/USD dips back towards 1.3130, this is set against strong resistance in line with the 23 March 2022 peak at 1.3298," says Jeremy Stretch, an analyst at CIBC Capital Markets.

Buying the dip is trader parlance for buying any weakness on an overarching thesis that an exchange rate is trending higher. This is a view shared by a number of analysts we follow, given an expectation that the Federal Reserve will cut interest rates faster than the Bank of England in the coming months.

Economists at Rabobank say the Bank of England is likely to only cut rates once a quarter going forward. In contrast, the bank now forecasts a 25 basis point rate cut from the Fed in the four consecutive meetings between September 2024 and January 2025.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

"We would be buyers of cable on dips and look for the pound to perform well against both the USD and the EUR into next spring," says Jane Foley, Senior FX Strategist at Rabobank.

The prospect of a bigger pullback in the Pound-Dollar will grow from next week when the next round of U.S. macroeconomic data is due for release.

In particular, watch the U.S. job report on Friday. A stronger-than-expected outcome would result in a decent unwind in Dollar shorts, deepening any Pound-Dollar pullback.

This is because the market is already expecting a generous rate cutting cycle from the Fed, which includes the prospect of a 50bp rate cut in September. When these odds retreat - as they will inevitably do in the event of a strong data print - the Dollar will temporarily rebound.